Seedrs EIS 100 Fund

Today’s post is another follow-up to our recent deep dive into the Seedrs portfolio update. It’s a look at the recently launched Seedrs EIS 100 fund.

Contents

Seedrs portfolio update

Last month we looked at the Autumn 2018 Seedrs EIS portfolio update.

- And we examined how we might construct a relatively safe yet outperforming portfolio of EIS investments.

We ended the third article in the series by mentioning that a speaker (from Seedrs) at a VC conference had mentioned that they were about to launch an “EIS 100” fund.

- The fund would invest in 100 companies over 12 months, with a £1,000 minimum investment.

I joined the mailing list on the website and promised an update when the fund was formally launched.

- That was supposed to be in 4Q18, but the email arrived in my inbox in January 2019.

So let’s take a look at the fund.

Status

As of the weekend, the fund had raised £663K of its minimum £1M.

- There’s a £20M hard cap on the fund-raising.

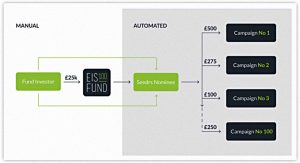

Seedrs expect the first fund to top out at between £1M and £5M, because of the deployment constraint of investing a fixed %age stake into each of the eligible campaigns.

The fixed % will be determined once the Fund has closed for investment.

For example, if the Fund size was £10,000,000, and our projected eligible dealflow was £100,000,000, then the fixed percentage that the Fund would invest into each eligible campaign would be 10%.

There will then be more Fund launches “as 2018 progresses”.

The minimum investment is £1K, with no maximum.

- The £1K minimum is basically the standards Seedrs minimum of £10 in a company, multiplied by the 100 companies in the Fund.

Team

Here’s a chart of the key players:

Passive VC

Seedrs make a bit of a thing about their fund being a unique passive fund in venture capital, but it seems to me that Syndicate Room got their first with their Fund Twenty8.

- This launched a couple of years ago, and I invested in the first round.

It’s true that the Seedrs fund will invest in many more underlying companies, but it won’t invest in everything on the Seedrs platform, so it’s still an algorithmically sampled fund in the same box that Fund Twenty 8 lives in.

I find it strange that the table above omits the 80 or so VCTs that are the main competition for the EIS Fund 100, as well as the many listed Private Equity Investment Trusts.

Product

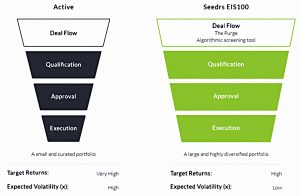

The product description on the website stresses the passive nature of the deployment and the diversification benefits, and explains something about the process by which the underlying companies will be selected.

It also stresses the nominee structure of Seedrs, where the platform acts in the interests of investors by voting their shares and taking seats on company boards.

We’ll look at fees and the secondary market in more detail below.

Process

In 2019 we are expecting approximately 15,000 deals to engage with the Seedrs platform.

Out of this very large funnel we expect approximately 500 to launch a campaign on Seedrs, with 260 of those successfully hitting their funding target. The EIS100 Fund will then invest into approximately 100 of these deals.

There are several diagrams explaining how the Seedrs deal flow is converted into investments in the fund.

A 10% cap on a single company’s share of the fund looks high to me

I also don’t quite understand how to square “fixed % of funding round” with the 25% cap per funding round

- But I think that it’s a way of capping investment into very large and / or very small funding campaigns.

Fees

There is a 25 bps (0.25% pa) platform fee, calculated on the basis of the investment lasting eight years.

- That works out at 2% up front.

At the moment, this fee is being waived for investors on the email list:

For a limited time, we will be waiving our platform fee on any investments made by investors on the priority access list, as a thank you for your early interest.

I find the fact that they want to take the fee up front slightly disappointing, as it implies that the value of the investments will fall on average.

There’s also a 7.5% “carry” which is taken from any profits.

- This is best viewed as a performance fee, in which context it’s relatively modest.

Secondary market

It appears that investments in the fund can be traded on the Seedrs internal secondary market.

- I can only assume that this will be on an individual company basis.

- I’m not clear who would want to invest in the fund as a whole without the benefit of EIS income tax relief.

