DeFi and the Future of Finance

Today’s post looks at a paper from 2021 on Decentralised Finance, or DeFi as it is known.

Contents

DeFi and the Future of Finance

Today’s paper is written by Campbell Harvey and two colleagues.

- Cam is a finance professor at Duke University, as well as a partner at Research Affiliates and an advisor to Man Group.

Despite all that, I had managed to not come across him until just before Xmas, when he was a guest on the Top Traders Unplugged podcast.

- Cam has a recent book on Strategic Risk Management and Portfolio design which I plan to read later this year, but today we’re looking at DeFi.

This paper is also the basis of a book but as it is ninety-two pages long, I expect there to be enough content for a blog post or two.

The paper outlines the problems with our legacy financial infrastructure (TradFi) – including high costs and uneven access, leading to lower investment and growth – and explains how decentralised finance (DeFi) can offer solutions.

We argue those initiatives that use decentralized methods – in particular blockchain technology – have the best chance to define the future of finance.

P2P

Cam (et al) describe barter, the earliest form of exchange, as peer to peer, which means that DeFi brings us full circle.

- The problem with barter is matching supply and demand, which lead to the use of money as the medium of exchange.

Early money (shells, stones etc.) was not centralised.

- Later we had money with tangible value (gold and silver, known as specie money) and then centralised notes backed by gold and silver.

Now we have non-centralised (fiat) money run by central banks.

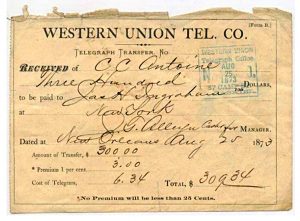

- This started as paper but is now electronic – the first electronic transfer was by Western Union in 1871 (with the 3% fees that persist today).

This brings me to my first issue with the DeFi thesis – why should the blockchain be cheaper and easier to access than electronic money on a credit card or phone?

- Indeed, our experience with crypto to date (chiefly BTC and ETH) is that it is expensive and slow, with no real use cases for first-world citizens whose base currency is stable.

As always, I’ll be writing this article from the perspective of a UK private investor, so there will be a first-world bias throughout.

- You should also be aware that I am far from a crypto expert and so there is always the possibility that I will misunderstand or mistranslate some of the ideas from the paper.

Problems with TradFi

The authors identify five problems with centralised finance:

- Centralised control – a single entity sets interest rates to control inflation and most consumers deal with a single bank from an oligopoly

- Limited access – 1.7 bn people globally are unbanked and small loans are hard to arrange cheaply

- Inefficiency – slow and expensive transfers (of funds and stocks) and high credit card fees, and a large spread between deposit and loan rates

- Lack of interoperability – moving between institutions can take three days

- Opacity – bank customers don’t know much about the health of their institution and rely on government insurance schemes (FSCS here in the UK)

- The loan market is also fragmented, but internet comparison sites help to deal with this (though not the underlying inefficiencies and costs).

As noted above, the authors identify two consequences:

- lower economic growth from high borrowing costs (which preclude marginal projects)

- inequality, through uneven access to finance

- Again, this doesn’t seem to be a serious issue in the UK.

Blockchain

A blockchain is (amongst other things) a public history of data transactions that are cryptographically protected.

- The name comes from the construction process, whereby blocks of data rea regularly chained together (blocks are added to the end of the chain).

Chains use a Consensus Protocol to decide which data is added to the chain.

- These protocols are designed to be resistant to tampering.

The dominant protocol is Proof of Work (PoW) – in the case of BTC, solving math problems.

- Taking over the chain would require control of the majority of the network (processing) power (the hash rate) – this is known as a 51% attack.

With a large network, this would be difficult even for a nation-state.

The biggest rival to PoW is Proof of Stake (PoS, unfortunately).

Validators commit some capital (the stake) to attest that the block is valid. Validators make themselves available by staking their cryptocurrency and then they may be selected to propose a block. The proposed block needs to be attested by a majority of the other validators. Validators profit by both proposing a block as well as attesting to the validity of others’ proposed blocks.

This sounds a bit like a P2P version of the shareholders in a limited company.

Fintech and Bitcoin

For the authors, Fintech is equivalent to decentralisation and cost-cutting.

- They cite the development of the centralised FX market and dark pools for stock trading as examples of decentralisation and PayPal for cost-cutting.

In the US, there is also Zelle, a payment system operated by seven banks.

- But the cost-cutting initiatives, in particular, use the legacy financial infrastructure.

Then in 2008 “Satoshi Nakamoto” combined blockchain (from 1991) and proof of work (from 2002) to create Bitcoin.

Blockchains allow for cryptographic scarcity (Bitcoin has a fixed supply cap of 21 million), censorship resistance and user sovereignty (no entity other than the user can determine how to use funds), and portability (can send any quantity anywhere for a low flat fee).

