Weekly Roundup, 19th September 2017

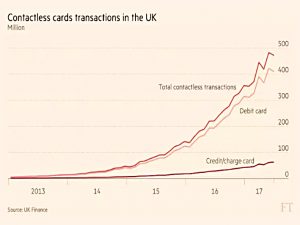

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about contactless cards.

Contents

Tap and pay

The rot at the Weekend FT continues – this was the only article worth mentioning this week.

Hugo Greenhalgh looked at the rise and rise of tap and pay on contactless debit and credit cards (mostly debit).

- £23bn was spent on them in the first half of 2017, which almost matches the £25bn for the whole of last year.

- There are now 111M cards issued in the UK, up from 250K ten years ago, when the system was introduced.

- The UK has the most pay and go cards in the world.

Contactless is used mostly to buy booze and food, with average transactions of £10 (well below the £30 limit).

- This is part of a trend away from cash, which was overtaken last year as a spending medium by cards (PIN and contactless combined).

- Central banks don’t like cash, as it prevents them from implementing negative interest rates and is linked to the black economy and to crime.

On the other hand, doing away with cash would impact privacy, as all transactions would be recorded.

- Which is why I would like to keep it, though I suspect that if it were banned, something else would take it’s place (as with cigarettes and phone credit in prisons).

ICOs

Over in The Economist, Buttonwood looked at Initial Coin Offerings (ICOs).

- He joked that the abbreviation really stood for Investor Caution Obligatory.

ICOs sound crazy to me. As Buttonwood puts it:

You buy an entry in a computer ledger issued by a startup via an unregulated prospectus.

The ledger entry is called a coin, but you cannot spend it in any shop.

The use of the term ICO makes it sound like an IPO, but coin ownership does not necessarily get you equity in the company.

Yet more than $2bn has been raised and the ICO alert website lists 600 ICOs.

Many ICOs are issued to fund apps built around blockchain, and often the coins can be exchanged for services from the app (should it materialise).

- In this sense they are like the Kickstarter version of crowdfunding, where goods and services rather than shares are promised.

- This guarantees some startup demand for the new company.

Others are simply a form of capital raise, and “investors” can only be drawn in by the meteoric rise in value of other “coins” like Bitcoin and Ethereum.

- But unlike ICOs, Bitcoin is a currency, and limited in quantity (hence the frequent comparisons made to gold).

- At the moment its too volatile to be used as a store of value or medium of exchange.

- And if it does stabilise, it may suffer from government crackdowns on its use in the black economy.

Buttonwood closes with another expansion of ICO: “It’s Completely Off-limits”

- While I can see some point in treating Bitcoin as a currency, I agree that ICOs belong on the bargepole list.

SIPPs vs ISAs

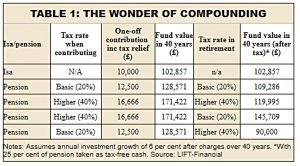

Money Observer reported on a subject we’ve looked at before – whether SIPPs or ISAs make the best savings vehicle.

- As we found, SIPPs are better.

- Though if you want to retire before the age of 55, you’ll need a mixture of both.

You do pay more tax in retirement on your enlarged SIPP pot than you saved on the way in

- But thanks to compounding, that’s not enough to offset the increase in the size of the pot relative to an ISA.

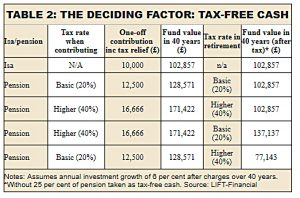

It’s important to remember that 25% of your SIPP is tax-free.

- Plus you have an £11.5K tax -free personal allowance.

So the effective tax rate on SIPP withdrawals is more like 11%.

The advantage of the SIPP over the ISA is even greater for those who are higher-rate taxpayer while they are contributing.

- But if you pay basic rate tax now, and expect (bizarrely) to be a high-rate taxpayer in retirement, you would be better off sticking with an ISA.

It’s true that SIPPs don’t let you access your money until you are 55, but this is really a positive rather than a negative.

- If you dip into your ISA, your pot will be even smaller when you come to retire.

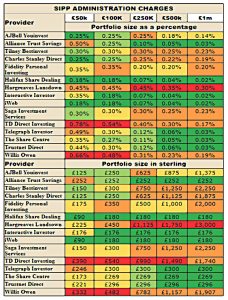

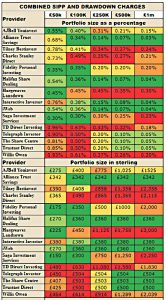

SIPP broker costs

In a second article, Money Observer looked at broker costs for various sizes of SIPP.

- SIPPs are now 27 years old, though I didn’t start mine until Gordon Brown’s pensions A-day on 6th April 2006, when many of the restrictions were lifted.

- The rules were further relaxed (particularly on the back end) by George Osborne in 2015.

