Vince – Tax Exile

Today’s post is a profile of Guru investor Vince, who appears in Guy Thomas’s book Free Capital. His chapter is called Tax Exile.

Vince – Tax Exile

Vince is a contrarian, and Guy thinks that he’s a true contrarian.

To identify real contrarians, it helps to look at behaviour outside the investment arena: is the investor willing to hold unpopular beliefs in other fields?

Vince runs a small publishing firm issuing books that other publishers will not touch.

Early career

Like many of the investors in Guy’s book, Vince suffers from ill-health – in his case childhood tuberculosis.

Early in his career, Vince later opened a sandwich bar in Bishopsgate which he sold for a good price.

- The proceeds allowed him to start investing in stocks, initially just by following tips.

He also began to invest in property, which meant that he largely dodged the 1974 stock market crash.

Houses became very cheap in the mid-1970s, sometimes offering a 25% rental yield on the purchase price.

Vince got a sales job with Chrysler and later moved into government housing.

- He quit work in 1979, aged 33. By this time he could live off his rental income.

In the 1980s he put more money into the stock market (successfully dodging the 1987 crash), and also moved into commercial property.

- By now onto a second marriage, he moved from London to Switzerland in 2007.

Small companies

After the 1980s, Vince moved into small companies.

He liked the “mispricing of insolvency risk and excessive discounts for illiquidity”.

Institutions will often sell at any price if a company appears to have a substantial chance of going bust.

On a Friday afternoon I have often been the only buyer in any size of a small company. If an institution needs to get out that day, you can often name your own price for a large block of shares, well below the mid-price, and sometimes even below the bid.”

Vince looks for situations with “an absence of competition”.

Investing style

Guy struggles to classify Vince.

- He makes top-down macro calls (dodging all the crashes during his investing lifetime, moving from the UK to German property).

- But he also carries out detailed bottom-up research on individual companies.

By the time of the 2009 crash, Vince had 200 apartments in Germany, across a dozen blocks.

Vince uses low PE and high yield to screen for stock ideas.

His checklist of positive characteristics includes:

- recent substantial director shares purchases

- the absence of a large number of naïvely enthusiastic posters on bulletin boards

- recent substantial share purchases by a commercial rival (potential for a takeover bid)

- a paucity of broker research coverage

Negative factors include:

- a personality cult around the chief executive

- a gimmicky annual report

- “flagpoles and fountains” (glitzy company premises)

Vince often holds just six shares at a time.

When you find a good idea, buy enough of it to make a difference. Diversifying away risk also means diversifying away profit.

He also often holds notifiable stakes of more than 3% in a small company, though he is not an activist manager who seeks to influence management.

- Indeed, he does not talk to company management before investing.

Vince carries mortgage debt on his properties but doesn’t borrow to leverage his shareholdings.

- Nor does he spread bet.

Options

When interviewed by Guy, Vince had moved on from small caps.

- He held property in Germany and Singapore, and just four large FTSE-100 companies (Shell, Glaxo, AstraZeneca and Vodafone), held for liquidity.

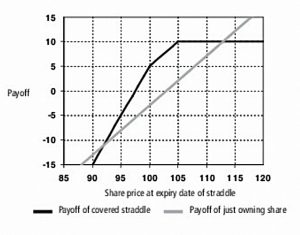

He was also writing options against these holdings – usually covered straddles.

This involves selling puts and calls on shares he already owns with the same expiry date and strike prices close to the current share price (one either side – the straddle).

- This gives a better return than just owning the share, provided the share price does not move too much.

It’s a bet on low volatility, with an asymmetric payoff.

- The upside is capped but the downside isn’t.

Conclusion

I didn’t get much from this chapter, as you can see from the length of this article.

Vince’s fortune was originally made from property, and his macros call on stock markets have been extremely fortunate.

- I’m not suited to this full-on market timing, and nor could I run a highly concentrated portfolio of large stakes in small companies.

I had hoped to learn something from Vince’s options strategy but the capped upside and unlimited downside are not for me.

As Guy says:

It is not enough to be contrarian, one also needs to be right.

Which of us can guarantee that?

- Until next time.