Investment Trust Portfolio 3 – Money Week part 2

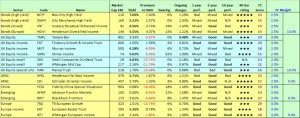

Today’s post is a catch-up with the Investment Trust Portfolio, where we investigate the 24 trusts identified during last week’s look at the MoneyWeek portfolio.

Contents

Where we left things

The portfolio has 37 trusts, out of a maximum of 50:

The portfolio has a weighted average ongoing charge of 1.28% and a weighted average quality score of 16.6. The “simple” 23 trust portfolio has an ongoing charge of 1.27% and a weighted average score of 17.0.

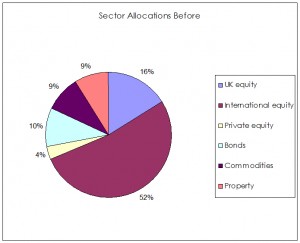

Our target is to have 25% to 33% of assets in non-equities. At the moment we have 28%:

- Bonds = 10%

- Commodities = 9%

- Property = 9%

Within equities, we will be underweight the UK, and overweight sectors which are otherwise difficult to access (themes, private equity, frontier markets etc). The current breakdown is:

- UK = 16%

- APAC = 5%

- Japan = 5%

- Emerging markets = 9%

- Europe = 9%

- Global = 6%

- Themes = 18.5%

- Private Equity = 3.5%

The obvious gap is US exposure, though some of the themes and global trusts will have exposure here. The UK weighting seems likely to come down.

The MoneyWeek trusts

From looking at the history of the MoneyWeek Investment Trust Portfolio last week, we have 24 “new” trusts to investigate.

This week I have arranged them by sector (as you can see they cover quite a range):

UK Growth:

- Edinburgh Investment Trust (EDIN)

- Law Debenture Corporation (LWDB). This “combines a diverse investment portfolio of mainly UK shares” with a stand-alone trustee business. The dividend was 3.7% and the total expense ratio (TER) was over 0.5%. The apparent premium of 8% (at the time MoneyWeek reviewed it) reflected the fact that the trustee business is not included in the NAV.

UK Mid / Small Caps:

- The smaller sister to EDIN, Perpetual Income and Growth (PLI), (smaller and has more flexibility to invest in mid-caps)

- Henderson Smaller Companies Investment Trust (HSL)

- Diverse Income Trust (DIVI) – UK small cap income

UK Income / Income & Growth:

- Troy Income and Growth (TIGT)

Japan:

- Baillie Gifford Japan Trust (BGFD) – this is the large cap sister to BGS which is already in our portfolio

Emerging Markets:

- Templeton Emerging Markets Investment Trust (TEM)

Global Equity:

- Scottish Mortgage (SMT) – Baillie Gifford’s largest trust (£1.6bn) focuses on companies with long-term growth potential. It is also cheap (TER around 0.5%)

- Caledonia Investments (CLDN), which invests internationally in quoted and unquoted companies

Private Equity:

- Standard Life European Private Equity (SEP)

- Pantheon International Participations (PIN) – it turns out that the PINR shares are redeemable

- NB Private Equity (NBPE) – NBPE is priced in $

- HarbourVest (HVPE) – HVPE is priced in $

- Electra Private Equity (ELTA)

- Graphite Enterprise (GPE)

Property:

- F&C Commercial Property (FCPT), based mostly in London and the southeast, with an “attractive yield”.

Infrastructure:

- HICL Infrastructure (HICL) – low-risk exposure to an asset class with long-term target returns of 7%-8%

- 3i Infrastructure (3IN) – a “more absolute return income-generating pick” with 5% plus yield. This fund invests in operating assets rather than contracts.

Commodities (mining):

- Blackrock World Mining (BRWM)

Multi-asset:

- Personal Assets Trust (PNL) – big, liquid and with a discount defence strategy so that it trades around NAV. “With its emphasis on absolute returns, wealth preservation and zero discount policy, we see this as a core defensive holding.” It holds cash, inflation-linked government bonds, gold and conservatively managed large stocks

- RIT (RCP) – chaired and part-owned by Lord Rothschild, with a good long-term record, but not so good short-term one. Investments are diverse (including listed firms, hedge funds and private equity).

Hedge Fund:

- BH Macro (BHMG) – effectively, the Brevan Howard Master Fund, a defensive US-based hedge fund, inversely correlated with equity markets.

