Weekly Roundup, 5th December 2017

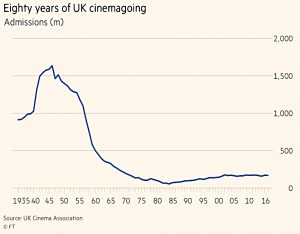

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about cinema attendances.

Contents

Cinema attendances

Ed Bowsher had a strange chart for us this week – eighty years of UK cinema attendances.

- The peak year was 1946, before TVs became affordable for most people.

- There was a further slump in the 70s and 80s when VCRs appeared.

- 1984 was rock bottom – 54M tickets sold, compared with 1.6 bn in 1946.

Things (well, sales) started to recover after that:

- The studios figured out from the success of Star Wars that you can sell franchises of dubious quality to teenagers and families

- Multiplexes meant that many films could be shown in the same town at the same time (( When I was young, each region had it’s own expensive celluloid print of a big film, and it could take months for the film to hit your town ))

Sales have been flat over the last dozen years, but revenues have increased by 4.4% pa since 2002, compared to average inflation of 2.9%.

- Food sales (popcorn etc) are a big factor as the cinemas retain all profits in this area (they share ticket income – still 70% of revenue – with distributors and studios).

Ed played down the threat from Netflix and noted that Amazon is cooperating with cinema chains rather than competing with them.

I couldn’t really see the point of this article, though the headlines implied that the sector is ripe for M&A activity.

- That may well be the case, but I’m not sure how it follows from the chart.

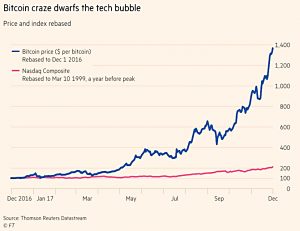

Bitcoin

Bitcoin moved closer to the mainstream, with a couple of articles on the cryptocurrency in the FT (1 and 2), plus others in The Economist, MoneyWeek and The Spectator.

Here are a few quotes to give you a flavour of the articles:

The dramatic price action — at a time of low volatility in stocks and bonds — has proved impossible for the financial world to ignore.

Nasdaq, the US exchanges operator, said on Wednesday it planned to launch bitcoin futures contracts next year, which would make it easier for investors to profit from losses as well as gains in the cryptocurrency.

“It’s not for me, but there’s a lot of things that weren’t for me in the past that worked out very well,” Lloyd Blankfein, Goldman’s chief executive, said this week.

“Bitcoin just shows you how much demand for money laundering there is in the world,” says Larry Fink, chief executive of BlackRock.

“Bitcoin is successful only because of its potential for circumvention, lack of oversight,” Joseph Stiglitz said this week. “It doesn’t serve any socially useful function.”

William Goetzmann, a Yale economist, said: “It does not have future dividends. Its value is set by expectations of future demand and/or expectations of future resale value. There is no way to value it fundamentally.”

The Economist article focused initially on Bitcoin’s lack of liquidity.

I should declare at this point that I have been dabbling in crypto, with no liquidity problems to date.

- Of course, I’m not buying the coins themselves – I haven’t found a safe way to do so.

Instead, I’m using spread bets.

- IG let you trade BTC, ETH and Bitcoin Cash, against the dollar, pound or euro.

I have no crypto positions open at the moment, but I intend to open more.

- I’m ahead so far, but not in a meaningful way.

I’ve noticed two things in particular:

- Daily volatility is massive – often 10%, rather than the 1% or 2% that is normal in the stock markets.

- If you don’t trade currencies (and I rarely do) then the 24-hour nature of the market takes some getting used to.

The Economist pointed out that the high volatility impacted Bitcoin’s effectiveness on the three main functions of a currency (towards which status it has aspirations):

- store of value

- means of exchange

- unit of account

The newspaper puts the increase in the price of BTC down to the new, easier ways to trade it.

- That’s certainly made all the difference with me.

With more potential investors, demand goes up.

- Since supply is limited by design, the price goes up, too.

The underlying price of BTC ought to be close to the marginal cost of production (in electricity and computers). (( More on this idea in a later post ))

- This is increasing, but remains much lower than the current price.

The Economist invites investors to consider Nathan’s Rothschild’s explanation of his wealth:

I always sold too soon.

Matthew Lynn also warned his readers to prepare for the crash.

- As well as avoiding cryptos, steer clear of banks.

Stick with cash and gold instead, and possibly the Swiss Franc.

John Lee

The recent change to the format of John Lee’s column in the FT – where he interviewed a fellow small-cap investor about a share that had done well for them – doesn’t seem to have lasted.

- This week he was back to discussing his own portfolio, though it’s possible this is just a slightly early end-of-year review.

He’s up 20% for 2017, after 16% in 2016 and 18% in 2017.

Treatt has been his big winner, and even after trimming 8% of his holding, it makes up more than a third of John’s ISA.

- Christie and Anpario are both well up also, with Air Partner, Gooch & Housego and Vianet.

On the downside, Quarto has more than halved.

John’s main purchase for the year was Tarsus, but he also bought MS International and MP Evans.

- He topped up his position in Charles Taylor, and pruned Nichols and Gooch % Housego.

He’s worried about the removal of IHT relief on AIM shares under a Labour government.

- Prices for these shares are quite high now, and they would be vulnerable.

Defined ambition

Labour’s shadow pensions minister Alex Cunningham had an article in the FT backing “defined ambition” pension schemes.

- These schemes – also known as collective defined contribution schemes (CDCs), or “target benefit schemes” – allow workers to pool their investment pots and share an income that depends on the underlying investment performance.

For me, this combines the worst features of existing DB and DC schemes:

- A lack of flexibility (you have to take the income, whatever it is).

- No guarantee of performance.

