Smarter Investing 4 – Smarter Implementation & Insight

Today’s post is our fourth look at Tim Hale’s book Smarter Investing. We’re going to cover the final two sections of the book today – Smarter Implementation and Smarter Insight.

Contents

Smarter Implementation

Tim breaks this section down into two:

- smarter product choices – how to select the best (passive) products

- smarter advice – DIY or hire an adviser?

Smarter product choices

Since Tim strongly prefers passive funds only, there is not much in this section to detain us.

The selection process is as follows:

- decide on your asset allocation / exposure to various factors

- this will include your decisions on home bias, acceptable level of diversification, and return and / or smoothing tilts

- choose a benchmark to track for each type of asset

- total return indices are best

- find products that track that benchmark

- these could be OEICs or ETFs – I prefer ETFs (( There are a few index-tracker investment trusts, but this class of product is better used for active investment ))

- bigger is generally better since costs will usually be lower and liquidity (in the case of ETFs) will be higher

- check that the products don’t drift too far from this benchmark

- this is known as tracking error, and should be less than 2% pa (ideally less than 1% pa)

- choose the fund with the lowest running costs for an acceptable level of tracking error and fund size

- costs will be a big contributor to tracking error, so it’s quite likely that the same funds will do well on both criteria

- large size and low portfolio turnover (see below) should also reduce tracking error

Other criteria that might be used to differentiate between index funds include:

- currency hedging policy

- portfolio turnover

- physical vs synthetic implementation

- full replication vs sampling

Since I use only ETFs these days, in practice there are only half-a-dozen providers with scale in the UK, and my choice is usually quite straightforward.

Lifestyle and target date funds

Tim also mentions lifestyle and target date funds.

- These use a “fund of funds” approach to target an asset allocation that typically becomes more conservative as you age.

- My own opinion is that these are of limited use since the 2015 pension reforms.

We are no longer targeting the purchase of an annuity at age 55 or 60.

- Instead we need to manage an investment portfolio through 30 years of retirement.

- Gradually reducing exposure to equities is not as sensible as it once appeared.

Smarter advice – DIY or an adviser?

You already know where I stand on this one – go DIY.

- Advisers add costs, a conflict of interests and potential translation errors.

- Costs in particular are prohibitive for investors with smaller portfolios.

There’s also the irony that those investors least suited to go the DIY route – inexperienced, risk-averse investors with smaller portfolios – also have the least to gain from consulting an advisor.

- They should construct a well-diversified, multi-asset passive portfolio.

- Since “what good looks like” is well known for such a portfolio, an advisor should not be able to add much value.

Tim is not an advisor in the usual sense, but he provides services to advisors.

Naturally, he sees things differently:

Good advice and ongoing guidance over your lifelong investment journey from a leading adviser is worth its weight in gold.

Assuming that you agree with me, here are the steps involved in the DIY process: (( If you agree with Tim, I’m afraid that you’ll have to read his book ))

- Choose your platforms

- Make your initial trades

- Review your performance once a year and rebalance your asset allocations

- If your portfolio throws off a lot of income, or you are making a lot of contributions, you might want to review performance and rebalance twice a year, or quarterly or even monthly

Tim also talks about lump sum investment versus dollar cost averaging, which we’ve covered here.

It really is as simple as that.

Smarter Insight

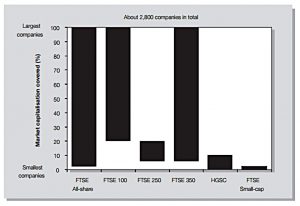

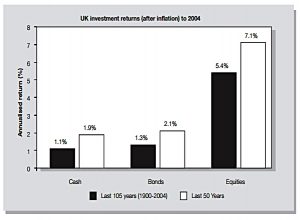

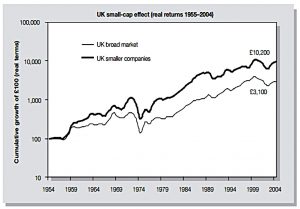

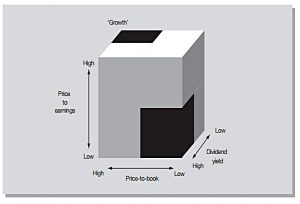

The fifth and final section of the book looks at the various assets that you can use as part of your portfolio.

- We’ve already looked at these in our third post when we discussed portfolio construction, but this section provides more detail.