Money Observer asked Lang Cat to do the research for them, so I expect the data to match Lang Cat’s Platform Review, which we covered in July of this year.

- They looked at portfolios of £50K, £100K, £250K, £500K and £1M.

I usually recommend iWeb (which came out well) and YouInvest (which did ok, but not great).

- I think this is because the article looked at the costs of holding funds rather than ITs and ETFs.

- Costs for these are capped on some platforms (like YouInvest and Fidelity) which operate a percentage fee for funds.

Usefully, they also looked at drawdown costs, which are rarely reviewed.

- iWeb does well again and YouInvest not so well (because they are looking at funds rather than ITs and ETFs).

It’s worth noting that HL and Fidelity make no extra charges for drawdown, which makes them competitive in this area (if you are holding ITs and ETFs).

Graduate tax

The London Evening Standard reported Vince Cable’s proposal for replacing student loans with a graduate tax.

- Obviously, Vince is a Liberal, so he has little chance of setting government policy, but it’s an interesting idea.

Unfortunately, that’s effectively the system that we already have:

- Loans are written off after 30 years whether or not they’ve been paid.

- And payments are taken as 9% of earnings over £21K pa.

All that needs to be fixed about the current system is the interest rate and the repayment threshold.

- 6% pa is far too high – it should be something like 2% above base, which would be 2.25% at present.

- And the threshold should be the median wage for the country, which is something like £27K pa.

Vince knows this, but thinks that the change would be better psychologically:

People don’t normally think of their future income tax obligations as debt. It’s that psychological thing that is quite problematic, and I would quite like to convert it into something that is not just a graduate tax in practice but a graduate tax in name and form.

To be fair to Vince, he has been pushing this tax line since 2010:

- But then he had the bad luck to be part of a coalition government that raised student fees.

So perhaps there is nothing that the Liberals could suggest that would make students feel happier.

National Wealthcare Service

In the Guardian, Patrick Collinson argues that the country needs a service to help the elderly with their finances.

- There are already a lot of services (Age UK, Citizens Advice, the Money Advice Service, Power of Attorney etc.) but Patrick wants to see more face-to-face help.

Barclays has a great “digital eagles” programme that gives practical support to older adults at “tea and teach” sessions, helping them set up passwords, send emails, shop online and use Skype and Facetime. A broader programme like that, available in branches, jointly funded by the banks and aimed at the over-75s, could be hugely beneficial.

I can’t see much wrong with a programme specified by the government and financed by the banks, so long as they keep up selling out of it – but will the banks want to provide the service?

Lifetime allowance

Now for the first of three stories from the FT Advisor.

- The lifetime allowance is finally going up again, after seven years of cuts reduced it from £1.8M down to £1M.

The LTA is index-linked from April 2018, and the September CPI of 2.9% is being used to calculate the increase.

- So the allowance rises from £1.0M to £1.029M – up £29K.

Which will save someone who is over the limit £16K in tax (55% of £29K).

Indexed state pension age

The second article looked at what would happen if the state pension age (SPA) had risen in line with longevity and inflation since the end of World War 2.

- It turns out that the SPA would be 74 rather than 65.

- And the pension would be £16K rather than £8K pa.

This would make the average retirement only seven years long.

- And the “healthy retirement” would be reduced to only two years.

VCTs in an ISA

The third article reported that Octopus Investments is allowing people to invest in VCTs through their ISAs for the first time.

- I couldn’t work out the point of this, since capital gains and dividends from VCTs are already tax-free.

But it seems it’s designed to allow people to invest who have no spare cash – because they already put it into their ISA.

Twitter pics

I have four for you today.

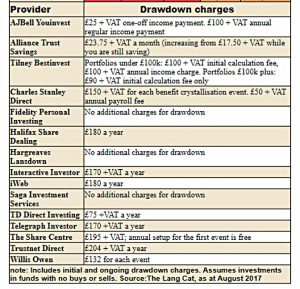

The first shows how much better things have been getting over the past 25 years.

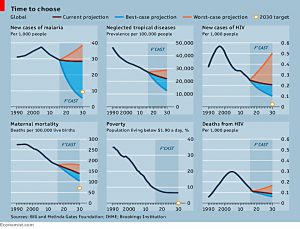

The second shows that marriage is becoming less popular, particularly with non-graduates.

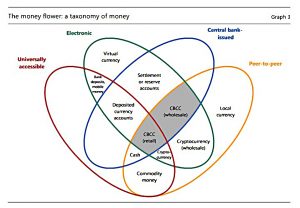

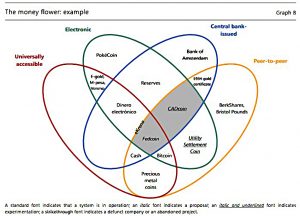

The third and fourth are Venn diagrams from the Bank of International Settlements (BIS), showing just how complicated money can be.

Until next time.