I’m all for increasing the scale of pension schemes, and hence their efficiency, but:

- The best way to do that is to increase contributions by scheme members, and

- There’s no evidence that the asset management industry is interested in passing on scale economies to its customers (or that the customers are even aware of eg. high charges).

What people really need is a scheme that combines the best features of DB and DC:

- Guaranteed returns, and

- Flexibility in accessing the pot, and in the underlying investments.

I won’t hold my breath on that.

Efficient markets

John Authers looked at whether markets are efficient.

- The background to his question is that stocks have been rising steadily all year, and have hit new highs once again.

- And then, of course, there is Bitcoin.

John rules out the hard form of the Efficient Markets Hypothesis (EMH) where stock prices are a news-driven random walk.

- For example, US tech stocks “crashed” 4% last Wednesday, on no news.

- And the bitcoin market is clearly not efficient.

He concedes that the market is very hard to beat, and that it gets the price right over the long term.

- Over decades, stock prices move in line with growth in the economy.

New research confirms Fisher Black’s idea that markets are efficient to within a factor or two.

- That means that they move in a range between half and double the “fair” or “correct” value.

The researchers explained this using two market behaviours:

- Trend following or momentum – people get on board the stocks that are moving.

- Mean reversion or value – other investors buy only things that look cheap.

This brings to mind the Ben Graham quote:

In the short run, the market is a voting machine but in the long run it is a weighing machine.

Mathematically, the markets are not a random walk, but rather a “biased geometric random walk with a non-stationary drift”.

The switchover from momentum to value being more successful happens after about two years.

- So timing is everything, after all.

Fidelity fees

Fidelity have explained a bit more how their new “fulcrum fees” will work:

- 0.1% will be taken off the base fee of 12 funds to begin with.

- A Variable Management Fee (VMF) will add or remove up to 0.2% to or from this.

The ceiling and floor are hit when the fund outperforms / underperforms by 2% pa over a rolling three year period.

So the final outcome could be 0.3% lower or 0.1% higher than things stand today.

- Which smacks of confidence from Fidelity.

- On the other hand, good luck explaining that charging system to retail investors.

Or indeed, explaining why a performance fee is needed on top of the management fee which is already much higher than for passive funds.

- Most investors will feel that they are already paying up for outperformance.

Nationwide nudge

You’ll remember that a few weeks ago, Richard Thaler of “nudge” fame won the Nobel prize.

- Now the Nationwide building society has applied the opt-out technique used by the government’s workplace pension auto-enrolment system to its own pension scheme.

Members get 9% pa from Nationwide in return for 4% of personal contributions.

- But if they put in an extra 3%, Nationwide will match it.

Under the new system, 7% is the default contribution, and members have to ask to scale back to 4% pa.

- Which means that 84% are now on the higher rate, compared with 9% under the old system.

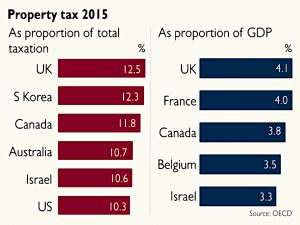

Property taxes

The Times reported that UK property taxes are likely to hit £80 bn for the first time.

- Despite what you read in the mainstream media, Britain has the highest property taxes (stamp duty, business rates and council tax) in the OECD.

That’s both as a share of all taxes raised, and as a share of GDP.

Which means that those who agitate for council tax reform – or even a land value tax – must be more concerned with who pays the property taxes, rather than how much money they raise.

Twitter pics

I have five for you this week.

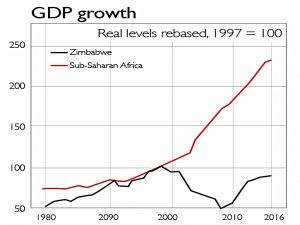

The first shows the (economic) damage that Mugabe did to Zimbabwe.

- Remember this chart when you think of voting for that nice man Jeremy.

This one shows the ten biggest companies in the US market at various points in history.

- There’s little continuity in terms of industries, let alone companies.

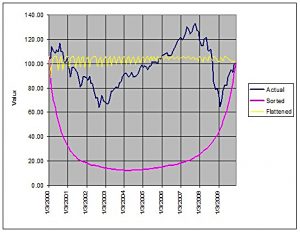

This one shows the importance of sequencing:

- The blue line shows actual market returns over a decade.

- The yellow line flattens these returns to produce minimum volatility, by putting up months next to down months.

- The purple line sorts the monthly returns from worst to best.

Investors travelling along these three lines would have had very different emotional journeys.

- But they all reached the same destination over the same timescales.

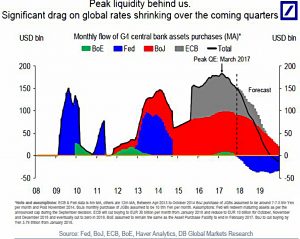

The penultimate chart shows that we are past peak liquidity from central banks.

- Which is bad news for markets and asset prices.

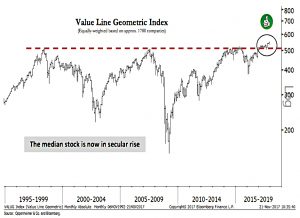

But the final graph (from Oppenheimer, via Josh Brown) shows that we might not have to worry for a while yet.

- The US market has moved into a secular bull, with more stocks going up than down.

Whilst this event usually precedes serious market crashes, the crash itself doesn’t happen until after the geometric index turns down again.

- Which suggests that we could have another one to two years before things get serious.

Until next time.

I’m waiting for bitcoin to be on the front page of The Sun, or for my postman to say he’s bought some. Then I know it’s reached the peak.

I’m actually surprised how few people know about it yet.

I asked around at the football and at a family party up in Manchester over the weekend, and I was the only one who was involved.