Weekly Roundup, 16th July 2019

We begin today’s Weekly Roundup in the FT with The Chart That Tells A Story. This week it was about perils of investing in high-yield shares.

Contents

Lucy Warwick-Ching reported that the 10-highest-yielding share in the FTSE-100 underperformed the index by 3% pa over the last five years.

- Research from Brewin Dolphin showed that they also underperformed over 10 and 15 years.

The returns included both the dividends paid and the share price movements.

Investors need to look at how the dividend is being paid and whether it is sustainable.

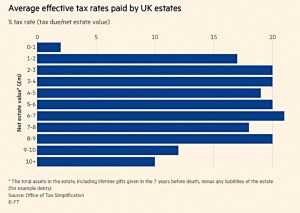

IHT

Emma Agyemang looked at the OTS review of IHT.

- We looked at this in a separate post last week.

I didn’t find anything new in Emma’s article, but you might.

Wombat

Hot on the heels of my taking the plunge with Freetrade, there’s a new “free” stock trading app on the block.

- Wombat offers 15 theme-based portfolios like The British Bulldog (top UK companies including Burberry and Rolls Royce), The Robo (including HTC and Huawei), and Social Media Guru (including Facebook and Google/Alphabet).

Kane Harrison, (co-founder and CEO) said:

At Wombat, we strongly believe that the best way to approach investing is to back companies that you know, love and can identify with.

By putting together a wide range of portfolios that should suit nearly every lifestyle, set of beliefs and interests, we believe we have handed power back to a new generation of investors.

Hmm, not quite sure about any of that.

Wombat also offers monthly automatic investing and that awful “round up” spare change approach.

Unfortunately, Wombat is only free for accounts worth less than £1K.

- The rest of us pay £1 per trade and a 0.45% platform fee.

I can’t see it taking off with that kind of pricing, though the same enormous fee hasn’t exactly held back Hargreaves Lansdown.

Low interest rates

The Economist looked at the impact of low interest rates.

John Maynard Keynes once fantasised about a world of permanently low interest rates.

He imagined an economy in which abundant available capital causes investors’ bargaining power, and hence rates, to collapse. The result would be the “euthanasia of the rentier”.

Yet the actual impact of the low rates (and QE) of the past decade have been higher stock, bond and house prices, increasing wealth inequality.

Falling interest rates make all streams of future income more valuable. That includes dividends from stocks, coupons on bonds and homeowners’ privilege of being able to occupy their houses without paying rent.

But the newspaper notes that the only way to access these increases in asset prices is to sell the asset.

- A “penniless millennial” can also spend more under low interest rates, by borrowing more cheaply.

And lower rates should cause inflation (which hasn’t appeared to date).

- This benefits debtors (by inflating away the size of their debts) and hurts creditors.

Adrien Auclert of Stanford University has tried to work out the impact of all these effects on different groups of people.

The crucial question is whether someone’s assets and liabilities mature at different points in time.

People with short-dated assets but long-dated liabilities—for example a saver with lots of cash in the bank to fund a purchase ten years hence—do badly when rates fall.

But those who wish to spend today and hold long-dated assets, such as long-term government bonds, do well.

Auclert suggests that older, higher-income Americans do badly from low interest rates.

- Panagiota Tzamourani of the Bundesbank has also found that younger households and those with low net wealth benefit from lower rates.

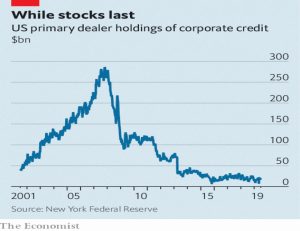

Bond Liquidity

Buttonwood looked at corporate bond liquidity.

More investors are using corporate-bond funds as an alternative to cash.

But fewer dealers are willing to trade bonds in size. A big scare could feasibly start a run.

Corporate bonds are inherently illiquid since they are traded over the counter rather than electronically and are not standardised.

- Companies may have several issues, and issues from different companies will vary along several dimensions.

This means that the dealer banks are very important to the ease of trading.

Since the financial crisis new rules have made it less cost-effective for banks to use capital for trading of any kind.

The inventory of corporate bonds held by dealers has fallen sharply in the past decade.

