London Forex show – 20th February 2015 (1)

Today’s post is a review of the presentations in the main conference room at last week’s London Forex show at Olympia.

Contents

Webinars

I had flu last week, so was unable to use my ticket to the show. Instead I listened to the presentations as webinars. So this is actually a review of the London Forex eShow, as they style it.

This was a first for me, ((I’ve attended webinars for work previously, but never sat at my desk for a whole day to listen to eight in a row before)) and I was pleasantly surprised. The technology was reliable and it was easy to take screenshots of the slides. I would attend this way again if I hadn’t arranged to meet anyone at the show.

Intro to FX

Signing up for the show meant that I was mailed a complimentary copy of Trader’s magazine. The issue was focused around the show and included an article on “Forex trading for beginners”. I don’t trade FX, so we’ll start there.

The first point to make is that FX is traded off-exchange. Instead, trading is “over-the-counter” (OTC) between banks, brokers, funds and private investors, who were only allowed to trade as recently as 1999.

The market opens on Sunday afternoon (in Australia) and closes on Friday evening in the US. Volumes are higher than any other market ($5 trillion per day). Most trading is done in London, and 66% of trades take place in the US, UK Singapore or Japan.

Twenty-four hour trading means that price gaps are rare except at weekends (but see the recent Swiss Franc event as a counter-example). The market has high volatility and low trading costs, plus lots of leverage, which means lots of opportunities for traders (to win big and to lose big).

All FX trading is pairs trading – one currency is traded against another.The dollar dominates the market – 87% of transactions involve it. The euro is second with 33%.

The most-traded pairs are EUR/USD, USD/JPY and USD/GBP. To avoid over-exposure to dollar movements, it would be wise for UK traders to add in the complementary pairs (EUR/GBP, EUR/JPY, GBP/JPY) where possible.

With few fundamentals (other than central bank interest rates and macro-economic trends) most trading is driven by technical analysis. Moving averages, Fibonacci, MACD, RSI and stochastics are all popular.

Big “figure” days (Fridays) when important numbers from the US such as the Non-Farm Payroll are released are fundamentals-driven. The same applies to central bank announcements in the UK, Euro zone and Japan.

The presentations

Now on to the presentations. The webinars on offer were all from the main conference room, and there were eight of them.

I’m always aware that mentoring and training other traders is a strange thing for a successful trader to want to do. This means that I take what I hear with a pinch of salt, but the average standard of the presentations was higher than usual.

Master the Markets

Master the Markets were selling training courses (2 days for £2K +VAT!) and a CD. As is often the case, there was a discount for anyone that signed up on the day. Rishi Patel was standing in for the advertised speaker, and his talk was mainly about Price Expansion. ((Although the term Profit Expansion seemed to be used interchangeably))

Before that we got a slide that showed us how well their strategy was doing:

The basic thrust of Rishi’s presentation was the analysis of chart patterns for predicting future profits. For two chart bars there are four patterns from the high and low, but 256 if the open and close are included.

Rishi ran us through a typical study. Five exits for Price Expansion were analysed between 2012 and 2014 on USD/EUR, EUR/JPY and USD/GBP. Entries and stops were constant, and only exits varied.

The five exits used were:

- High of previous bar

- Close above / below previous bar

- 3 buyer / seller bars after entry

- previous Swing High / Swing Low

- 10 periods

The results showed that Exit 2 was best, with a 57% profit from 100 trades. Exit 1 was more reliable (55% vs 50%) but losses were typically larger than profits so the next profit was only 31%, All five exits were profitable.

So that gives a flavour of Master the Market’s approach: back-testing of price patterns and optimisation of exits.

The Traders Cosmos

Zaneer Anwari from The Traders Cosmos was selling his mentoring service. He has a trend-following software package which you get for free, as long as you have signed up to the mentoring.

His talk was low on hype and contained a lot of common sense about trend-following, but it was also low on detail about the mechanisms, results and costs for his system. He has a 30-day free offer available on his website.

Hypnotrading

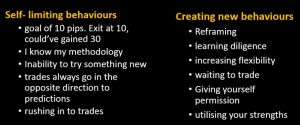

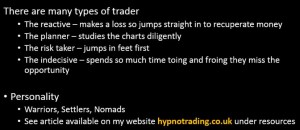

Catherine Scott from Hypnotrading gave a more unusual presentation about the psychological aspects of trading, and how hypnotherapy can help.

I think the slides speak for themselves, but you can find out more on Catherine’s website.

The presentation also included a number of case studies, which I haven’t captured.

Forex Insider Daily

Forex Insider Daily (FID) is a subscription newsletter from the Agora Lifestyles stable, home of Money Week and The Right Side. FID is written by Tom Tragett, who gave the presentation, and costs £197 a year. There are supplementary products if you want to spend even more. The on-the-day offer was a trial for £1.

On the website, Tom styles himself as a whistleblower who will teach you to “trade dirty”, but there was little hint of that from his presentation.

He advocated instead a marriage of fundamental and technical analysis. He began with an overview of fundamental analysis as it pertains to FX (macroeconomics). His advice was to keep analysis simple and look at the long-term price action.

Moving on to technicals, Tom recommended the following tools:

- trend lines and channels

- support and resistance lines

- pennant or wedge formations

- moving averages (closes above/below the 200MA)

- the Golden Cross (especially 30- & 90-day / week / month crossing the 200MA)

- double tops and bottoms

- head and shoulders formations

- Fibonacci and Elliott Wave theory

- Relative Strength Index (RSI – range of 0-100, overbought above 80, oversold below 20)

Which is pretty much every technical indicator that I as an infrequent trader am aware of.

What was missing from Tom’s presentation was an example of what your money buys you. I would have liked to have seen that morning’s newsletter, and had a discussion on how we could use the information it contains to place favourable trades.

Conclusions

That takes us to half-way through the presentations – we’ve covered four out of eight. It’s a lot of information to take in at one sitting, and I’m going to pause for breath here.

I haven’t seen a service I could recommend to date.

- With Master the Markets I’m not convinced that training seminars are much better to learn from than a book that you can study at your leisure. I’m certainly not convinced that they are £2,000 better.

- Something I might be interested in is a seminar from a person whose book I have already read and been impressed by. For some reason the model never seems to work that way.

- The Traders Cosmos and Forex Insider Daily presentations both lacked the detailed information needed to work out just what you were paying for.

- Hypnotherapy might be of some use to an active trader with some obvious trading issues, but I’m not in that situation.

I’ll be back later in the week with coverage of the last four presentations.

Until next time.

Interesting to see a review of all the speakers. I’d be happy to talk more if you’d like to understand hypnotherapy more even if its not something you need at the moment ð