Lang Cat Platform Review 2017 – Are You Being Served?

Today’s post takes a look at a report on investment platforms from a Scottish consultancy – the Lang Cat Platform Review. Does it match what we know already?

Contents

LangCat

The Lang Cat is a consultancy that largely works with providers and financial advisers on strategy and communications.

- But they also compile reports that are useful to private investors.

Last week they published “COME AND HAVE A GO: ARE YOU BEING SERVED?” – a review of UK investment platforms.

- It’s a big report (48 pages and 20,000 words), and most people won’t work their way through it.

So here are the easily-digestible edited highlights.

RoboAdvice

For all the hype around the possibilities, very little of the development in the robo-advice market has dared to stray very far from what’s already available. Truly there is no new thing under the sun.

Robo services target younger savers and believe they can reach parts that traditional providers cannot.

We’ve seen evidence of some big improvements from those involved in the robo-advice market. In terms of cost disclosure the old guard could learn a lot from them.

The report has a list of new entrants to the market, most of which we’ve already reviewed (see here for our summary page):

- evestor

- MunnyPot

- Scalable Capital

- UBS SmartWealth

- Netwealth

I hadn’t come across ETFmatic or Investec Click and Save, so they will be added to our next article.

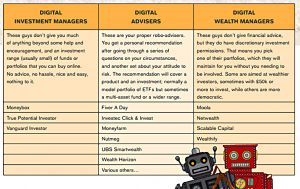

A lot later in the report, there’s a table dividing the RoboAdvisor market into three sections:

- Digital Investment Managers

- Digital Advisors

- Digital Wealth Managers

Once again, we’ve covered most of these already.

- There are two more to add to the review queue (in addition to ETFmatic and Investec Click and Save) – Fiver A Day and Moola.

So you can expect part nine in our series on RoboAdvisers next month.

Savings

The savings ratio – the maximum that could be saved – fell to a record low of 1.7% at the end of March 2017, according to the ONS. The BoE expects inflation to push it down further in 2017.

Cash remains king even though stock markets have hit record highs. Stocks and shares ISAs accounted for just £21bn of almost £80bn saved into ISAs in the 2015/16 tax year.

80% of the 12.7m savers who paid into an ISA chose cash. Lower income groups and under 25s are most likely to hold all their ISAs in cash.

That preference for cash has been an expensive one. Royal London reported that investors had lost an estimated £100bn in returns over the past decade by sticking with cash rather than stocks and shares.

LISA

Some believe the launch of the Lifetime ISA (LISA) will help to reach younger savers.

But LISA hasn’t started well. Most platforms and all the high street banks have decided to either stay out, or enter the fray when they get a better idea of the likely demand.

There’s also a concern in the industry that the LISA could undermine automatic enrolment.

FCA Asset Management Report

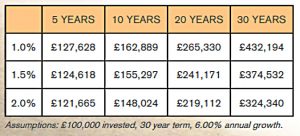

We covered this in detail last week, but LangCat has a nice table of how annual charges affect your returns:

A 1% difference in charges paid can make a difference of £100K over 30 years.

Advice

The Regulated Activities Order (RAO) will be updated in January 2018 to fall in line with MiFID (the European regulation).

Firms will be exempt from the need to hold a permission to advise on investments unless the firm is providing a personal recommendation.

To be fair, that’s pretty much how I understood the current rules to operate.

LangCat are under the impression that:

… telling you what people like you usually do in relation to a particular product, and solutions offered on the basis of your risk profile (model portfolios) …

will count as personal recommendations.

- That seems a bit of a stretch to me, but we’ll see how the RoboAdvisors react.

LangCat would like to see a “guided sales” category inserted between the existing “guidance” and “advice”.

- This would cover RoboAvice and the online offers from high street banks.

Platform categories

And now on to the platform reviews.

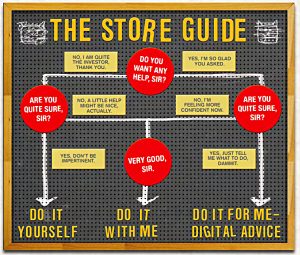

LangCat divide the 52 platforms they review into three types:

- Do It Yourself (DIY)

- Do It With Me (DIWM)

- Do It For Me (DIFM)

Here’s their definition of DIY:

being clear on why you are investing, what you hope to achieve by the end and when that will be;

deciding how much you want (and can afford) to invest, allowing for life’s unexpected expenses;

understanding your attitude to risk and how much money you can emotionally bear to lose for the potential of gaining more;

understanding your capacity for loss and how much money you could actually afford to lose in pursuit of growth;

researching your investment options from the myriad funds, ETFs, equities and whatever else is out there;

building a portfolio from those options; and

having done all this, keeping track of both your portfolio and anything in the big wide world which may potentially affect it, and what (if anything) you should do about that.

Sound like they are trying to make it seem harder than it actually is.

- All you really need to do is read 7 Circles every week.