If it is on a company basis, then investors would in theory be able to cash in their winners early, once the EIS tie-up period (three years) has expired.

Note that not all underlying companies will be eligible for the secondary market.

- Seedrs also point out that the secondary market is the reason why the Fund is not HMRC approved (ie. will need 100 individual tax certificates rather than one for the whole fund).

- HMRC require that there is no ability to sell out of individual companies within a fund.

Returns

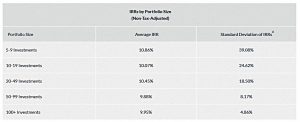

Seedrs justify their use of 100 companies in the fund by reproducing a table from their Autumn Portfolio Review.

- Investors who made 100+ investments had much lower volatility, whilst giving up less than 1% pa in returns.

It should be noted that the high volatility shown by smaller portfolios was driven by the outsize returns from the unicorn Revolut.

- This doesn’t invalidate the fund’s approach, it just means that the numbers will be different, unless the fund uncovers another Revolut.

Tax

The fund (and the underlying companies) qualify for the EIS tax reliefs.

- We’ve looked at these many times before.

The potential downside of a fund structure is that it might generate 100 EIS tax certificates than need to be submitted to HMRC.

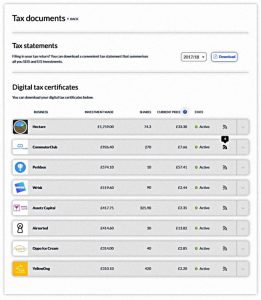

Seedrs claim to have dealt with this problem by consolidation all your tax paperwork online, with yearly summaries available.

We developed a tax portal where investors can see a simple tax statement which summarises all investments made into EIS, SEIS or non tax eligible deals, which contains all the information needed in order to complete their tax return in one handy place.

In addition, we have designed a proprietary ‘digital’ tax certificate, which means that tax certificates required in order to claim any relief are issued to investors digitally via the Seedrs platform, where they can be accessed at the investor’s convenience.

No more waiting for the certificate in the post.

There also a useful summary of the tax treatment of exits.

- The levels that they’ve chosen to look at are a doubling in value (£10K becomes £20K), a break-even (£10K) and a total loss (£0K).

Note however that the table doesn’t take account of fees and the loss relief in the right hand column is shown for a 45% taxpayer.

Risks

We’ve summarised the risks of EIS investment / equity crowdfunding before, and they match to the Risk Warnings document that comes with the EIS 100 Fund application:

- Lots of firms go bust, and investors lose all their money.

- The shares are illiquid (hard to trade).

- Seedrs offers a limited secondary market (see above) but in general you have to wait for an “exit event”

- They don’t offer dividends.

- In contrast, VCTs offer regular (and usually high) tax-free dividends.

- You might get diluted by later-stage investors.

- Seedrs offers pre-emption rights to protect against this.

- For the first several years, “returns” are mostly just paper revaluations from subsequent funding round.

- Any crowdfunding platform may have a different mix of deals (with different prospects) in the future.

- You may be getting involved too late, or as with Seedrs, European expansion might mean that EIS opportunities are reduced.

- Not every deal is open to every investor.

- Seedrs admit that most deals have a period during which they are “private”.

- Other deals involve exercise of pre-emption rights and are only available only to existing investors in that company.

In my opinion, crowdfunding is best suited to sophisticated investors who have maxed out their pension tax relief and have run out of VCT investments for the tax year.

Videos

Seedrs has a couple of videos, if you’d like to watch them.

Conclusions

I like to have access to a passive approach to higher risk investments, so in principle I’m a fan of the EIS 100 Fund.

- And the fees don’t seem unreasonable to me.

But as with so many EIS and VCT investments, it has been launched at the wrong time of the year for me.

With more than £40K to invest each year, and a dozen individual investments to make, my search begins with the new tax-year in April.

- By Xmas, I’ve usually allocated all of my money for the year.

It might seem sensible to wait, but the one year I tried that ended with a mad scramble to fill up my allocation in March.

- So I will revisit the EIS 100 Fund (or its successor) in April.

Until next time.