The immutable ledger also means that digital money can’t be copied and spent twice.

- Ownership is protected using asymmetric keys, one public (the account address) and one private (for spending).

To tackle the criticism that BTC has no tangible value, the authors cite the Iraqi dinar.

In 1991, Iraq was divided with the Kurds controlling the north and Saddam Hussien in the south.

The north used the original dinars printed from Swiss plates, and Saddam printed his own money (which suffered from serious inflation).

Eventually, the exchange rate was 300 new dinars for a single Iraqi Swiss dinar.

The point is that there was an exchange rate at all – the Kurdish money had no official backing whatsoever.

- The authors also compare BTC to gold, in terms of its potential to survive inflation, and its marginal tangible value (as jewellery and in electronics).

As the [Bitcoin] network grows, the value proposition only increases due to increased trust and liquidity. Although Bitcoin was originally intended as a peer-to-peer currency, its deflationary characteristics and flat fees discourage its use in small transactions.

Ether and DeFi

Ethereum (ETH) is the second-largest crypto by market cap.

- It was described in 2014 and mined in 2015.

The key feature of ETH is smart contracts – code on the blockchain to control assets, data and interactions (transactions).

- These smart contracts are combined to form decentralised applications (dApps).

dApps allow P2P interaction – they enable decentralisation.

- Many dApps are financial, and collectively this set of dApps is known as DeFi.

The primary benefit of these applications is their permissionlessness and censorship resistance. Anyone can use them, and no single body controls them.

ERC-20 is an ether standard for fungible tokens on the network.

- ERC-721 is a standard for non-fungible (unique) tokens used for collectables and P2P loans.

DeFi proponents believe that all meaningful financial infrastructure will be replaced by smart contracts which can provide more value to a larger group of users. Anyone can simply pay the flat fee to use the contract and benefit from the innovations of DeFi.

I think this is theoretically possible, but the timescale is uncertain and the drivers for first-world citizens are unclear.

Gas

The big drawback of ETH at the time of writing is the high level of transaction fees (gas fees).

The gas fee is supposed to be proportional to the amount of computing power that a transaction requires.

- This analogy recasts the ETH network as a giant computer.

In many cases, the gas fee is set by the user, and a higher fee should result in the transaction being processed more quickly.

There are two problems:

- You need to maintain an ETH balance to pay gas fees

- If you bid too low the transaction might never complete (and you could still lose the gas fee)

Gas is also intended to protect against infinite loop attacks.

- Malicious code is difficult to identify before running it (the halting problem).

Using the car analogy, the car (malicious code) stops when it runs out of gas.

This incentivizes highly efficient smart contract code, as contracts that utilize fewer resources and reduce the probability of user failures have a much higher chance of being used and succeeding in the market.

Oracles

An oracle is a fancy title for a data source that reports information from outside the blockchain it lives on.

- Chainlink (which lives on ETH) is designed to solve “the oracle problem” by aggregating external data sources.

The reputation-based system by which data is evaluated by Chainlink is apparently yet to be implemented.

Stablecoins

Stablecoins are intended to fix the excessive volatility of cryptocurrencies like BTC and ETH.

- They are pegged (to a variable degree) to an external asset (usually USD, but alternatives like gold or stocks could be used).

Stablecoins require backing and that backing is usually fiat currency (USD).

- Questions arise when the collateral is not audited (see Tether/USDT, which is the third-largest crypto-currency behind BTC and ETH).

The second-largest stablecoin is USDC, which is backed by Coinbase and Circle and is audited.

- USDC can be swapped 1:1 for dollars on the Coinbase exchange, with no fee.

Note that these stablecoins are centrally controlled, which is not DeFi.

Other stablecoins are (over-)collateralized with crypto.

- The most popular is DAI from MakerDAO (backed by ETH).

There’s also sUSD, backed by Stnthetix (SNX).

- These coins are decentralised/DeFi.

They “suffer” from being “harder” to mint (in the sense that dollars are freely available and coins require “work”).

There are also uncollateralised coins.

- Here the supply increases and shrinks to stabilise the price.

The token holders usually receive new coins (seigniorage) during expansion and bonds for new supply during contraction.

- This is similar to central bank operations with fiat currencies, but with a price target.

Examples include Ampleforth (AMPL) and Empty Set Dollar (ESD).

- With no collateral, these coins could be subject to “bank runs”.

DAOs

DAOs are like dApps, built from smart contracts which encode their rules.

- They usually have a governance token that allows voting on the future direction of the DAO.

This is another version of the limited company shareholder model.

I’m going to leave it there for today.

- We’ve only scratched the surface, with most of today’s article taken up with definitions and descriptions of architecture.

We’ve only covered a fifth of the paper today, so I’ll need to pick up the pace in the next post.

- Until next time.