Here is DIFM:

If you really don’t want the responsibility of decision making, or would rather put your investment decisions in the hands of an expert, you can access digital advice. This may not cover your whole financial situation, just the investment in question. The outcome will be in the form of a portfolio which is based not only on your attitude to risk but also on your goals and what you can afford to invest.

The other option is digital guidance, a process which will guide you through much of the same material and ask many of the same questions but stops short of taking responsibility for what it suggests. (( Some would say that 7 Circles falls into this latter category ))

And here is the middle ground – DIWM:

Here , the investment decisions are yours to make but there is help available. That help tends to take one of two main forms: Fund lists and risk-based investments.

With the latter, there will be a scale from low to high with a fund or portfolio matched to each level. However, it’s for you to determine your risk-level. (( 7 Circles qualifies here – we have fund lists of ITs and ETFs, and even a risk questionnaire.

DIY ISAs for Funds

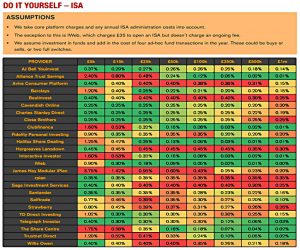

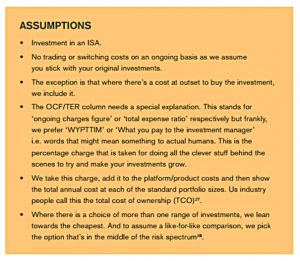

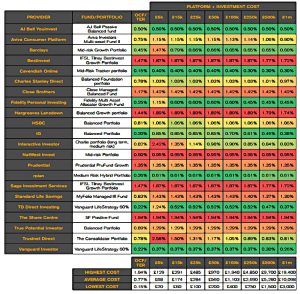

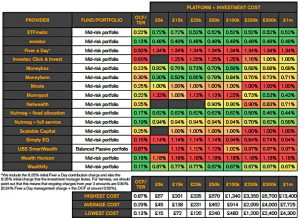

After a section detailing how all the various platforms work, we come to a series of tables comparing costs within the three LangCat categories, with some further subdivisions.

- These tables are colour-coded (like our own here on 7 Circles) so the LangCat call them heatmaps.

First up is DIY ISAs for Funds.

- LangCat assume four transactions per year.

- They include smaller portfolios (£5K, £10K and £25K) and larger portfolios (£1M) than we do, so they have eight data points to our four.

They don’t include the cost of the underlying investments in the DIY heatmaps, so focus on the colours rather than the numbers.

- Our tables here on 7 Circles include underlying investment charges.

In the range we focus on (£50K to £500K), only three platforms are completely green:

- iWeb (our favourite) ((Halifax are also green but they are the same service as iWeb in a more expensive form ))

- ClubFinance

- Interactive Investor

I will review these last two platforms in a separate article on Robo Advisor comparators.

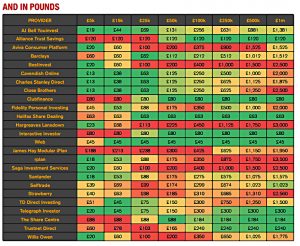

There’s a second table showing the annual charges in real English pounds, which makes for sobering reading at the top end:

- iWeb charge £45 pa for a £1M portfolio of funds, whereas rplan charge £3,500 pa.

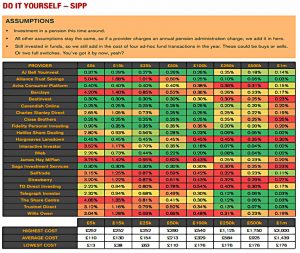

DIY SIPP for funds

This is similar to the first table, but with any extra charge for a pension (these are surprisingly common) added in.

- The table is slightly smaller, since Clubfinance, rplan and Santander don’t offer pensions.

iWeb is now the clear winner in our range of portfolio sizes.

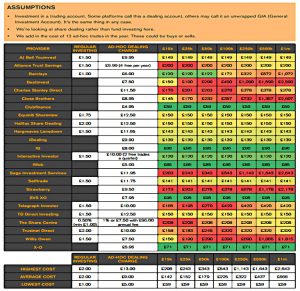

This is a trading account, not an ISA or a SIPP.

- As such it’s not much use to us.

- LangCat assume 12 trades per year.

Most platforms don’t have an annual percentage charge for such accounts.

ClubFinance are cheapest, followed by X-O, iWeb, SVS X-O and IG (lots of letters there).

In fact, DeGiro and Trading 212 are even cheaper, but LangCat doesn’t include them.

It’s also disappointing that LangCat don’t look at DIY ISAs and SIPPs for shares.

- If you want a SIPP for shares (or ETFs), then YouInvest and Fidelity are the cheapest.

- If you want an ISA for shares / ETFs, then iWeb is the cheapest.

More information can be found here.

Do It With Me

Here we are looking at ISAs.

- Initial transaction costs are included, but there’s no switching.

