Smarter Investing 1 – The Basics

Today’s post is about one of the most popular investing books in the UK – Smarter Investing by Tim Hale.

Contents

Smarter Investing

Last week we took a first look at what seems to be the most popular book with UK active traders – The Naked Trader.

Today we’ll start work on the book which seems to be the most popular with passive investors – Smarter Investing by Tim Hale.

- I have the third edition of this book, from 2013.

- I don’t think there’s been a further edition since.

Tim Hale

Tim read Zoology at Oxford, then went to work in Corporate Banking for Standard Chartered, based in Hong Kong.

- After an MBA he moved to Chemical Bank, now part of JP Morgan.

In 2001 he set up Albion Strategic Consulting, helping financial planning firms to develop their investing methodologies.

Aims of the book

In the introduction, Tim sets out what he hopes the reader of the book might achieve / acquire:

- defining your goals

- techniques to control your “demons” (( I assume this means bad habits and psychological weaknesses ))

- a set of rules to make investment decisions

- constructing a portfolio to meet your needs, and that you can live with

- practical ways of being an efficient (“good”) investor, including guidance on products and advisers

to help you to relax and enjoy investing

All pretty good stuff.

Eye openers

Tim also includes a list of “eye-openers” at the start of the book, to encourage people to read further:

- it’s not hard to be a great investor

- all you need is a global stock tracker

- plus index-linked Gilts, or even cash

- and to keep your costs down (( Tim doesn’t mention being tax-efficient, which can be just as important ))

- the market beats the average investor

- the market is the sum of all investors

- and then you need to deduct costs

- the average investor is terrible at investing

- investors underperform by possibly 6% to 7% pa (( These poor results were for the US and Germany – UK investors seem to be a bit better, underperforming by “only” 4% pa ))

- some of this is costs, but

- most of this is “chasing the market” – buying high and selling low

- this loss outweighs the gains from investing in stocks rather than cash

- the market beats most professionals, too

- this is really just a consequence of the market being the sum of all investors, plus

- the fees that professional managers charge, and

- the fact that most fund managers are forced to stay long through the bad times (( Tim doesn’t explain this, focusing instead on the fact that professional managers offer bad value for money ))

- costs are too high

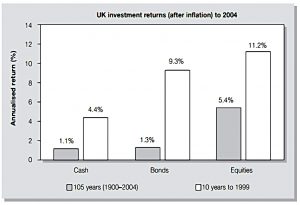

- equities return on average 5% pa above inflation, and

- most funds take 1.5% to 2% of this (30% to 40%)

- “where are the customers’ yachts?”

- past performance tells you almost nothing

- few managers get it right all the time

- you need 15 years of data to spot a winner

- rather than the 3 years favoured by the industry

- picking winners is hard

- Tim’s talking about funds here, rather than stocks

- there are thousands of funds and few consistent winners

- there are also few metrics to distinguish funds (compared to those available for individual stocks)

- many people will be poor in retirement

- people don’t save enough

- the new state pension and workplace auto-enrolment may fix this in time

- but that will take another 30 years

- the average pension pot in the UK is £35K (around £1K pa in pension)

Structure of the book

Tim’s book is broken into five sections:

- basics

- smarter thinking

- smarter portfolios

- smarter implementation

- smarter insight

So we’ll try to cover the book in five articles, this being the first.

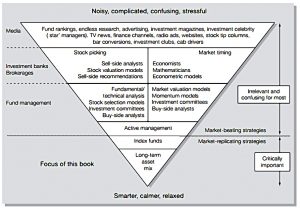

Simplifying the confusion

To beginners, the world of investing seems very confusing and complicated.

- Not only are there thousands of possible investments, but there’s a constant barrage of news / noise, mostly of the return-chasing variety.

- See Cut Out The Noise for more detail on how to deal with this.

