SIPPs vs ISAs

NOTE: This post was originally published in November 2014, but was updated in August 2015 in response to the 2015 Budgets and a visitor comment (see below).

It was updated again in November 2015 when the section comparing both products to investment outside a tax shelter was added.

Despite its legendary size and complexity (reportedly 11,520 pages and the longest in the world), in practice the UK tax code is quite simple for investors.

There are three main rates of income tax:

- 0% for the first £10K (the personal allowance)

- 20% (basic rate) on the next £32K (to a total of 42K)

- 40% (higher rate) on the next £58K (to a total of 100K)

There are more complex and punitive arrangements for those earning more than £100K pa but they need not detain us here.

In addition to income tax, national insurance contributions (NI) are also paid on earned income, with the main rate of 12% paid on earnings between approximately 8K and 42K. NI is not reclaimable.

The third main tax is capital gains tax (CGT) on gains over 11K each year. This is paid at 18% for basic rate (20%) income tax payers and at 28% for higher rate (40%) income tax payers. Entrepreneurs pay CGT at 10% on their first million pounds from the sale of their businesses.

There are three main tax exemptions:

- ISAs (Individual Savings Accounts)

- SIPPs (Self-Invested Personal Pensions) ((Other pension products are available, but are less flexible))

- primary residence (your home) – gains from the sale of a primary residence are free of CGT

In addition to these three, there is income tax relief on investments in VCTs and EIS / SEIS schemes.

The two budgets of 2015 (normal and Summer) have introduced a further two tax breaks:

- the first £1K of savings interest is now tax-free to basic-rate taxpayers; higher rate taxpayers have a £500 limit so that the tax saving is the same (£200)

- at current interest rates, this would cover a £50K pot for a basic rate tax-payer, or £25K for a higher-rate tax-payer

- there is now a £5K dividends tax-free allowance, replacing the dividend tax credit

- this would cover a £100K portfolio of income shares outside an ISA / SIPP

We will look at other tax-efficient investments in later posts, but today’s topic is SIPPs vs ISAs. Which is better, and do you need both?

ISAs do not reduce tax on contributions but they grow free of tax ((Dividends are taxed at the basic rate)) and income can be taken at any time free of tax. Up to £15K can be invested each year.

SIPPs (and pensions in general) receive tax relief (at 20% or 40% as appropriate) on contributions up to £40K or the level of an individual’s salary (whichever is smaller) each year.

Thus up to £55K each year can be tax sheltered across a SIPP and an ISA. This is more than enough to generate the retirement incomes we are considering.

SIPPs also grow free of tax up to a limit of £1M but income cannot be taken until age 55 and is taxable apart from the first 25% of the pension, which is tax-free.

The £1M limit on the total value of a SIPP allows annual withdrawals of 40K on the 4% rule, and so is a practical issue for those targeting an annual income higher than this. ((The £1M limit is the end result of a series of reductions down from £1.8M, but the government has now pledged to index-link this limit to CPI from April 2018))

The amount of tax paid on SIPP income of 25K pa is calculated as follows:

- take off 25% for the tax-free amount (= 6.25K)

- take off 10.6K for the personal allowance (=16.85K in total)

- tax the remaining 8.15K at 20% to give a tax bill of 1.63K

- this is an effective rate of 6.5% on the 25K of income

For SIPP income of 40K pa the calculation is:

- take off 25% for the tax-free amount (= 10K)

- take off 10.6K for the personal allowance (=20.6K in total)

- tax the remaining 19.4K at 20% to give a tax bill of 3.88K

- this is an effective rate of 9.7% on the 40K of income

Thus the boost from tax relief within a SIPP (25% for a basic rate taxpayer, 67% for a higher rate tax payer) more than offsets the effective tax rate on withdrawal.

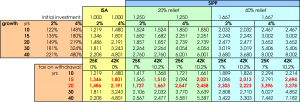

The rather complicated table below shows the growth in each product over a range of durations at both 2% and 4% pa. The ratio of SIPP return to ISA return is constant across time, but it may be useful to consider some returns in detail. ((The table has not been updated to reflect the 2015 budget changes, but the principles remain the same))

The key periods for us are 15 and 20 years since these represent the average time in the market for those retiring at 55 and 65 respectively. ((Assuming they began to invest at 25, as we recommend))

For a basic rate tax payer retiring at 55, £1,000 invested in an ISA will become 1,346 under 2% growth, or 1,801 under 4% growth. Withdrawing 42K pa from a SIPP would produce 1,510 and 2,021 respectively, a 12% uplift.

A higher rate taxpayer retiring at 55 would receive 2,013 (2%) or 2,694 (4%) – a 50% uplift. Taking 25K pa from a SIPP is even more beneficial, producing a 16% uplift for a basic rate taxpayer and a 55% boost for a higher rate taxpayer.

Given these returns, it seems obvious that the higher-rate taxpayer at least should focus on SIPPs as a retirement vehicle.

It’s also worth comparing the two products to investment outside a tax shelter.

It’s clear than investing outside of a tax shelter produces worse results across the board than investing in either a SIPP or an ISA.

Alongside the Summer Budget of 2015, the government published a green paper consulting on further changes to tax relief.

- It seems possible that the current system of tax-relief up front will be replaced by an ISA-style system with tax-free withdrawals in retirement

- It is not clear whether such a “pension ISA” would include a top-up payment from the government, but if it does, it may well be a flat payment (of 25% or 30%) to all taxpayers, removing the pensions advantage for higher-rate taxpayers over basic-rate taxpayers

- A top-up would mean that pensions retain their advantage over ISAs, whereas no top-up would mean that ISAs should be filled first (since there are no restrictions on withdrawals)

- Higher-rate taxpayers should consider using their pension reliefs while they are still available

Until next time.

This very clear post is now out of date and, thanks to George Osborne’s walloping of investors in the summer 2015 UK budget, becoming incorrect.

There are now two additional allowances in the tax code: £1k per year of interest and £5k per year of dividends. Dividend taxes are now higher above that limit.

The lifetime limit for SIPPs has fallen to £1m but is now inflation linked.

Moreover, Osborne is consulting on major changes to pension tax relief. It takes a credulous investor to believe SIPP tax breaks remain unchanged in 10+ years time. ISA tax breaks look more likely to stay however.

Thanks for the comments. I’ve updated the post to reflect your points.

SIPPs still beat ISAs for the time being, though I agree with you that the future looks very uncertain.