- For each type of asset there’s a graph and or a table of historical returns, and a discussion of what drives them.

- Tim divides the assets into “on-menu” and “off-menu” categories.

We’ll briefly recap what we learned last time.

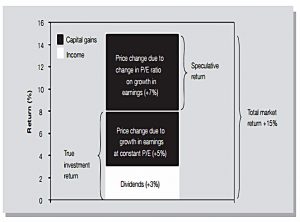

The basic return driver is equities.

- The initial split is between home market (UK) and international developed equities.

- Tim throws in global commercial property as a diversifier for equity returns.

As enhancers of return, Tim has three assets:

- Emerging market equities (( I’m less convinced than Tim that they will outperform in the foreseeable future, but just as convinced that they should be in the core portfolio ))

- Small cap equities

- Value equities

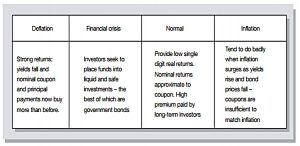

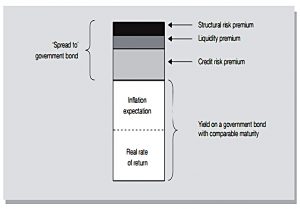

As defensive assets, Tim has two types of bond:

- short-dated high-quality (investment grade, government and corporate)

- inflation-linked

Tim excludes just one return enhancer (which I would include):

- Private equity (which is easy to invest in through investment trusts)

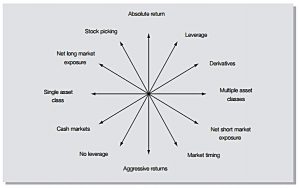

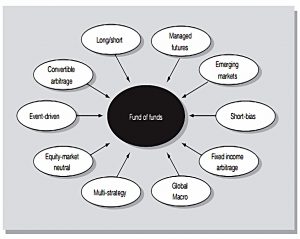

He excludes five diversifiers, all of which I would consider:

- Gold

- Commodities

- Hedge funds

- Structured products

- Emerging market bonds

And he excludes two defensive assets that I would consider:

- Cash

- Junk (corporate) bonds

There are also collectibles (art, cars, stamps and coins) to think about, but as we saw when we looked at stamps and coins, it’s hard for the private investor to access these at a reasonable cost.

We’ve discussed how to approach allocating your money between all these assets here, here and (for the more adventurous / ambitious) here.

Appendices

We’ve reached the end of the book proper.

In the appendices, Tim plugs Sensible Investing TV, a passive investing evangelist website, set up by one of his clients.

He also has a short list of books that are worth reading:

- Winning the Loser’s Game – Charles Ellis

- The Little Book of Common Sense Investing – John Bogle

- The Little Book of Behavioural Investing – James Montier

- Pioneering portfolio management – David Swenson

[amazon template=thumbnail&asin=1259838048]

[amazon template=thumbnail&asin=0470102101]

[amazon template=thumbnail&asin=0470686022]

[amazon template=thumbnail&asin=1416544690]

Next, he looks at working out your risk profile.

- We have a questionnaire that you can use here.

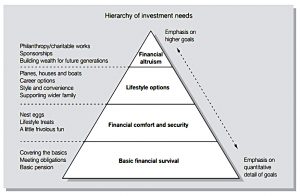

The next appendix is about goal planning, using a Hierarchy of Investment needs, modelled after Maslow’s pyramid and shown below.

The final appendix is a list of data sources.

Conclusions

And that’s it – we’ve finished Smarter Investing.

There’s not much in the final 40% of the book, to be honest.

- Looking back at earlier editions, it could be that the content in these later chapters was once distributed throughout the book, but was later pushed backwards to make the earlier sections simpler and easier to understand.

Overall, the book is generally accurate and potentially of great use to the beginner.

- Whether a beginner could make their way through it is another question.

- And whether a book that says “buy some index funds” needs to be 270 pages long is yet another.

For me, the holy trinity of investment remains asset allocation, costs and taxes.

- Tim is strong (if a little conservative) on asset allocation and costs, but puts less emphasis on taxes.

- He also believes in advisers, which doesn’t make much sense in view of his passive bias.

It’s a decent read, but I still can’t understand why it’s become the go-to book for the passive investing community in the UK.

- Perhaps it’s a lack of alternatives – please suggest any books that you think are more useful.

I’ll be back in a couple of weeks with a new book.

- At this point I really don’t have much idea what that might be.

Until next time.