Tim explains how we got to where we are by looking at the history of investment in the UK:

- before the 1970s, people used stockbrokers, either to buy securities directly, or by allowing the broker to manage a discretionary portfolio

- high commissions encouraged portfolio churning

- in the 1970s, active funds emerged and became the default way to invest

- active funds charge a percentage of assets under management, and so marketing is more important than performance

- gradually, passive “Index-trackers” were developed alongside active funds

- high commissions from active funds meant that index-trackers were rarely recommend by advisers (( Nor were the cheaper and better investment trusts ))

- index funds are now very popular in the US and are gaining ground in the UK

- this has been helped by the development of ETFs (index trackers listed on an exchange and bought like stocks)

- DIY investing has become easier than ever, thanks to lower trading commissions, free data and instant online trading

- Tim warns that novice investors who can’t manage their emotions are likely to significantly underperform by going down this route

Tim’s book is focused on:

- portfolio design (asset allocation) and

- the implementation of this design using index funds

Not only will this approach give you an easier life, Tim believes that it will also maximise your success.

- Tim has covered asset allocation and costs (since index funds are cheap), but made no mention of taxes yet – we live in hope.

The basics

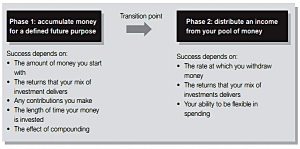

In the next chapter, Tim explains what smarter investing involves:

- Smarter investing is not about “saving” (ie. cash accounts)

- cash is ok for an emergency fund, or for a short-term goal

- over the medium-term (“a few years”) cash is “recklessly prudent”

- you are giving up wealth compared to stocks, and run the risk of inflation eroding your spending power

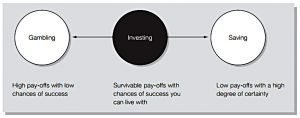

- Investing is not about gambling

- Tim is firmly of the opinion that short-term trading is gambling that “ends in tears for most”

- Where we disagree is that he characterises the few who do well as “lucky”

- I would argue that discipline, risk- and money-management have a lot to do with it

- Tim defines gambling as “long shots with high payouts”

- I would argue that it’s possible to take short-term (less than a year) positions with good odds and moderate payouts, but it’s clearly not for everyone

- Smarter investing is dull

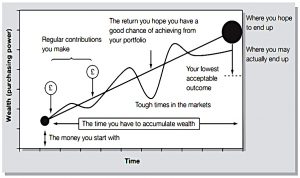

- investing is “pay-offs you can survive with, along with chances of achieving them that you can live with”

- investing is deciding on your future goals for your money, then

- finding a mix of assets to get you there, and

- keeping your costs down

- all perfectly true, but once again, no mention of taxes

Ten things to know

This section should really be called “the only ten things that you need to know”:

- Investing is a “get rich slow” process

- it uses compounding to “magnify the two steps forward, one step back journey” in the markets

- Tim excludes market timing and stock selection along with star fund managers and hot markets

- I think that this is throwing the baby out with the bathwater

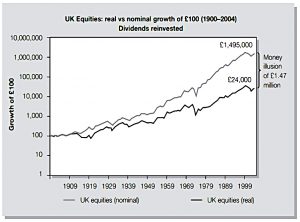

- Harness the power of compounding

- we’ve written about this here

- the key point is that small differences turn into large ones over time

- this is why what look like small annual charges have a big effect in the end

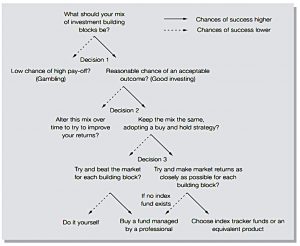

- It’s not rocket science – there is one big decision

- Tim thinks the key decision is the stocks / bonds split

- I agree that asset allocation is crucial, and the stocks / non-stocks split is the most important aspect of that

- but costs and taxes make quite a big difference, too

- the key driver of the stock / non-stock split is the high short-term volatility of stocks, and your own ability to tolerate it

- Don’t put all your eggs in one basket

- diversification across assets, sectors, geographies and time-frames is fundamental

- Capturing the market return is good enough

- this is certainly true historically, assuming you are saving enough to begin with

- 5% real per annum on a 15% savings rate will make you rich enough over 30 years

- “average” returns don’t sound like you are winning, but you are

- If it looks too good to be true, it probably is

- this is another topic that we’ve covered already

- Investment costs matter

- see here for more details

- Manage yourself as tightly as your investments

- There are no perfect answers

- but there are better and worse solutions

- Don’t worry about what you can’t control

- this includes the economy, the markets, inflation / deflation etc.

- instead, position your portfolio to weather a range of outcomes

Twenty tips

Tim says that when he was writing the book, his friends and colleagues asked him to keep it short, since they didn’t have much time.

