DeFi and the Future of Finance – Part 3

Today’s post is our third visit to a paper from 2021 on Decentralised Finance (DeFi).

Contents

Problems

Chapter 5 of the paper is about the problems that DeFi solves.

- From my perspective as a UK private investor, I’m going to say that DeFi theoretically solves these issues, since, to me, DeFi for the most part doesn’t seem ready for prime time.

I would also say that for a first-world consumer, not all of the issues are really problems.

Inefficiency

DeFi can accomplish financial transactions with high volumes of assets and low friction that would generally be a large organizational burden for traditional finance.

Fees are an issue for me:

In the case of Ethereum-based DeFi, the contracts can be used by anyone who pays the flat gas fee, usually around $15.00 for a transfer and $25.00 for a dApp feature such as leveraging against collateral.

The paper was written in April 2020, and I have the feeling that gas fees are higher t the time of writing, but even the quoted fees are scarily high.

- For a $40 charge, I would want to be making a transaction in the £50K area, which excludes most people.

These are the kinds of fees we were facing back in the 1980s.

The authors also site forking as a force for efficiency.

Should inefficient or suboptimal DeFi applications exist, the code can be easily copied, improved, and redeployed through forking.

Forking runs the risk of vampirism, where a new fork offers higher rewards to steal liquidity/users.

- If the new rewards are too high, the fork will collapse in time.

If viewed as natural selection, we can expect the survival of the fittest over the long run but the road might be bumpy.

Limited access

DeFi gives large underserved groups, such as the global population of the unbanked as well as small businesses that employ substantial portions of the workforce (for example, nearly 50% in the United States) direct access to financial services.

This is not a big deal in the first world, at least in countries with stable currencies.

- The authors expect retail investors in the first world to have access to institutional pricing in the long run, but we are not there yet.

It’s true that things like yield farming offer fractional ownership to smaller players, but so does the stock market.

- The Initial DeFi Offering (IDO – setting up your own token on Uniswap) does lower the bar for issuing equity to strangers, but it’s not clear to me at this point why this isn’t subject to TradFi security laws.

Opacity

It’s true that DeFi potentially offers more information:

All parties are aware of the capitalization of their counterparties and, to the extent required, can see how funds will be deployed. The parties can read the contracts themselves to determine if the terms are agreeable to eliminate any ambiguity.

It’s a bit “so what”, though – few bother to read listing prospectuses or even accounts within TradFi.

- It probably makes DeFi participants feel better about trusting money to decentralised networks of strangers, though.

Staking (and the possibility of penalties) can be used to enforce good behaviour.

Centralisation

Governments and large institutions hold a virtual monopoly over elements such as the money supply, rate of inflation, and access to the best investment opportunities.

This is another issue that I think most private investors and consumers don’t care too much about.

Even the paper admits that there are advantages to centralisation:

Centralized control allows for radically decisive action in a crisis, sometimes the necessary approach but also perhaps an overreaction. The path to decentralizing finance will certainly encounter growing pains because of the challenges in pre-planning for every eventuality and economic nuance.

Lack of interoperability

TradFi products are usually standalone, but DeFi products can be combined:

DeFi Legos is an analogy often used to describe the act of combining existing protocols into a new protocol.

The authors cite tokenisation as a major advantage:

A simple use case would be creating fractional shares from a unitary asset such as a stock. We can extend this concept to give fractional ownership to scarce resources such as rare art. The tokens can be used as collateral for any other

DeFi service, such as leverage or derivatives.

The sounds good, but in practice, it’s currently difficult (slow, expensive and complicated) to move tokens around.

- The current workarounds tend to reintroduce centralisation (eg. at the exchange level) and potential exposure to relatively volatile exchange rates.

And the interface to hard assets (ie. the real world) has issues:

The practical considerations related to the hard assets, such as maintenance and storage, cannot be enforced by code. Legal restrictions across jurisdictions are also a challenge for tokenization.

The paper also mentions pooled liquidity across exchanges, but until the exchanges have comparable liquidity to the largest centralised exchanges (for me, the LSE, NYSE and Nasdaq) this is not a direct advantage.

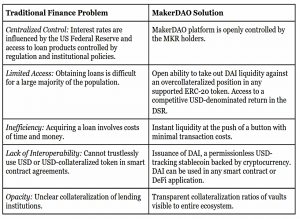

MakerDao

Chapter 6 has deep dives on individual DeFi projects, but we’ll be staying at as high a level as is practical.

- First up is credit/lending, and MakerDAO (DAO stands for decentralised autonomous organisation).

The primary value-add of MakerDAO is the creation of a crypto-collateralized stablecoin, pegged to USD. This means the system can run completely from within the Ethereum blockchain without relying on outside centralized institutions to back, vault and audit the stablecoin.

There are two coins:

- MKR is the governance token, with voting rights and value capture

- DAI is the stablecoin, pegged at 1 to the dollar and generated via escrow contracts on deposited capital (ERC-20 assets)

Due to the volatility of ETH and most collateral types, the collateralization requirement is far in excess of 100% and usually in the 150-200% range.

