Buying Bitcoin in the UK – Part 3

Today’s post is the third in a series on buying bitcoin in the UK.

The Story So Far

- Interest in Bitcoin is at an all-time high, as is the BTC price itself ($35K as I write this).

- There has also been a lot more positive sentiment from institutional investors recently.

- So long-term DIY investors might want a small permanent allocation (say 1%) to bitcoin.

- The UK regulator (the FCA) recently (January 2021) banned the sale of crypto derivatives to retail investors.

- This removed both tax-efficient ways of gaining exposure to BTC:

- ETFs (strictly, ETPs) within a SIPP

- Spread-bets

- So you’ll need to pay 20% capital gains tax on your profits.

- Unless these are below £12.3K pa (the annual CGT allowance).

- You can get a form of crypto using UK funds like RICA , BCHM and BLOK.

- Or stocks like ARB, MODE, TRD, KR1 and COIN

- One way to theoretically access your crypto profits without paying tax would be to take out a loan against them.

- Another potential way around the FCA ban is to become a “professional” spread bettor at one brokerage.

- The key downside is that you lose the negative balance protection introduced a few years ago – retail investors can’t lose more money than they hold in their spread-betting account.

- To qualify as a professional, you need an overall portfolio worth €500K – SIPPs, ISAs and cash all count, but property and company pensions are excluded.

- You also need to place 40 trades of significant size over a year, which in turn required a spread-bet account size of around £50K to £60K.

- The process of buying and storing bitcoin directly has three steps:

- You open an account with a crypto broker (also known as a cryptocurrency exchange)

- You transfer fiat money (£) into the account

- You buy crypto with that £ balance (we’ll assume BTC)

- There are reports that some UK banks take a dim view of crypto transactions, so tread carefully.

- At this point you have three options:

- You can leave it with the broker – hardcore crypto HODLrs won’t do this (“not your keys, not your crypto”) but beginners may not care, especially for small balances

- You can move it into a software wallet on your phone or PC – this will have public and private keys so that people can send you money and you can access your stash

- You can move it offline into a hardware wallet (costing £50 or more to buy); this comes with a 12- to 24-word “seed phrase” which allows the wallet to (re-)generate your keys.

- The seed phrase needs to be physically stored and protected (eg. against theft and fire).

In the previous article, we came up with a long list of brokers, trusts and platforms to investigate:

- Coinbase

- Binance

- Gemini

- Ziglu app

- Mode app

- Cash app (Square)

- Revolut app

- eToro

- Kraken

- Bittrex

- Bitfinex

- Bison

- Grayscale Bitcoin Trust (GBTC) – in the US.

We’ll also look at plans from PayPal to support bitcoin transfers and balances.

- And we’ll look at the Trezor and Ledger hardware wallets.

We also need to think about fees, which can be considerable.

- I’ll try to put a table together of costs at popular transaction sizes (say £100, £250, £500, £1000, £5000).

Bitcoin in a company

Before we get started, a small detour.

- Michael at FoxyMonkey (( Which I had thought was a bingo site )) recently published his way of getting bitcoin exposure inside your limited company.

He went with Binance, but he warns that there are paperwork hoops that you need to jump through (in the same way as when you open a stock trading account for your company).

The documents you need are:

- Certificate of Incorporation

- Memorandum and Articles of Association

- Companies House list of directors

- Ownership structure document

- Sanctions Questionnaire

- Authorisation letter

- Link to your page on the Companies House website

- Screenshot of this page, with computer system clock showing

Michael also tried Coinbase (which he uses personally).

- Coinbase offers company accounts but could be targeting “institutional” investors.

He never heard back from them.

Apps

Let’s start with the apps.

Ziglu looks pretty easy to get started with.

- It seems to be a phone app bank, with a debit card (Mastercard).

The app is available on Android and iOS.

Ziglu is FCA-authorised, as an Electronic Money Institution.

- They offer £50K of insurance for “hot” (online) wallets, but this is private insurance, not the government compensation scheme.

The account is free, but each transaction is charged at 1.25%.

This sounds fine, but on a (say, monthly) transaction of £1,000, that’s £12.50.

- A percentage rate favours many small transactions, so perhaps a daily buy of £33 (costing 41p) is more appropriate.

I think Ziglu is banking on the tendency of people to disregard small nominal amounts, whatever the percentage involved.

Mode’s app is only available for iOS at the moment, so I won’t spend too much time on it.

- One notable feature is interest on your Bitcoin Jar, accrued daily and credited/compounded weekly.

When I checked, the annual rate was 5%.

Mode has a 0.99% transaction fee but offers no insurance.

Since I first looked at Mode, (( It’s also possible I just missed this detail )) they have added a withdrawal fee measured in BTC.

- The fee appears “small” (0.0005 BTCmaximum) – but with BTC at $40K, that’s a $20 fee.

So Mode is only competitive at very large transaction sizes.

Paypal crypto has arrived in the US, but I couldn’t find a launch date for the UK.

- Nor can I access the fees page from the US site.

Fees are reported as being 2.3% for transactions below $100, 2% to $200, 1.8% to $1,000 and 1.5% for transactions above $1,000. There’s a minimum fee of $0.50.

- So that’s more expensive than Ziglu at all levels.

Cash is the app from Square.

- It’s available in the UK for Android and iOS, but only the US version supports crypto (and stock investing).

The fees charged by Cash are opaque, being calculated at the time of the transaction.

- Reports suggest they are around 1.75% per transaction.

Revolut is available in the UK and does support (unregulated) crypto investing.

- Standard customers (who don’t pay for a premium account) are limited to £1K of “exchanges” per month; usage beyond this attracts an extra 0.5% fee.

Revolut’s base fee for crypto is 2.5% per transaction.

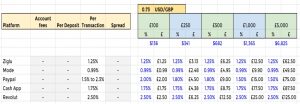

Here’s how our fees table looks so far.

- Only Ziglu and Revolut can be used today on an Android phone in the UK to trade crypto.

So Ziglu is the leader until the Android version of the Mode app appears. (( I’ve put my name down on the waiting list ))

Hardware wallets

This section should be a little simpler, as we only have two wallets to investigate.

- They seem to operate like smart USB keydrives.

The Trezor One is £53, comes in black, white or grey.

- Amazon can get it to me in one day (as a Prime subscriber).

The listing stresses a number of features:

- security

- compatibility with Windows, MacOS and Linux

- small (2.3 x 1.2 x 0.2 inches, weighs half an ounce)

- 128 x 74 pixel screen

Click on the picture for more details.

- More expensive options are available.

The Ledger Nano S is £54 and Amazon can also deliver this tomorrow.

- This one looks more like a USB key and comes in black and silver.

Features include:

- security

- firmware v 1.4

Click on the picture for more details.

- More expensive options are available.

We’ll leave it there for today.

- Ziglu is the cheapest crypto app for UK users, and you have a choice of two hardware wallets once you accumulate enough BTC to justify spending £54.

In the next article, we’ll look at the crypto brokers:

- Coinbase

- Binance

- Gemini

- eToro

- Kraken

- Bittrex

- Bitfinex

- Bison

Until next time.