- Investments in the middle of the risk spectrum have been chosen.

Only four platforms beat our 0.5% pa target at any of our portfolio sizes:

- Vanguard, which we have already covered

- Cavendish online and TD direct, which I’ve added to our “to do” list, and

- AJ Bell, which we reviewed but found more expensive – so a re-check is required.

Do It For Me

This is the same as Do It With Me, but with more emphasis on your personal circumstances (usually via an online questionnaire).

The only sub-0.5% platform here is evestor (we’ve already reviewed them).

Awards

LangCat have nine awards this year, though one has no winner and another is an award that you wouldn’t want to win. (( There are 10 if you include their praise for the FCA ))

1 – Best for DIY

- The winner is iWeb

- I concur, especially for ISAs (Vanguard is the alternative here)

- YouInvest and Fidelity can be a bit cheaper for SIPPs

2 – Best for Do It With Me

- This goes to Fidelity, though apparently it’s awarded to a revamp of the existing platform that LangCat have seen a preview of

- I’m not convinced, since they say the platform charge is 0.35%, so all-in the charges will be around 0.6%

3 – Do It For Me (Beginners)

- They’ve given this one to Nutmeg

- I like their service (especially the Fixed Allocation portfolios) but they are just a bit too expensive for me to recommend

4 – Do It For Me (Experienced)

- Scalable Capital get this one, and LangCat point out that they are a client of theirs.

- They’ve just has a big investment from BlackRock.

- This is another platform that I like, with a more sophisticated investment approach than most.

- But they charge 1% pa and don’t offer a SIPP.

- Hopefully this charge will come down as they get more assets under management.

5 – Best for Clarity

- No winner, for the fourth year in a row

- LangCat have decided to retire the award since no-one is winning it

6 – Villain of the Year

- Virgin Money win this for charging 1% for a UK index tracker.

- That’s about 12 times what it should cost.

- Despite this, there is £3.34bn in the fund.

- Which earns Richard Branson £33M a year. From an index fund.

7 – Disruptor of the Year

- Vanguard win this one

- I agree that there’s potential for disruption, but I would note that

- (1) iWeb are still cheaper than Vanguard and

- (2) iWeb have been massively cheaper than Hargreaves for years, without denting HL’s massive market share

- Perhaps Vanguard will have more success

8 – Best for Pensions

- They’ve only gone and given this to HL.

- I get their logic about HL’s terrific service levels, but they are SO expensive.

- AJ Bell (YouInvest) and Fidelity provide a similar service at a lower price, and I would recommend them instead.

9 – Best for Innovation

- This went to Octopus Labs rather than a platform.

- They are behind Moola and Advicefront (?).

- I haven’t looked at either, so I’ll refrain from comment at this time.

There’s actually a 10th award, to the FCA for their Asset Management report.

- They are the LangCat Hero of the year (!)

- I disagree with this so much that I’m leaving out the picture for this one.

- See here for what I thought of the FCA report.

Conclusions

This is a fun report, packed with information and at an attractive price (free). (( I know, I’m a sad man for finding this stuff fun ))

- And I like the LangCat’s use of heatmaps (though I will continue to call them colour-coded tables, because I’m that old).

But choosing funds for ISAs and SIPPs, and restricting shares / ETFs to trading accounts only is a strange approach.

To give HL an award also strikes me as strange.

- And I totally disagree with LangCat calling the FCA a hero. Coward of the year would be nearer the mark.

We’ve picked up quite a few platforms that warrant further investigation (nine in total).

- So keep your eyes peeled for at least another couple of articles in our RoboAdvisor series.

Until next time.

I notice that Fidelity Personal Investing have now changed their fee structure so that instead of them being very cheap to buy ITs/ETFs with a 0.1% charge (with no minimum) that they are now going to levy a £10 fee per transaction and charge £1.50 to reinvest dividend income.

They also don’t allow their ISA investors to pay their service fee of 0.35% by cash and have to sell units in their biggest holding -something that generally is not good sense for investors as that will mean that part of the income that they get to reinvest in further units will be used instead to pay their fee. Most platforms will only do that if there is insufficient cash in the ISA account-Fidelity give you no such choice now so they are likely to be less competitive than others….

Appalling inaccurate feedback from the Interactive Investor “help” desk over several months!

I have been repeatedly been informed both on the phone and every 3 months that the £80 admin fee on my ISAs was being taken from my account associated debit card and then having this confirmed after the event.

However, the “help” desk have just actually discovered that they have been misinforming me and the £80 admin fee has, in fact, been taken from the ISA investment itself.

Obviously, if you want to maximise your investment in the ISA, this is the last thing you want.

The “help” desk have also now finally informed me that they can only take the £80 ISA admin fee from the associated debit card when the total investment in the ISA is less than the £80 investment charge!

Only if the debit card will then not cover the £80 admin charge will they draw this to my attention.

Do these process following idiots have the slightest conscious awareness of what they are doing all day, every day?