A TradFri example of a collateralized loan would be equity release from a property.

If you mint DAI up to your collateralisation limit, you run the risk of an immediate liquidation should the value of ETH/your collateral fall below the limit.

- There are no margin calls in DeFi.

The loan is liquidated by a keeper (any external actor). A keeper is incentivized to find contracts eligible for liquidation. The keeper auctions the ETH for enough DAI to pay off the loan.

Liquidation incurs a penalty fee, which incentivises keepers to liquidate.

- Liquidation also stabilises the DAI price by selling ETH to buy DAI.

If not enough DIA is generated, a Protocol Debt arises.

- There is a buffer pool to deal with this but on occasion, this will be exceeded and the governance system intervenes.

Newly minted MKR tokens are auctioned off in exchange for DAI and the DAI are used to pay back the Protocol Debt. This process is Global Settlement.

Global Settlement dilutes the MKR pool.

Vault holders pay a Stability Fee on DAI debt which funds a DAI Savings Rate (DSR), effectively interest on DAI deposits.

- There is also a debt ceiling for DAI which can be adjusted to match supply and demand.

In practice, most users of DAI will buy it on an exchange without going near a Vault, and they can still receive the DSR.

A noteworthy drawback to DAI is that its supply is always constrained by demand for ETH-collateralized debt. No clear arbitrage loop exists to maintain the peg.

This is in contrast to, say, USDC which is redeemable at Coinbase for $1.

I can’t say that I intuitively understand the mechanics of the Stability Fee and the DSR.

- What is the incentive for people to run up DAI debt and pay the Stability Fee in order to fund the DSR?

Or more simply, where is the money coming from?

- I guess there must be a lot of whales with taxable crypto assets who would rather borrow against them than sell them.

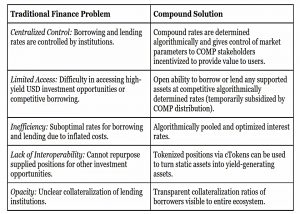

Compound

Compound is a lending market that offers several different ERC-20 assets for borrowing and lending. All the tokens in a single market are pooled together so every lender earns the same variable rate and every borrower pays the same variable rate.

Since debt recovery is difficult with pseudonymous accounts, debts are over collateralised (using a different asset from that being borrowed).

Each ERC-20 asset on the platform has its own collateral factor ranging from 0-90%. Volatile assets generally have lower collateral factors.

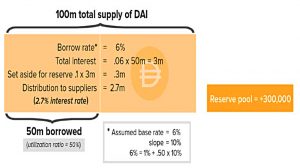

The borrow rates are calculated every 15 seconds (on every ETH block), using a variety of inputs including utilization (borrow/supply).

The formula is an increasing linear function with a y-intercept known as the base rate that represents the borrow rate at 0% borrow demand and a slope representing the rate of change of the rates.

Some assets have a formula with a kink (a utilization beyond which the slope steepens/cost of borrowing increases).

The supply interest rate is the borrow rate multiplied by the utilization ratio so borrow payments can fully cover the supplier rates.

There’s also a reserve factor held back from supplies and used to cover defaults.

Like MakerDAO, the point of Compound is to unlock the value of (crypto) assets without selling them.

- You can also borrow an asset (eg. ETH) to effectively short it against a stablecoin.

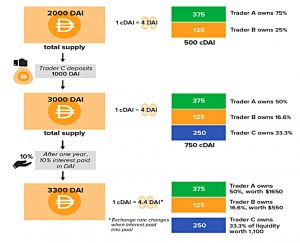

Escrow of collateral tokens is handled via cTokens.

Compound’s cToken is an ERC-20 in its own right that represents an ownership stake in the underlying Compound market. For example, cDAI corresponds to the Compound DAI market and cETH corresponds to the Compound ETH market.

cTokens are minted and burned as funds are added to and removed from the markets.

cTokens can be traded and used as collateral.

Assume there are 2,000 DAI in the Compound DAI market and a total 500 cDAI represents the ownership in the market; 1 cDAI is worth 4 DAI, but after more interest accrues in the market the ratio will change. If a trader comes in and deposits 1,000 DAI, the supply increases by 50%.

Therefore, the Compound protocol mints 50%, or 250, more cDAI and transfers this amount to the trader’s account. Assuming an interest rate of 10%, at year end there will be 3,300 DAI, and the trader’s 250 cDAI can be redeemed for onethird, or 1,100, of the DAI. The trader can deploy cDAI in the place of DAI so the DAI is not sitting idle but earning interest via the Compound pool.

Parameters like the collateral factor, reserve factor, base rate, slope, and kink, are all set (“tuned” by the Compound Governance function.

- Governance was transferred to the COMP token in May 2020, and the token was distributed to all users of the platform (suppliers and borrowers).

We’ll leave it there for today.

- We’re about 60% of the way through the report, so there will probably be another couple of articles in this series.

Until next time.