The Behaviour Gap

Today’s post looks a the Behaviour Gap, a psychological phenomenon that causes private investors to underperform.

The Behaviour Gap

The behaviour gap is the gap between the returns enjoyed by private investors and that from simply tracking the market.

- There are two reports produced annually which look at this gap, and a famous book of that name.

We should begin by noting that both reports have been criticised for their methodologies,

- Dalbar, in particular, divides returns by the balance at the end of the period, rather than the average balance through the period.

- In contrast, Morningstar uses money-weighted returns (rather than time-weighted returns).

Nevertheless, the broad findings are interesting.

DALBAR

DALBAR is a financial services market research firm in the US.

The latest DALBAR Quantitative Analysis of Investor Behaviour (QIAB) report dropped in August 2021.

- This has been produced every year for 27 years, and there is often a mid-year update.

The reports are not freely distributed, so I can only report numbers that are available on the internet.

In 2020 the gap was just 1.1% (17.3% for US investors vs 18.4% for the S&P 500).

- For the first half of 2021, the gap widened to 2.1% (13.1% vs 15.2%).

Cory Clark, Chief Marketing Officer at DALBAR, said:

At the end of 2020, the Average Equity Fund Investor looked to be holding their own in a vacuum. However, one year or one moment in time is never the end of the story. Unfortunately, the money left on the table so far in 2021 is invisible to the Average Equity Fund Investor.

Investors should be taking a critical look at their investment decisions during 2020 to fully understand the latent implications that can arise months or years later when overreacting to market gyrations.

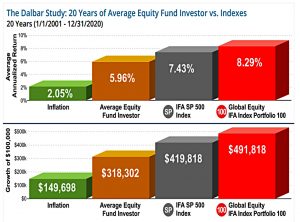

Over 20 years to December 2020, the S&P 500 returned 5.4% pa (net of 2.1% inflation), but investors only made 3.9% pa.

- The global equity index returned 6.2% pa.

Morningstar

The Morningstar study is called “Mind the Gap”, which makes me think that someone from London was involved at some point.

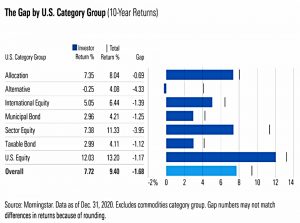

The 2021 report (also published in August) said that US investors earned 7.7% pa in the decade to end 2020, compared to 9.4% pa from the underlying funds.

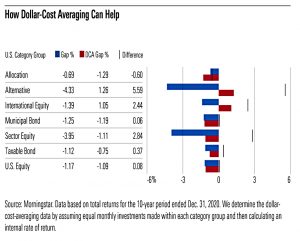

Morningstar says that dollar-cost averaging can help to close the gap.

Carl Richards

Carl Richard’s book (with the American spelling) came out way back in 2012.

- The book’s subtitle is ” Simple Ways to Stop Doing Dumb Things With Money”.

You might know Carl for his back-of-a-napkin sketches which he uses to illustrate investment concepts.

The central point of the book is that people tend to buy when things are doing well (at the top) and sell when things are at their worst (the bottom).

- As you can imagine, this doesn’t lead to superior investment returns.

Emotions are what drive these mistakes – people seek pleasure and want to avoid pain, which leads to greed at the top and fear at the bottom.

- The more you can manage your emotions, the better you will do.

Carl recommends index funds and a slow-and-steady approach.

- He also advises learning how to live in the present – the future represents anxiety (fear) and the past is regret (fear again) or nostalgia (greed).

He points out that financial success is just a means to an end – happiness.

- And accumulating money has diminishing returns – the first million makes a lot more difference than the second.

So you need to be clear about what you want from life, and then make the financial decisions that align with those goals.

- You also need to be honest with yourself about what kind of person you are – and especially about your own limitations.

Solutions

There are lots of ways to avoid falling into the behaviour gap:

- Have a plan and stick to it

- Make it as simple as possible (( But as Einstein would remind you, no simpler ))

- You don’t need to achieve perfection, only to point yourself in the right direction of travel

- Focus on the things you are in control of (fees, taxes, asset allocation) and ignore those that you can’t affect (market returns)

- Choose the cheapest solution that meets your needs – avoid closet indexers

- Use your tax shelters (SIPPs, ISAs, VCTs)

- Diversify – have an asset allocation plan, and rebalance regularly (though not too frequently), and ideally using cashflows

- Use automation “tricks” like dollar-cost averaging

- Don’t react to the news – instead, cut out the noise

- Don’t try to predict the future – instead, react to what is actually happening

- Don’t over-trade

- Admit to your mistakes (cut your losses short) and move on.

That’s it for today.

- Until next time.