- Battle Against Cancer Investment Trust (BACT) – low-cost access to hedge funds

For the purpose of the analysis, we can group these into four sections:

- UK (6 trusts)

- International (4 trusts)

- Private Equity (6 trusts)

- Non-equity / multi-asset (8 trusts)

UK trusts

This is a good set of scores, and ideally we would add all six of these trusts to the portfolio. We will have to displace others in order to accommodate them.

Even then it’s possible that as the UK allocation in the portfolio comes down from 16%, there won’t be enough slots for UK trusts in the maximum allowed fifty.

International trusts

This is another good set of scores, with all four trusts candidates to be added to our portfolio. At this stage it’s looking as though the problem might become picking which 50 trusts to keep.

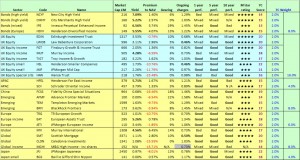

Private equity

At first sight we have the same problem again, with none of the six trusts scoring badly enough to be immediately ruled out. But this section is more homogenous than the others. Including SEC which is already in the portfolio, we now have seven private equity candidates.

I’ll assume that we won’t need more than four, and simply take the four highest-scoring trusts. GPE and NBPE are tied for fourth place, so I will take GPE because it’s based in the UK and priced in sterling.

So for now:

- SEP, ELTA, PIN and GPE will be added to the portfolio

- SEC will be removed from the portfolio

This means we now have 40 trusts in the portfolio, from a maximum of 50.

Non-equity / multi-asset trusts

For a variety of reasons, these trusts don’t score so highly. Many trade at a premium to NAV, and several have short track records. Performance is also more patchy than the equity funds above.

- Only RCP scores highly enough to be added to the portfolio automatically.

- PNL (the other multi-asset fund) and the two hedge fund trusts (BHMG and BACT) will be added for diversification purposes.

- There are no infrastructure trusts in the portfolio at the moment, so HICL and 3IN can also be added.

- There are four property trusts in the portfolio already, so FCPT will replace BBOX.

- There are three commodities trusts in the portfolio already, so BRWM will replace GPM.

We have added another 6 trusts to the portfolio, bringing the total to 46.

Squeezing in the equity trusts

We now have the problem of squeezing in the UK and International trusts. We have 10 candidates and only four spaces left.

We’ll start with the international trusts, since we have more scope to reduce the weighting to UK trusts.

- BGFD scores well, but the existing large cap Japan trust (JFJ) scores even better. Two Japanese funds are probably enough, so BGFD won’t be added to the portfolio.

- We have room for another emerging markets fund, so TEM will be added.

- We can also find room for two more global funds, so SMT and CLDN will be added.

This brings us up to a total of 49 funds, so we have only one place left to accommodate the six UK candidates.

- In the large UK equity space, EDIN and LWDB outscore the incumbent TMPL, and will be added in its place. We have now filled all 50 spots.

- In the small UK companies area, HSL will replace SDV.

- In the UK Equity Income space, TIGT will replace SHRS.

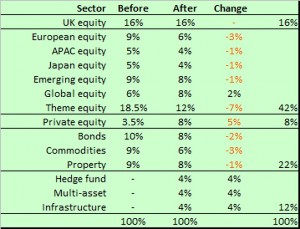

The final portfolio

We now have a completed portfolio of 50 investment trusts. The spread of sectors is good and we can treat this as a live portfolio from here.

The average annual charge on the portfolio has reduced from 1.28% to 1.24%, and the average score has risen from 16.6 to 16.9. The simplified 25 trust portfolio has an average annual charge of 1.22% and an average score of 18.

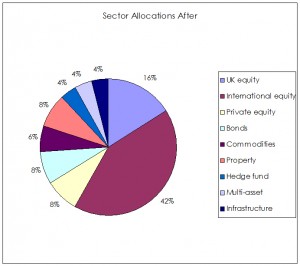

The non-equity allocation is now up to 34%, right at our maximum level: ((The multi asset and hedge fund trusts will probably hold some equities))

- Bonds = 8%

- Commodities = 6%

- Property = 8%

- Hedge fund = 4%

- Multi-asset funds = 4%

- Infrastructure = 4%

We’ll be back to look at this portfolio again in around a month’s time. In the next post we’ll back-test the performance of this portfolio, and review a few more trusts for possible inclusion.

Until next time.