Robo Advisors 8 – Barclays, UBS and Brewin Dolphin

Today’s post is our eighth look at robo-advisors and ready-made portfolios. Today we’re going to look at some more traditional wealth managers, to see how they shape up.

Contents

Barclays

This post was prompted by an article in the Daily Mail that Barclays was “squaring up” to Hargreaves Lansdown by cutting their charges.

- The article actually focused on fund, with Barclays planning to charge a 0.2% platform fee (on the first £500K) in contrast to the 0.45% charged by Hargreaves (on the first £250K – 0.25% after that).

- Even 0.2% of £500K is £1k pa before you get to the fund charges

We already knew that fund on HL (and everywhere else) are expensive, so let’s look at the ETF costs.

As before, when we looked at Vanguard and its comparators, we’ll use the core 7 Circles diversified ETF portfolio as the basis for comparison.

The article calls the new service Barclays Direct Investing, but when you get to the site, it now seems to be called Smart Investor.

There’s an ISA at present, with a SIPP due for 2018.

They also offer two ready-made portfolios – Growth and Income.

- But these are made from funds (OIECs) and are expensive.

- The Growth portfolio costs 0.65% pa and the Income portfolio is a massive 1.65% pa.

The platform charge for shares and ETFs is 0.1% on the first £200K.

- As far as I can tell, this cap is just for existing Barclays Stockbrokers customers, and may be temporary.

See this note:

We’re introducing special pricing just for Barclays Stockbrokers customers. We’ve capped the customer fee on ‘other investments’, so you’ll only pay the customer fee on ‘other investments’ up to £200,000. This special pricing will be available for at least three years and is designed to help you transition to the new service.

Trades cost £6, so our year 1 trading costs are £90.

Platform costs are as follows:

- £50K costs £50

- £100K costs £100

- £250K and £500K each cost £200

There’s a minimum charge of £4 a month (£48 a year), but all our portfolios will exceed that.

- There’s also maximum fee of £125 per month (£1,500 per year) but none of our portfolios will get close to that.

So the total Year 1 charges are as follows:

- for £50K: £140 = 0.28% + 0.21% (for the ETFS) = 0.49%

- for £100K: £190 = 0.19% + 0.21% = 0.40%

- for £250K: £290 = 0.12% + 0.21% = 0.33%

- for £500K: £290 = 0.06% + 0.21% = 0.27%

These are respectable numbers.

- They are beaten by the iWeb and Fidelity ISAs at the bottom end (£50K and £100K)

- But they are competitive at the top end (£250K and £500K), for those who can access the platform fee cap.

So Barclays have been added to our leaderboard.

UBS

Shortly after the Barclays announcement, the FT ran an article on how traditional wealth managers were failing to adapt to robo advice (or “the digital revolution” as they called it).

- It turned out that only UBS and Brewin Dolphin currently had offerings.

- Killik have one coming in the autumn.

So let’s take a look at UBS.

Their service is called SmartWealth, and you can start investing with as little (for a bank like UBS) as £15K. (( Disclosure – I worked at UBS for six years ))

- One quirk is that you have to pay in via CHAPS (rather than BACS) – this will usually cost you (the fee is £30 per transaction at my bank)

The approach here is that you answer some questions and this leads to a “personalised investment strategy” which is reviewed once a year.

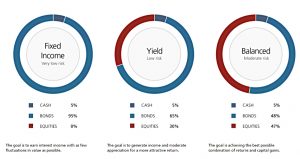

- It looks like there are five underlying strategies, which seem to be built from in-house UBS funds.

There is an ISA but not SIPP.

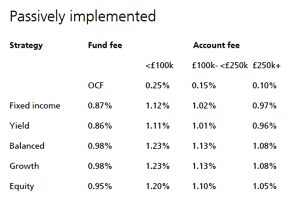

The platform fee (here called the advisory account fee) looks at first glance to be tiered:

- below £100K it’s 0.25%

- between £100K and £250K it’s 0.15%

- above £250K it’s 0.1%

So for our portfolio sizes, the fees would be:

- £50K and £100K = 0.25% pa

- £250K = .4*.25% + .6*.15% = 0.1% + 0.09% = 0.19%

- £500K = (0.19% + 0.10%) / 2 = 0.15%

But from looking at the table of fees for the passive portfolios, it looks as though the fee is not tiered.

On top of this we have fund fees:

- passive funds run between 0.80% and 0.98% – an average of 0.89% pa

- In practice, the five portfolios range between 0.87% and 0.98%

- The two most useful portfolios cost 0.98%, so that’s the number we should use

- active funds run between 1.15% and 1.75% – we won’t be using the active funds

So the overall charges are pretty steep:

- £50K and £100K = 1.23%

- £250K = 1.13%

- £500K = 1.08%

That puts UBS firmly into the red zone of our table.

Brewin Dolphin

Brewin Dolphin (BD) offer a Portfolio Service, starting from £10K (and apparently capped at £200K).

- The front page tells us that there are six model portfolios

- The portfolios are made up of funds from Vanguard, BlackRock, Fidelity, HSBC and L&G

There is an ISA, but no SIPP.

BD use a model involving 10 levels of investment risk, but they only offer portfolios for levels 3 through 8.

The front page also states that fees are below 1% pa.

- That fee comprises a 0.7% platform fee, and fund fees between 0.11% and 0.16%

So the maximum fee is 0.86% and the minimum 0.81%.

- This puts BD towards the bottom of our table, largely because the platform fee is not tiered or capped for larger portfolios.

That’s it for today.

- UBS and Brewin Dolphin are really just web front-ends onto a traditional ready-made fund portfolio.

- They are way to expensive for us.

- Barclays Smart Investor is a new cheap platform – at least for existing Barclays customers.

- But it’s not quite cheap enough to displace our incumbents (iWeb, YouInvest and Fidelity).

You can find links to all of the articles in this series – plus the live spreadsheet summarising our findings – here.

Until next time.