Weekly Roundup, 8th February 2021

We begin today’s Weekly Roundup with a look at commodities.

Commodities

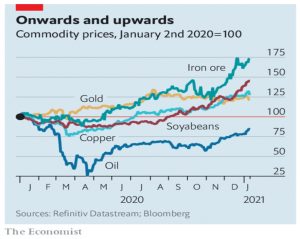

The Economist noted that commodity prices are surging.

- It hasn’t been a universal or steady rise, though.

The pandemic pushed oil prices down, though they are now recovering.

- Gold went the other way, with an early rise followed by stagnation/decline.

But Citigroup reported that commodity assets under management reached a record $640 bn in December 2020, up close to 25% in a year.

- Price rises were driven by demand from China and supply problems from pandemic-driven closures and bad weather.

This year has already seen more supply issues, and the vaccine rollout should lead to increased demand.

- A weaker dollar might also stimulate demand in emerging markets.

Jeff Currie of Goldman Sachs suggests that the pandemic could be a catalyst for a commodities supercycle, but Ed Morse of Citigroup disagrees.

In the FT, Merryn Somerset Webb came down on the side of the supercycle.

You don’t get proper long bull markets in industrial commodities very often: over the past 227 years, says Saxo Bank, there have only been six. A glut of supply drives down prices. Producers go on strike — they stop exploring and innovating. Supply falls behind demand. Stockpiles run down and prices rise.

The investment strike began with metals miners in 2014, and the end of lockdown will supply the extra demand. But there is more:

In the post-Covid-19 era, it appears that no one will worry much about fiscal prudence. Instead, there is every chance that the fashion for the government to fill individuals’ pockets will continue; that the endless promises of green transformation and infrastructure revolution will come good; and, crucially, that governments will prioritise high levels of employment over low levels of inflation.

Copper, in particular, should do well from the planned green transformation.

Redwood

In the FT, John Redwood proved his regular update on the ETF fund he runs for the paper.

- He was up 2% as at 2nd Feb, which means that for once I’m slightly ahead of him.

Exposures to the green and digital revolutions have been particularly helpful, with

the global clean energy index the star performer. The specialist global indices for robotics and cyber have also put in a strong showing.

At the end of last year, John rebalanced away from Nasdaq (which had shown big gains) and into the global index.

John’s focus last week was Joe Biden:

Instead of reaching out to Republicans and building bridges on difficult issues like migration, climate change and pandemic measures, the president has opted rapidly to reverse as much of his predecessor’s work as possible.

This is a radical governments with serious implications for investors.

The key changes are the replacement of pro-oil and gas policies with a green agenda and an increase in the size of government (and hence of government spending).

- Higher corporate and personal taxes will likely follow.

The high valuations created last year in many US sectors will be more at

risk as the sums are done on the impact of higher taxes on shareholder profits and

dividends. Good returns are more likely in Asia which has got through the

pandemic more quickly and in better economic shape than the US or Europe.

So John has reduced exposure to the US and to tech, and increased his Asian holdings.

Retail

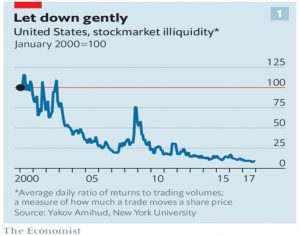

The Economist claimed that a new epoch is just beginning for retail investors.

- They note that the Gamestop saga shows how frictionless tech has made stock trading.

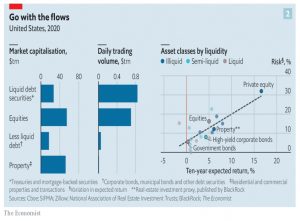

Now the same thing could happen to other markets:

Outside stocks, fat fees and thin volumes still gum up markets, resulting in slow-motion transactions and deterring traders. But the same forces that pushed down trading costs and drove up liquidity in the stockmarket are poised to disrupt all manner of assets, from corporate bonds to property, and even Picassos and classic cars.

But whilst the bond and property markets are broadly comparable in size with stocks, they are fragmented rather than standardised.

There are 224 AT&T bonds alone: each pay different coupons, mature at different times and are worth different amounts. And there are 300,000 distinct corporate bonds in America. There are 5m-6m commercial buildings and more than 140m dwellings in America, each unique.