At the same time, low yields on safer government bonds mean that more people are interested in trading corporates.

The role of ETFs is another factor:

There are concerns that in a stressed market, outflows from ETFs might make a bad situation worse.

And in addition, lots of companies have issued bonds to buy back shares (ironically weakening the credit rating of the same bonds).

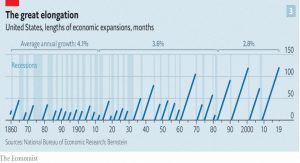

The next recession

The Economist had two articles about what might trigger the next recession in the US and globally.

- The expansion in the US is now the longest since records began in 1854, at 121 months.

And now long-term interest rates have moved below short-term ones (a yield curve inversion).

- But the stock market is booming and lots of new jobs are being created.

US housing is “only” 143% of GDP (compared with 188% in 2008.

- And inflation remains low, as does wage growth.

As well as being a long expansion, it has been a slow one (2.3% pa in GDP growth, compared to 3.6% pa over the previous three).

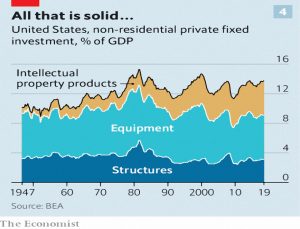

- The US workforce is ageing, companies reinvest less of their profits and productivity growth has slowed.

The shift to services and intangible assets (IP) also means that growth is more stable.

The newspaper sees six risks:

- Shocks to global supply chains from the trade war.

- Cyclical threats to advertising revenue (Google and Facebook).

- Regulatory threats to all tech firms.

- Private debt is historically high at 250% of GDP, and interest rates may rise.

- Prolonged low interest rates will eventually weaken the banks.

- Politics on both sides – low taxes and interest rates (and possibly the gold standard) from Trump, high government spending and MMT from the Democrats.

McDonnell watch

The Sunday Times had an interview with John McDonnell, who forecast that capitalism would evolve its way out of existence.

Amongst the measures he said that a Labour government would enact were:

- Nationalise rail, water, power and the Royal Mail, at well below their market valuations (after taking into account subsidies, pension deficits and asset-stripping)

- Fund these “purchases” via issuing regular government bonds

- A new 50% income tax rate starting at £125K, with the 45% band brought down to £80K

- 10% of the shares of all companies with more than 250 employees to be taken into “inclusive ownership”, with £500 in dividends to each worker, and the rest going directly to the Treasury

Other possibilities include:

- Using RBS as a development bank

- Forcible delisting of companies that breach environmental targets

- A tax on commercial land ownership

Things he ruled out were:

- A wealth tax

- A mansion tax

- Capital controls (there would be no need, as sterling will strengthen “as a result of the plans we’ve laid out”)

All we need to do now is decide whether to believe him.

Bits & Pieces

Boris Johnson has pledged to fix the NHS pensions crisis.

- A lot of commentators want him to scrap the annual allowance taper, but he’s reported to be looking at the LTA instead.

It would be great news if he did.

The government plans to extend the civil partnership structure to opposite gender couples by the end of the year.

- That would be great news, and I might even take one out myself.

Almost half of the people investing through an adviser don’t know how much their platform costs.

- The average estimate of a 0.3% charge on a £50K pot over 25 years was £7.4K – the real cost is £12.5K.

Thirteen per cent of those surveyed didn’t know they were paying any fees at all.

The Woodford scandal has led to £1.9 bn being pulled from active funds by UK investors over the last three months.

- £2.1 bn has gone into passive tracker funds.

This is the biggest switch since the Brexit referendum.

And FT Adviser speculated that the UK might follow the example of Austria and issue a “century bond” – 100-year gilt.

- Issued at say 1.5% pa, it could fund a lot of infrastructure projects.

But given the way that we wasted the North Sea Oil revenues from the 1970s, long-term thinking from a UK government should not be expected.

Quick links

I have just four for you this week:

- Investopedia noted that all of the world’s 10 biggest companies are now American

- UK Value investor looked at three high-yield stocks that might be bargains (or might not)

- Of Dollars and data wrote about The Price of Admission (it’s volatility), and

- NotAYesMansEconomics looked at the potential policies of a Lagarde-run ECB.

Until next time.