Family Trusts

Today’s post takes a look at family trusts – when might they be useful?

Contents

Family investment companies

A while back we looked at family investment companies (FICs), which proved to be less useful than I had imagined:

- Capital gains are subject to corporation tax at 19%.

- Dividends are free of tax within the FIC, but then taxable on the individual above £2K pa.

- So share buy-backs look like the only way of extracting money cleanly, up to a limit of £12K pa.

- You can also take back your original loan of capital to the company.

So FICs are only of limited use:

- You could get marginal protection compared to a taxable account if you are a high rate taxpayer.

- Or you could get fractional ownership/scale economy/diversification benefits.

- Or you retain control of assets that will be eventually/gradually passed down the generations without incurring IHT.

But most of us would be better off sticking with SIPPs, ISAs, VCTs and a primary residence.

Let’s see if family trusts are any better.

What is a trust?

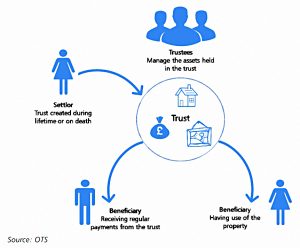

A trust is a legal structure where assets are held on behalf of someone else.

- They have been used in Britain since the Crusades when departing knights used them to protect their assets and provide for their wives and children.

The key parties are:

- The settlor – the person who puts the assets into a trust,

- The trustee(s) – who manage(s) the assets and technically own(s) them, and

- The beneficiary – the person who can receive benefits (eg. interest) from the assets.

Trusts can run for up to 125 years, and assets in trust can be distributed without probate on the settlor’s death.

Why set up a trust?

Ironically, the key reason for setting up a trust is that you don’t “trust” someone.

For example:

- You might not be convinced that your child’s marriage will last, and you want to ensure that assets will be passed down to your grandchildren, and not lost in a divorce.

- You might want your former spouse to live in the family home, but for it to pass to your children on her death.

- You might need someone young or incapacitated to benefit from assets that they are unable to control personally.

- You might want to keep a family business in the family.

Paperwork

It will cost thousands of pounds to set up a trust using a solicitor, and I imagine that this is one area of finance where few people will be willing to risk a DIY approach.

- You also need to enter details of the assets, trustees, beneficiaries and settlor on the UK Trust Register – introduced in 2017 – if the trust has a UK tax liability.

MiFID II required trusts to pay (£115 upfront, then £70 a year) for a legal entity identifier (LEI) if they wanted to trade in assets.

- A LEI is a unique 20-digit number that allows regulators and tax authorities to identify the parties involved in any financial transaction.

And the EU’s fifth Anti-Money Laundering Directive (known as 5MLD) will require all UK trusts to be on the register whether or not they have a tax liability.

- It will also open up the register to anyone with a “legitimate interest” (which is yet to be defined.

Of course, Brexit might yet save us from that one.

Types of trust

There are seven main types of trust:

- bare trusts

- these are used to pass assets to young people until they reach the age of 18

- interest in possession trusts

- these are used to pass income to the beneficiary until he dies, at which point the assets pass to someone else

- discretionary trusts

- these give the trustees some level of discretion on what happens to the income from and capital within the trust

- they are often used for incapable beneficiaries

- accumulation trusts

- these trusts accumulate income within the trust (though they may also be able to pay it out under certain conditions)

- mixed trusts

- these are umbrella trusts made up of several other types of trust

- settlor-interested trusts

- here the settlor (or their spouse) can benefit from the trust

- non-resident (offshore) trusts

- these are trusts where the trustees are not UK tax-resident (non-doms)

- they have complicated tax rules and we won’t consider them further today

The first three types are the most common.

Taxation

Avoiding inheritance tax – and in particular, avoiding double inheritance tax – will be a feature in deciding whether to set up a trust.

- Nil rate band and discounted gift trusts are particularly relevant here, as they are set up to maximise/reuse the nil rate band.

But they are taxed, and they don’t have the tax advantages that most people imagine.

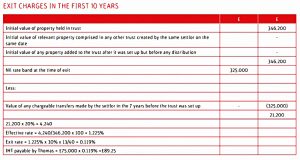

If assets worth more than the nil rate band of £325K are placed into a trust, an “entry charge” of IHT is paid by the settlor (at the “lifetime rate” of 20%).

- This assumes that the assets are not exempt from IHT (like unquoted trading businesses and farms).

- The £325K limit is reset every seven years (ie. there is only a 7-year look back).

Once inside the trust, CGT is charged if gains exceed half the regular CGT allowance (so £6K pa at present).

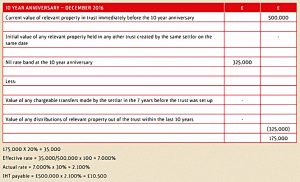

IHT is charged on the trust on each 10-year anniversary of when the trust was established.

- This charge is lower, with a maximum rate of 6% on assets above the £325K IHT allowance.

Assuming the assets are growing at more than 0.6% pa, there’s no reason for this charge to consume the trust entirely – though CGT needs to be considered as well.

There may also be an IHT exit charge when assets are removed from a trust of when the trust comes to an end.

- Again, this can be up to 6%.

The tables (from Scottish Widows) show that the calculations are not straightforward.

A consultation on the taxation of trusts was carried out at the end of 2018 and a response from HMRC will be forthcoming.

Recent trends

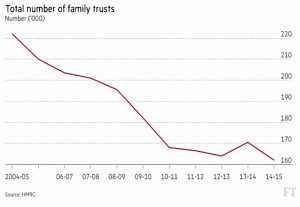

The vertical axis on this chart from the FT is misleading, but the message is clear:

- Family trusts have fallen out of fashion, with numbers reducing by 27% in the ten years to 2015.

- Numbers have fallen further since then, to 157K in 2016-17.

Tax rates have drifted up and down, but the big change came in 2006 when Gordon Brown moved to stop trusts being used as a shelter against IHT.

- He introduced the entry tax and the 6% charge every 10 years.

The idea was that over a generation, the ten-yearly charges should be roughly the same as the tax which might have been paid if the assets had been held privately outside the trust.

Conclusions

I can’t really see any reason to up a family trust.

- Unless you have assets that you need to protect from someone that you can’t/don’t trust.

They are complicated, inflexible, expensive to operate and don’t even have any significant tax advantages.

- They seem even worse than FICs, which are at least familiar to those of us who have operated companies before

- And which could potentially be useful under certain circumstances.

So I think I’ll say no more about trusts unless the tax treatment changes.

- Until next time.