Stock to Flow

Today’s post is about the Stock to Flow model used to value Bitcoin.

Stock to Flow

We’re partway through a series of articles on how best to buy bitcoin in the UK, in the wake of the FCA’s ban on crypto derivatives for retail investors.

- But today we’re going to look at a way of bitcoin valuation popular within the crypto community.

The Stock to Flow (STF) model looks at bitcoin as a commodity, similar to precious metals like gold, silver and platinum.

- One of the qualities which makes these metals a decent store of value is their scarcity, and in particular the difficulty of adding to the global stock of these metals.

They need to be mined (and refined) – a process which takes time and money.

- And this extraction becomes progressively more difficult, as the easiest reserves are used first.

This mirrors the “mining” of bitcoin, which takes computers and electricity and becomes progressively more difficult as the reward rate halves every four years (in a “halvening” event).

- More than 85% of bitcoins have already been mined, and there is still another 120 years of extraction to go.

Note that we are ignoring the impact of lost key/coins – which reduce the annual flow – here.

Stock-to-flow models have been used for decades to predict commodity prices.

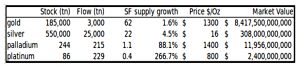

The Stock-to-flow ratio measures the amount of a new commodity produced in a year to the outstanding stock.

- Store of value commodities should have a high STF value, indicating that supply is growing slowly (and implying that the commodity is not largely consumed by industrial production).

Gold has the largest current STF of 62 – there are 185K metric tonnes of gold and 3K metric tonnes are produced each year.

- Silver has an STF of 22.

BTC has an STF of 52 – there are 18+M bitcoins in existence and 328K are mined each year.

- After the 2024 halvening, BTC will have an STF of 113.

Bitcoin should overtake gold in 2022.

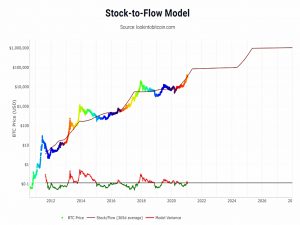

The chart above overlays the BTC price with the projections from the STF model.

- Note that this is a log chart, so small deviations can have large consequences when measured in £ or $.

The colours show how long to the next halvening (red = more than 1200, blue = less than 200).

- Each halvening reduces the flow and should increase the STV and therefore the price.

The STV level on the chart is a 1-year (365-day) MA.

- The line at the bottom is a divergence chart.

The formula

The (pseudonymous) original article about the bitcoin stock to flow model included the following formula:

Price = exp(-1.84)*STF ^ 3.36

The formula comes from PlanB (@100trillionUSD), who claims to be a Dutch institutional investor with a quant background.

- He has tweaked the formula since and provided a new model that he calls the BTC S2F cross asset model (S2FX).

But the key takeaway is that STF predicts a BTC price of $288K by 2024.

- It also predicts a price of $235 bn per BTC by 2045, which is even harder to envisage (but then extreme extrapolations often are).

Critiques

Alex Kruger, an economist and cryptocurrency analyst says:

The whole model rests on the wrong assumption that there is cointegration between price and scarcity.

Cory Klippsten, CEO of bitcoin buying app Swan, said:

It’s extremely important to be bullish for the right reasons. Otherwise, you’ll have weak hands when your belief is proven false.

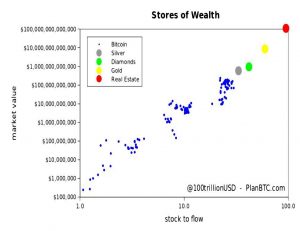

PLanB defends his model by showing how the market cap tracks towards that of other high-value assets:

Fitting a linear regression to the data confirms what can be seen with the naked eye: a statistically significant relationship between SF and market value (95% R2).

The likelihood that the relationship between SF and market value is caused by chance is close to zero. Of course other factors also impact price, regulation, hacks and other news, that is why R2 is not 100%.

PlanB admits:

A model is a simplification of reality, and all models are wrong, but some are useful.

Which is my own take on models.

Adam Back, CEO of blockchain technology company Blockstream, suggests another way of looking at STF:

One should think about the model like Moore’s Law: it’s just an observation and speculative projection – an observed trend may continue.

Charlie Morris of BytTree suggests that the (ultimately) fixed supply of BTC removes supply-side economics from the equation entirely.

- Instead, the price will be entirely determined by demand.

The model overemphasizes newly-mined coins as if they were the only ones available:

But anyone who owns Bitcoin is free to sell. When the network has a large stock and a relatively small flow, it is the stock that matters. As the flow diminishes, it becomes less important in influencing market prices.

Morris sees the usage and adoption of BTC as the driver of the network’s value.

- But at high BTC valuations (which are expected to get higher) and a network which is slow and expensive for everyday transactions, this adoption seems ever more unlikely.

Conclusions

That’s it for today.

- The STF model may be flawed, but for as long as the BTC price maps reasonably well to its predictions, people will be following it.

It reminds me in this respect of the simpler aspects of technical analysis (moving averages, support and resistance).

- You don’t need to believe too firmly in something for it to be useful.

Until next time.

Sources

- Stock to Flow Model – Look into Bitcoin

- Modelling Bitcoin’s Value with Scarcity – PlanB, Medium

- Bitcoin Stock-to-Flow Cross Asset Model – PlanB, Medium

- Serious Warning Issued Over $300,000 Bitcoin Stock-ToFlow Price Model – Billy Bambrough, Forbes

- A researcher debunks Stock-to-Flow model, likens Bitcoin to a ‘tech stock – Michael Kapilkov, CoinTelegraph

- Why the Stock-to-Flow Bitcoin Valuation Model Is Wrong – Nico Cordeiro on CoinDesk