New Robo Advisers – MoneyBox, MoneyFarm and PensionBee

Today’s post is one of our periodic updates on the robo-advisor scene in the UK. Today we’re going to look at three robo advisors – MoneyBox, MoneyFarm and Beehive.

This post is part of a series of articles on Robo Advisors and Ready-Made Portfolios. You can find links to all of the articles – plus a live spreadsheet summarising our findings – here.

Contents

Robo advisors

We’ve looked at robo advisors before.

In October 2015 we looked at True Potential, Wealth Horizon and Bestinvest.

- Before that, we had looked at ready-made portfolios from Nutmeg, Hargreaves Lansdown and Fidelity.

We concluded that none of them were cheap enough to be recommended.

- At all practical portfolio sizes, DIY portfolios are superior in both cost and diversification.

Nutmeg is cheap-ish, if you are prepared to trust them with a lot of your money (£500K+).

- But it still doesn’t have enough in the way of asset diversification.

Today we’re going to have a look at three more robo advice firms.

MoneyBox

First up is moneybox.

This offer is a little different – it’s an app on your phone that rounds up your transactions to the nearest pound, and invests the difference for you.

- The app is only available for iPhone, with Android “coming soon”, so most people can’t use it. ((As an Apple hater, I like to think that the early availability of iOS apps reflects the gullibility and spendthrift nature of Apple users – developers want to go where the money is ))

- You need to connect a card to the app, and use this card for all the spending that you want to have rounded up.

MoneyBox make a big deal out of how safe they are, which I suppose reflects the cautious audience they are targeting:

- They are FCA authorised

- They have bank-level encryption

- They are covered by the FSCS up to £50K ((As are all SIPP and ISA providers ))

The spare change goes into a Stocks and Shares ISA that invests in “over 6000 global companies”.

- They have three portfolios on offer, each made up from the same three underlying tracker funds.

- The funds are Cash, Global equity and Property.

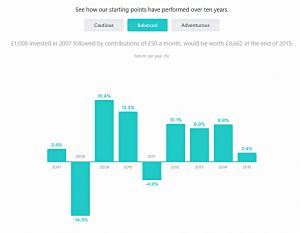

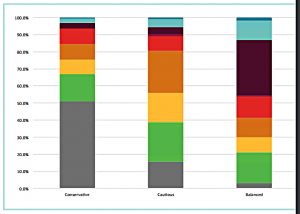

The portfolios are Cautious, Balanced and Adventurous.

- Equity allocations range from 10% to 60%.

- Property allocations range from 5% to 35%.

- Cash allocations range from 85% to 5%.

They have some nice graphs on past performance (which as we know is not a reliable guide to future performance).

Working out the costs is a little more difficult.

- You pay £1 a month to MoneyBox as a subscription fee, with the first 3 months free.

- You pay 0.45% of your invested funds as a platform fee.

- Then you pay around 0.23% on top of that to the fund providers (depending on your mix of funds, which depends on the portfolio you choose).

So on £10K invested your total fees are £80 a year, or 0.8%.

- This is high, but not crazy high.

The real problem is how do you get there?

- The average round-up per transaction is only 50p (since the range of roundup is 1p to 99p).

- Assuming you use your card twice a day (more than me) that’s only £30 being put away each month.

£30 a month is only £360 per year, gross.

- It will take you 30 years to save £10K.

And from that £30 a month you’ll lose £1 in subscriptions and 20p in fees.

- So your net contribution is only £28.80 and at the end of the year you’ll only have £345.60 saved.

Here are your year two fees on £300 (the nearest that the MoneyBox website would let me set the slider):

You’re now paying 4.7% a year in fees!

MoneyBox conclusions

MoneyBox is one of those ideas that sounds great in theory but in practice it’s very stupid.

- Saving a few hundred pounds a year is pointless, even if the app makes it simple (for Apple fans).

- You need to save thousands a year, and as many thousands as you can.

On top of that, the asset allocation choices are weird, and the charges are ridiculously high unless you save some serious money.

- Which you won’t do by chipping in 50p from your morning cup of coffee.

Avoid.

MoneyFarm

Next up is MoneyFarm.

- I got a flyer for this one in a magazine, with a sticker on the front trumpeting no management fees on the first £15K.

Here’s the front page.

MoneyFarm do a nice line in projections:

That one was for £10K plus £500 a month, for 10 years (the maximum length of projection they will do).

They are pushing their lack of bias, and their low fees.

- They also mention expert management, but since they use ETFs, I’ll need more detail on that one.

They offer an ISA and a regular (taxable) account.

- They also have a phone app (Apple-only, naturally.

To allocate you to the right portfolio, MoneyFarm do at least make you fill in a questionnaire, so they can learn more about your goals and risk appetite.

What about costs?

- The first £10K is managed for free (turns out the offer on my flyer was for the first year only, and subject to applying before 10th December).

- Then £10K to £100K costs 0.6% and £100K to £1M costs 0.4%.

- Above £1M is free.

- On top of this the underlying ETFs charge 0.25%.

This tiering doesn’t make as much difference as you might think.

Here are the total fees:

- £50K = 0.73%

- £100K = 0.79%

- £250K = 0.71%

- £500K = 0.68%

- £1M = 0.66%

These are not outrageous fees, especially at the low-end, but they don’t scale up too well.

