Piggyback Portfolio 12 – Return of the Piggy

Today’s post is a long-overdue catch up with the Piggyback Portfolio, our set of stocks listed on the Main UK market.

The history

A long time ago, in a galaxy far, far away- January 2015, actually – we created the Piggyback portfolio.

Soon after starting this blog, and taking a look around the Twittersphere and the Blogosphere, I decided that I needed to set up two portfolios:

- an AIM portfolio (the Smallcap Growth AIM Portfolio, or SGAP)

- and a Main Market Portfolio, which we christened the Piggyback

While the SGAP has gone from strength to strength (up 113%, or 37.6% pa compounded, at the most recent review), the Piggyback has been sorely neglected.

- But today is the return of the Piggy.

I’ve done a fair bit of active trading during my investing career, but at the time I started the blog I was largely a passive, buy & hold investor.

- This was mostly a reaction to the 2008 crisis, which made me re-think everything I thought I had understood about the markets from 1984 to then.

So one of the objectives of starting the blog was to ease myself back into active investing.

The name of the portfolio came from the idea that the initial selections would be taken from reviews of existing public portfolios (from other UK private investors).

- Nowadays we’ll just use a watchlist and the Stockopedia scores

- Though the watchlist is mostly generated through comments made by other UK private investors, so the core philosophy remains in place.

It’s as much an exercise in portfolio management as it is in stock picking, and in that respect we have failed miserably.

The rules (revisited)

Some of these are the original rules for the portfolio, and some have evolved.

- It’s a medium-term portfolio, with holding periods in the months to years range – it’s not about day trading.

- We will use comments from other traders to generate ideas only (to add stocks to the Watchlist), and not for specific buy and sell signals.

- As I was feeling my way back into active investing, the Piggyback began as a paper portfolio, with a plan to transition to real money if it did ok (beat the FTSE All-Share).

- We’re switching to real money only from today.

- UK stocks only, no penny stocks, nothing under £100M market cap, nothing over a PE of 25.

- I may go down to £50M Mcap, as in the SGAP – let’s see what turns up.

- I prefer PEs under 16, but there are fewer of those around at the moment.

- I’ll steer clear of small miners and energy companies, as usual.

- Blue-sky stocks are out, too, though this should be less of an issue on the main market.

- And so are loss-making firms.

- It’s not a defensive / dividend portfolio.

- I’ll be developing one of these separately, as part of my preparations for Armageddon 2018 (more on this in a future post).

- Stop losses have been relaxed from 10% to 15%, and may go as wide as 20%.

- Winners will be sold when they drop 15% from their high.

- Winners on stretched valuations (PEs above 25) may be transferred to the Spread Bet portfolio at any review (monthly / quarterly is the plan at the moment).

- We can also sell simply because we find a good new opportunity, and have no free slots in the portfolio.

I think that the paper element was one of the reasons I lost interest in the Piggyback.

- Reviewing all the public investor portfolios was very interesting, and a great learning curve for me.

- But once I had completed this and chosen the initial 20 stocks, there wasn’t anything to keep me engaged.

Real money concentrates the mind much more effectively, and I had a real AIM portfolio to think about (SGAP), plus the looming prospect of a large IHT portfolio (now implemented).

- I was also very pre-occupied with writing “essential” blog articles, and with setting up ETF and Investment Trust portfolios and lists.

- I even set up a financial coaching service.

But that’s all done now, and we can get back to the Piggyback.

As with our recent post on the SGAP, the target for the Piggyback is a 20-stock portfolio worth £93K to begin with (50% of the ISA it shares with the SGAP).

- That gives a position size of £4.6K (it was originally £2.5K).

The agenda

We have a lot to get through, and it will take more than one post:

- We need to catch up with how our long-neglected stocks have performed

- We need to check which stocks are real, and which are paper only

- We need to sweep our other accounts for stocks that should be in the Piggyback Portfolio

- We need to review the existing real stocks to check which ones are good enough to stay

- And we need to find some replacements for the ones that we kick out.

Performance

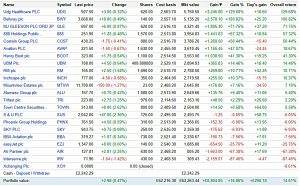

Here’s the portfolio in Google format (for the last time):

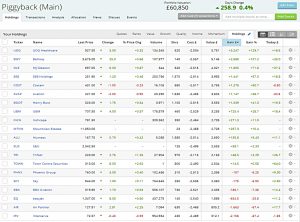

And here it is in Stockopedia format (for the first time):

The numbers don’t quite match up, despite me making a cash correction when I transferred the data into Stockopedia a couple of weeks ago.

- But since Google Portfolios will be gone in a fortnight, I probably won’t bother to get to the bottom of it.

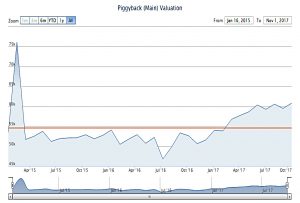

Here’s the Google performance graph:

Here’s the Stockopedia version:

Something funny going on there with the data in 1Q15, so here it is again, starting in March:

And here’s the most useful one (Google only, sadly) showing performance against the FTSE All-Share index:

We’re up by 27%, compared to 18% for the index.

- Not great, but we have no right to expect better from a portfolio that has been ignored for so long.

Analytics

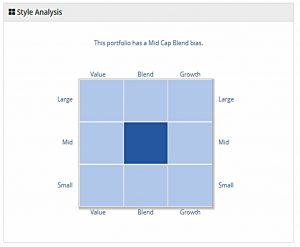

Here’s the style analysis, which shows this is a Mid Cap Blend portfolio:

That’s the result we were hoping for.

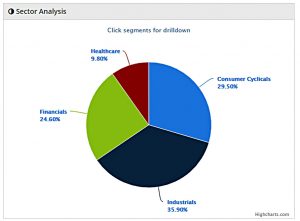

Here are the sector weights:

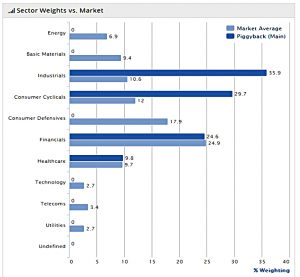

And here are the sector weights compared to the market:

We’re overweight in industrials and consumer cyclicals.

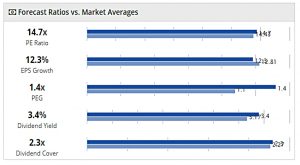

Here are the other ratios relative to the market:

The PEG is slightly high, but otherwise they look fine.

Here are the health check numbers:

The Z-Score is a little low.

- We’ll revisit this after we’ve restructured the portfolio.

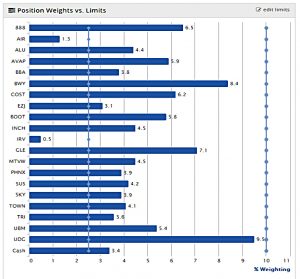

Finally, here are the position weights:

With 20 stocks in the portfolio, the default position is 5%.

- I’ve set alerts at 10% and 2.5% for now.

That’s it for today.

- I’ll be back next week with a review of the stocks in the portfolio.

- And a search through my other stock accounts for any companies that should really be in the Piggyback Portfolio.

Until next time.

The numbers may not add up because Stockopedia can calculate a purchase price rather than use the actual cost. It happens most when you have bought and sold the same share.

I have had gains out by hundreds of percent in some cases