Money for Life – Financial Health Check

This post is the first in a series describing the basics of personal finance – the things that you need to do before you start investing.

Contents

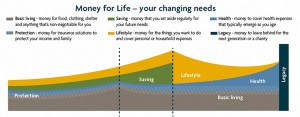

Life Stages

Life can be broken down into a series of stages. The simplest list might be:

- school

- starting work

- setting up home with someone (perhaps)

- kids (perhaps)

- retirement

Financial circumstances will change from stage to stage, as will your income and expenses. Just as importantly, so will your goals. To cope with these changing circumstances, we need to create a financial plan.

Financial planning

The diagram above may look complicated, but it isn’t. The financial planning process has six steps:

- Work out where we are

- Work out where we want to be

- Make a list of the options for getting there

- Work out which option(s) is/are best for us

- Implement the best option(s)

- Periodically review where we are (same as step 1)

You can also think of steps three and four as a single action, which gives us a four-step mantra: Review, Set Goals, Plan, Implement. Today we’re going to talk about the first two steps (Review and Goals), but there’s plenty on the rest of the website about the other two steps.

Review – Financial Health Check

The first thing to decide is how often to carry out the review. Once a year is the obvious choice, though you may want to do more frequent reviews when you are just getting started.

If you do choose an annual review, the next decision is when to carry it out. Right now is the answer if you haven’t done it before, but otherwise there are two likely dates – the end of the calendar year and the end of the tax year (5th April). ((I personally find that I often do both))

The simplest way to review our financial position is to draw up a set of personal accounts, treating ourselves as if we were a business. This sounds complicated, but it isn’t. The two documents we need to prepare are the income statement and the balance sheet.

- The income statement is also known as the profit & loss sheet, but a better way to think of it is as your budget for the year. It describes what is happening during the next twelve months.

- The balance sheet is a summary of what has already happened so far, and includes a calculation of your current net worth.

Let’s look at some examples (with completely imaginary numbers in them).

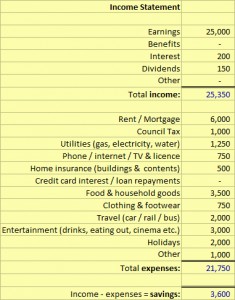

Income Statement

An income statement is simply a list of all your sources of income, with a sub-total, and another list of all your expenses for the year, with another sub-total.

Income minus expenses is how much money you have have left at the end of the year, to add to your savings. This number has to be positive, or you can’t save.

If it’s negative, you need to borrow money for the year, and you are going backwards. You may have debts now, but you need to be paying them down, not adding to them.

Emma Drew has some helpful tips on How to budget when you have an irregular income.

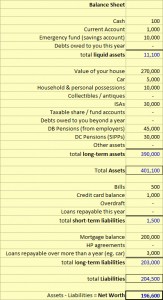

Balance Sheet

A balance sheet is a list of everything you have (assets) and everything you owe (liabilities). Traditionally it’s divided into things that apply to the coming year (liquid assets and short-term liabilities), and things that stretch out further into the future (long-term assets and liabilities).

Total Assets minus Total Liabilities equals Net Worth. Hopefully this is a positive number and is increasing from year to year. This is the number that shows how far you have come in achieving your goals – it’s how we measure progress.

Risk

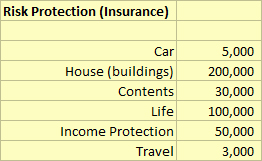

One other thing that you might consider in your financial health check is risk, and your attitude towards it. Someone with a high tolerance of risk will be able to consider a wider variety of options (ie. financial products) in reaching their goals than will a person who is risk averse.

At review time, another document you might consider preparing is a risk statement. The traditional way of dealing with risk is to take out insurance. ((I don’t like insurance as a rule, as it’s generally cheaper to self-insure over the long run)) A risk protection statement would list the areas that you’ve taken out insurance, and those risks that you haven’t insured. There’s no need to provide monetary values as I have in the example. ((One thing that I missed off the list is health insurance))

Goals

At review time, you should list your top financial goals – perhaps three, maybe five of them. Financial security should be at the top of the list – the main financial goal in life is to build up a pot of money to provide income in retirement.

Along the way to retirement you may have intermediate financial targets such as saving the deposit for a house or paying for school/university fees, but the main goal is financial security – the ability to meet your needs from what you already have, without further income from outside. ((financial independence and financial freedom are currently the popular terms on the interwebs, but for me the three phrases can be used interchangeably))

The goals need to have a monetary value and a timescale attached to them – we need to know how much money we’ll require, and when. The “how to get there” we can leave to the planning stage, but for now we’ll note that each action towards a goal will have an impact on our annual budget.

If they have too big an impact, and make the total on the income statement negative, then we have four choices:

- scale back the size of one or more of the goals

- push the goals further into the future,

to allow more time to put the money together - eliminate one or more of the goals,

by prioritising which are most important to us - increase our income

We could of course use a combination of these approaches, but the most important thing is to make the income statement balance, after allowing for the cash we need to put aside each year to achieve our goals.

Achieving goals

We’ll focus here on retirement. Meeting intermediate goals can be approached in exactly the same way as long-term financial security, but the time periods and sums of money involved will be shorter and smaller. Becoming financially secure has two parts:

- save some money every year

- start as early as possible

Most people have problems with at least one of these, and plenty of people have issues with both. Deferred gratification is difficult for lots of people, but it’s crucial to financial success. If you are unable to live within your means (have money left over each year, so that you are able to save) then you will never achieve financial independence. This is just maths.

It also ties back into goal-setting. Whenever we spend money we make clear what our priorities in life are. You can’t spend the same money twice – everything you buy involves giving up something else (this is known as opportunity cost).

The second problem is psychological. The prospect of retirement is not a pleasant one for most people. ((despite the fact that survey after survey shows that old people are the happiest people)) The young in particular prefer to live in the present, and can find it difficult to even imagine their old age.

The locking away of pension money until you reach age 55 doesn’t help – it’s a long way from 25 to 55 (though it goes much more quickly than you expect). Unfortunately, because of the time value of money and compound interest, ((which we will cover in a later post)) the sooner you begin to save towards retirement, the easier it is.

You can find out how much you might need to save here.

2 Responses

[…] week we will be using Ratios to look at the Income Statement and the Balance Sheet that we created last time, to see what they tell us about the state of our financial […]

[…] far we’ve talked about life stages, and how to plan for the future. Then we looked at personal financial statements (income statement […]