Bitcoin taxation

Today’s post is a look at bitcoin taxation in the UK.

Returns

Interest in Bitcoin – and to a lesser extent, other cryptocurrencies – has been rekindled by its recent record-breaking run.

- The BTC price is close to $32K as I write this.

There has also been a lot more positive sentiment from institutional investors (eg. hedge fund managers), in marked contrast to the last time the price was at an all-time high.

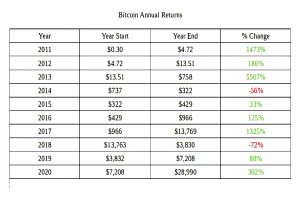

But first, let’s take a closer look at the annual returns to date. Here’s a table I found on Reddit: (( Thanks, u/ModernRefrigerator ))

This works out at 891% pa over the last decade.

- If you expect returns like this to continue, tax rates are unimportant.

The figures are in dollars, in which BTC is usually measured.

- Those of us in the UK will have to factor in the $/£ exchange rate, which for most of my lifetime has wobbled between 1 and 2 dollars to the pound – certainly enough to take notice of.

In recent years, Brexit-inspired gyrations have made things worse, but these may finally be behind us.

For those of us who think that returns won’t continue to be so high since BTC is already quite expensive, the fact that these are pre-tax returns is important, as you can’t spend those.

- So what might we expect post-tax returns to be?

Audience

Before we find out, a note on my target audience.

This article is not aimed at long-term HODLrs who are sitting on millions in potentially taxable gains.

- I won’t be providing any clever offshore laundering routes for unrealised profits.

Nor is it aimed at those with a crypto business (eg. mining, though I’m sure this is no longer economic at small scale).

- Crypto received through employment will usually be subject to income tax and NIC

I’m writing for those DIY investors who feel the time has come to allocate 1% to 2% of their portfolio to BTC, which has high historic returns uncorrelated to the stock market.

- You may, like me, alternate between viewing crypto as the greatest investment opportunity currently available, and as a high-tech Ponzi scheme – but you might still want to have an allocation.

A subsequent article will explain how to do this in practical terms, but first, let’s look at one of the big drawbacks with crypto investment – a lack of tax shelters.

Regulation

Tax is a subset of investment regulation and in the case of bitcoin, there’s one other piece of regulation we need to get out of the way upfront.

- Recently, the UK regulator (FCA) decided in its infinite wisdom that citizens needed to be protected from themselves and banned the sale of crypto derivatives to retail investors.

At a stroke, this regulation (which came into force in January 2021) removed the two tax-efficient ways of gaining exposure to BTC:

- ETFs (strictly, ETPs) within a SIPP

- Spread-bets

Since HMRC won’t recognise BTC and other cryptos as currencies, they become just another investment asset, more comparable to gold and silver perhaps, and in some ways to shares.

- As such, you are liable for tax on your capital gains.

Capital gains tax

Here’s a quick recap of CGT:

- It’s charged on profits only, not the total sale price

- Some things are excluded (cars, your home, ISAs and SIPPs, gilts and Premium Bonds, “chattels” worth less than £6K) – but crypto is not one of them

- Swapping an asset or giving it away still counts as disposal, but may not lead to chargeable profits (if to a charity or your spouse)

- You have an annual tax-free allowance of £12.3K of profits

- Losses can be offset against gains in the same year (and carried forward)

- There is no CGT on death (IHT applies instead) and the inheritor has the acquisition cost of an asset marked up to market

- If you are UK resident for tax, overseas assets attract CGT (so it doesn’t matter where you store your crypto)

- Gains can usually be reported on your annual tax return, but property profits now need to be reported within 30 days of the sale

- The tax rate is 20% for higher rate income taxpayers (28% on property profits)

- Basic rate-payers pay 10% (18% on property profits)

A review of CGT was commissioned in 2020 and changes are expected in 2021.

Crypto specifics

HMRC has been issuing cryptocurrency tax guidelines since 2014.

- This guidance is based on its interpretation of tax laws not originally designed for crypto assets.

- So tax law may evolve over time, as disputes are tested in the courts.

HMRC divides tokens into three kinds:

- utility tokens, which provide access to goods or services

- security tokens, which provide interests in a business (like shares)

- exchange tokens, intended to be used as payment, exchange or investment

We only need to worry about exchange tokens today.

In October 2020, Coinbase notified customers that they were reporting information back to HMRC on those with £5K or more worth of crypto.

- The data related to the 2017 to 2019 period, but is presumably ongoing.

Coinbase also drew their customers attention to the Digital Disclosure Service (DDS) which appears to be a confessional for those with undeclared crypto profits fro earlier years.

Crypto rules

Here are a few more tax rules specific to crypto:

- exchanging your coins (what HMRC calls tokens) for another flavour of crypto counts as a crystallisation event

- so does spending your tokens on goods or services

- and giving them away (other than to your spouse or usually a charity)

- selling tokens within 30 days of buying them has special rules (as with shares) (( It’s interesting to note that many share traders never use these rules, because of the availability of ISAs, SIPPs and spread-betting ))

- all tokens in the same class form a “Section 104 holding”

- each token (share) in the group is treated as if it is acquired at the same average cost

- sales are matched first to shares bought on the same day or in the following 30 days

- then to the rest of the Section 104 holding

- there are specific deductible costs:

- transaction fees paid before the transaction is added to a blockchain

- advertising for a buyer or seller

- drawing up a contract for the transaction

- making a valuation so you can work out your gain

- a proportion of any pooled costs across all crypto tokens

- mining costs (equipment and electricity) are not deductible, strangely

- you need to keep records of costs for each pool of tokens

- and records of every transaction

- number and type of tokens

- date of disposal

- number of tokens you have left

- value of the tokens in pound sterling

- bank statements and wallet addresses

- a record of the pooled costs before and after you disposed of them

- losing your private key (and hence access to some crypto assets) does not make them valueless

- hence you cannot make an automatic claim for a tax loss

- you can claim for the negligible value of the assets, but HMRC has to accept this

- Theft or fraud does not constitute disposal (or loss), since you still have rights of recovery

- Buying and selling crypto assets is not gambling

- which neatly avoids the loophole by which spread-betting profits are tax-free

Conclusions

There’s no easy way to avoid tax on crypto profits anymore, other than by keeping your gains below £12.3K each year.

- So you need to decide whether returns justify the 20% haircut – and the fairly onerous record-keeping, and the risk of loss.

Which is something each investor will need to decide for themselves.

- Until next time.