- He says that the 80 / 20 rule (the Pareto principle) holds true in investment as much as anywhere else.

His response is this list of twenty time-saving tips (it’s as much an action plan as a list of tips):

- Have faith in capitalism as a system for creating wealth.

- Decide how long to invest each pot of your money for.

- Work out your asset allocation, especially stocks vs bonds.

- There are two ways of working out the proportion of stocks:

- 4% for every year until you need the money

- your age (as a percentage) in bonds and the rest in stocks

- I think these rules are a bit crude: I’m 56 and will start withdrawing money in the next three months

- I need either zero stocks or 44% stocks (I’m actually at 40%)

- I prefer to hold the most stocks on which I can tolerate a 40% loss

- Be conservative when estimating future returns

- a split stock / bond portfolio is likely to return 3-4% pa above inflation

- ageing demographics and slowing global growth could see this dip towards 2% pa in the future

- Diversify using funds

- Tim likes OEICs but I prefer ETFs

- Don’t try to beat the market, be the market

- This is something of an oversimplification, as “being” the global market is both difficult and inappropriate for the UK private investor

- There’s no true passive investing – all portfolios involve decisions and choice

- It’s about trading off time (effort), costs and risks

- Own broad equity market funds, not just the biggest firms

- Stick to high quality bonds and avoid “junk”

- Keep your costs down

- Don’t buy products that you don’t understand

- Beat the taxman (legally)

- At last, Tim is recommending pensions and ISAs

- Contribution rules – Tim has three rules:

- £1 of savings for every £6 of (gross) salary – this is just above the 15% minimum I quoted above

- for late starters, your age less 25 (as a percentage)

- also for late starters, half your age

- for someone starting at 45, the rules give 20% and 22.5% respectively

- Lifecycle investing

- Tim believes that you should change the asset mix to protect your wealth as you approach retirement

- I think that this used to be good advice, but retirement lasts too long these days

- I stopped working at 50, and hope to be retired for 30 to 35 years

- I need to keep as much in stocks as I can tolerate

- For protection, I keep several years in cash so that I don’t have to sell stocks during a downturn

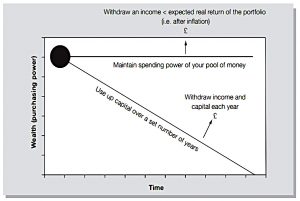

- Don’t withdraw more than 4% pa

- for more safety, only withdraw 3% pa (more on this here)

- Rebalance to stick to your asset mix

- Stick with your mix

- don’t chase returns or sell in a crash

- Don’t check your portfolio too frequently

- once a year is plenty

- Cut out the noise

- Pay for advice if you need it

- I don’t agree with Tim on this

- you can’t avoid a conflict of interests when you pay for advice

- you are better off being a DIY investor

Conclusions

That’s it for today – we’ve completed Part 1 of the book, and we’re about a fifth of the way through.

As with last week’s article on the Naked Trader, there hasn’t been much to disagree with in the introductory chapters.

- It’s all a little bit repetitive, but that’s probably what novice investors need

- Tim stresses asset allocation above costs and taxes, but that’s okay

- he also believes in lifestyling and paying for advice, which I don’t

The biggest area of contention is that Tim really doesn’t think that active investing adds value.

- While this is clearly true in the aggregate, I firmly believe that it’s possible for the UK private investor to beat the market.

- However, this takes time and discipline, and is not suitable for most people.

Other that that, there’s lots of good stuff to celebrate.

- I hope you’ve enjoyed today’s quick refresher course.

I’ll be back in a couple of weeks with part 2, which is called Smarter Thinking.

Until next time

Hi Mike,

very nice reviews. I read the book and going through your summary/analysis has been very helpful to assimilate stuff. On a completely different note, I was wondering whether you have come across equivalent material on crypto. I would very much appreciate any pointers in terms of books on the matter.

Thanks!

Hi Tom,

Thanks for the kind words. I’m not sure I understand your question – what specifically do you think is unique about crypto that it would need a different book?

In any case, I haven’t read any good books about crypto yet. I went to a good talk by Saifeden Ammous, so perhaps his book is worth checking out. https://amzn.to/3mOQlLh

Cheers,

Mike