And with fragmentation comes illiquidity and poor price discovery.

ETFs have helped in some markets, but there is more progress to be made, particularly in the area of regulation:

Only accredited investors can invest in property, venture-capital funds or hedge funds.

But alternative markets are now appearing:

- Cadre lets people trade stakes in buildings.

- Yieldstreet offers art and container ships alongside property.

Zillow acts like a market maker for houses:

After a decade gathering data on every home in America, it can now plug a property’s characteristics into machine-learning algorithms to price them Zillow buys homes based on the algorithm’s assessment, taking them onto its balance-sheet. It then sells these on its platform.

Which should bring down transaction fees, putting pressure on traditional intermediaries.

One door closes

Anglo-German robo-advisor Scalable Capital, one of the more sophisticated robos, has closed its UK business.

- The German and Austrian retail operations will remain open, along with a B2B unit in the UK.

- Their main UK customer is Barclays via their Plan & Invest service, which has a £5K minimum.

Scalable – which launched in 2017 – has raised €117M in venture capital, with the latest Series D round in 2020.

- Apart from Barclays, investors and partners include BlackRock, ING and Santander.

The firm had a more interesting investment strategy than most robos, but was never cheap enough (charging 1% pa) and had a high minimum investment of £10K.

- It also offered low-cost financial advice with a fixed fee of £200.

The firm has around €3 bn in assets in management, which makes it possibly the largest robo (now rebranded as “digital wealth managers”) in Europe.

- Nutmeg manages a similar amount.

Robos have largely failed to deliver on their early promise, probably because they fall between two stools:

- They aren’t reassuring enough for those who need advice and support.

And they aren’t cheap enough for anyone prepared to contemplate DIY investing.

Meanwhile, JP Morgan has announced that it plans to launch a banking app in the UK during 2021.

- Unlike Goldman’s Marcus savings account, this appears to be a current account.

And it will use the low-rent Chase brand rather than JP Morgan itself.

- The bank previously launched a digital bank called Finn, which was closed last year.

And another app – EverUp – is gunning for premium bonds (and to a lesser extent, crypto fans).

- This appears to be a savings account which instead of interest, pays virtual coins which can be used to enter lotteries.

There’s a weekly lottery which pays £365K, a daily raffle for cash or more coins, and an instant tombola which returns coins only.

- In each case, your underlying capital is not at risk (as per Premium Bonds).

- The odds against winning seem to be around 1 in 60M.

I like Premium Bonds(PBs) because the interest rate is often competitive, they are backed by the government, and winnings are tax-free.

- I think EverUp risks gamifying the PB experience in order to tap into a user base which craves instant gratification.

Bitcoin news

Bitcoin has been overshadowed by Robinhood and Gamestop in recent weeks, but my plan throughout 2021 is to keep an eye out for institutional comment – both positive and negative – on crypto.

- I see institutional adoption as crucial to the long-term future of bitcoin, even though influencers and memes seem more important right now. (( I’m writing as BTC hits a new all-time high on the news that Tesla has bought $1.5 bn of bitcoin, and plans to accept it as payment for cars in the future ))

In the positive corner, BlackRock has applied to the SEC to add BTC to two of its funds: Global Allocation and Strategic Income Opportunities.

- The second sounds a stretch since bitcoin (like gold) doesn’t pay an income.

The funds plan to use ” cash-settled Bitcoin futures traded on commodity exchanges registered with the CFTC [Commodity Futures Trading Commission].”

In the negative corner, UBS said that cryptocurrencies can never work as real money since supply can’t be reduced when demand is slumping.

- Chief Economist Paul Donovan also noted that BTC is too volatile to work as a stable store of value.

I’m not too concerned about the “real money” angle, and I think that th volatility argument is overblown, so long as the prevailing medium-term trend (and hence most of the volatility) is to the upside.

Quick Links

I have eight for you this week, the first five from The Economist:

- The newspaper explained how WallStreetBets works

- And why the WSB crowd can profit from predatory trading

- And described the real revolution on Wall Street

- And said that access to the EU financial services market in not worth the price

- And that Joe Biden’s proposed stimulus is too big

- Alpha Architect wondered whether secuirity analysts follow academic evidence

- And whether gamma hedging really affects stock prices

- And Musing on Markets looked at the price-value feedback loop (with reference to GME and AMC).

Until next time.