More annoyingly, they compare themselves to DIY, IFAs and Wealth Managers using a sneaky “oranges vs apples” methodology.

- MoneyFarm gets to use cheap ETFs, whereas everyone else has to use expensive funds (OEICs).

- Swap out the OEICs for ETFs and DIY would be cheaper, even for £50K.

- I suppose I should be grateful that they even include DIY in the comparison.

Finding out what goes into the portfolios is more difficult.

- You can download a PDF of MoneyFarms investment process.

- This tells you that they use portfolio optimisation based on the efficient frontier concept within Modern Portfolio Theory (MPT).

It looks as though the underlying ETFS are as follows:

- Commodities

- Emerging Market (EM) Equities

- Developed Market Equities

- EM Government Bonds

- High Yield Credit

- Inflation-Linked Bonds

- Long-term Government Bonds

- Cash equivalent

That looks like a decent spread to me.

There are six portfolios, as shown in the two-part graph below.

MoneyFarm conclusions

MoneyFarm comes closest so far to my idea of a robo adviser.

- Fees are only slightly higher than DIY, even for a small (£50K) portfolio.

- Diversification is pretty good.

- It’s FCA regulated, so your underlying assets and first £50K of cash should be safe.

PensionBee

PensionBee is all about collecting together your existing pensions into a single scheme which they claim offers good value.

You fill the details of your employers etc, and they find and transfer the old pensions into a central pot (for free).

- They claim fees are between 0.5% and 0.7% pa, so that is worth looking into.

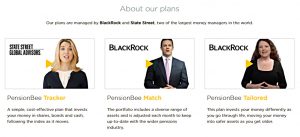

There are three plans to choose from:

- A Tracker plan, run by State Street.

- A Match plan, run by BlackRock, which seems to use a multi-asset approach. matching the portfolio composition to the pension industry standards.

- A Tailored plan from BlackRock, which seems to be a “lifestyling” approach, changing the asset mix as you get older by adding more safe assets (not necessarily a good idea).

To find out any more about the fees or the asset allocations, I had to sign up, which I didn’t like.

- Once I was registered, I had to choose a plan before moving any further.

- There are explainer videos, though.

Here’s what they say:

- Tracker is 80% equities, 20% bonds / cash, with international diversification

- Match uses a monthly match to the pension industry asset allocation.

- Tailored is lifestyling – the younger you are, the more exposure you have to stocks and property; as you get older you get more bonds.

I chose Match and moved forward to the next step.

- Sadly the next step is to fill in a form about the pensions that I want to transfer in, so I had to stop there.

- I’ve already had a follow-up email asking why I didn’t complete the form.

PensionBee conclusions

The PensionBee offer is an interesting one.

- Collating small pensions into one larger, cheaper one will make sense for a lot of people.

- The portfolios on offer and the headline charges seem reasonable.

But you can’t find out enough detail without signing up.

Conclusions

This year’s robo advice review has produced better – if dramatically mixed – results than before:

- You should run away quickly from MoneyBox.

- MoneyFarm looks to be the best robo-adviser yet.

- Pension Bee looks like an interesting offer for those with several small pensions, but the whole process moves way too fast.

If anybody decides to consolidate through PensionBee, please let us know your experiences in the comments below.

We’ll look at some more robo advisors in due course.

- Suggestions for the next set in the comments below, please.

Until next time.

Hi Mike,

I understand your comment about the level of detail we give about our plans at PensionBee.

We’re currently implementing an updated plans page that explain the plans in more details before signing up. That should be live very soon and I hope you’ll like it.

Jasper

PensionBee

Thanks Jasper, that’s great.

Let me know when it’s there and I’ll update the post.

Hi Mike,

The current plans page can be found here: http://www.pensionbee.com/plans. Next week we’re releasing an A/B test to test a new variant on that page. Based on the results, we should be rolling out a new plans page by the end of this month/early November. I can send you a screenshot of the new design by email.

On the charges, the 0.5 for Tracker / 0.6 for Match and 0.7 for Tailored are all-in fees. There are no underlying fund fees, trading charges or contribution/cancellation fees.

We started PensionBee to make it simple to get on top of your pension situation. The last thing you want is a complicated fee structure!

Let me know if you want to see the screenshot of the new plans page or a look into the BeeHive with a demo account.

Jasper

I used pensionbee to consolidate a number of pensions. I found the whole process to be quick(ish) and simple. The new performance tracker gives me a good picture of how my pension fund is performing and an idea of what to expect when I do eventually retire.

Now that my pension is in one place, I have true visibility of its value. It’s also cheaper for me in terms of fees! All in all I have had excellent service from PensionBee and would have no concerns in recommending them.

Would love to hear more about robo advisers in the future.

I have consolidated 5 pensions with Pensionbee and the experience has been flawless from their perspective, however I cannot say the same for a number of my existing/previous providers who have made the migration process excruciating in some circumstances.

The level of communication and information provided by Pensionbee throughout has been excellent and although with a pension pot of circa 250k I could probably find a slightly more competitive rate, compared with what I was spending including multiple eye watering fees I am to date exceedingly happy with the service and transparancy/clarity of my investment, long may it continue in this vein and i will retire content and well informed. Thanks