Trend-Following in a Crisis

Today’s post looks at an article in the Hedge Fund Journal about the performance of trend- following in a crisis.

Contents

Turbulence in 2018

The article is written by Artur Sepp and Louis Dezeraud of Quantica Capital in Zurich.

2018 was a tough year for quant approaches, with alternative-risk premia (ARP) hedge funds and trend-following (CTA) underperforming the S&P 500.

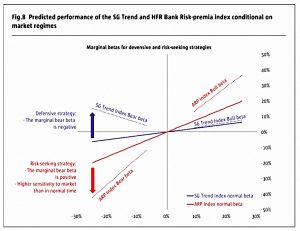

- To explain this, the paper presents a new quant model which demonstrates that ARP and hedge funds are risk-seeking strategies (and ARP has a lower risk premium than hedge funds).

In contrast, trend-following is a defensive strategy with a negative beta during market crises.

- On the other hand, the risk premium for CTA is “insignificant”.

Trend-following CTAs should be viewed as an actively managed defensive strategy with the goal to deliver protective negative market betas in strongly downside markets.

Because of the negative protective betas in bear markets, trend-followers well deserve their place as diversifiers in alternative portfolios to improve risk-adjusted performance and capture risk-premia alpha on a portfolio level.

Another finding from the model is that many “zero-correlated” and “market neutral” strategies, in fact, have a strong equity exposure during bear regimes.

When we analyse systematic strategies unconditional to market regimes, the performance may appear to be smooth and uncorrelated because of the aggregation across different regimes.

So ARP does well under normal conditions because of a hidden tail risk which leads to underperformance in turbulent markets.

In contrast, trend has no hidden tail risk but needs long trends to outperform.

- A turbulent year like 2018 – which had an unusual number of rapid reversals – will lead to underperformance.

Trend-following

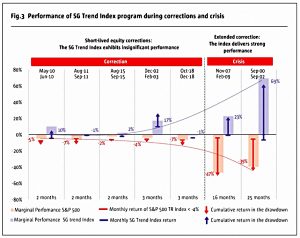

Quantica demonstrates how trend following works using the SG Trend Index.

Trend following has three basic elements:

- a signal in a particular instrument

- position sizing from that signal

- risk-based allocations across instruments at a portfolio level

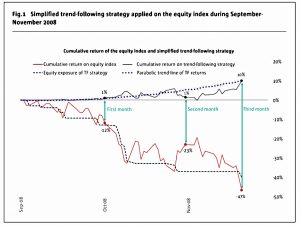

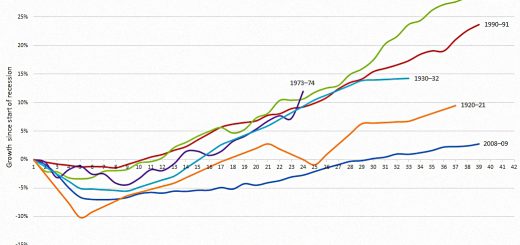

They look at a simplified strategy during the 2008 crisis:

- a short position was built up starting in September 2008 using a running minimum strategy

In month 1, the short position is too small to generate much return – the gain is 1% against a 12% decline in the equity index.

- By month 2, the index is down 23% but the strategy is still only up 1%

- By month 3, the index is down 47% but the strategy is now up by 10%.

The problem for trend followers is that at the start of a downturn they may have large long positions.

- Years like 2018, with two rapid corrections in February and October, can produce large losses.

With longer corrections trend will outperform.

Other asset classes

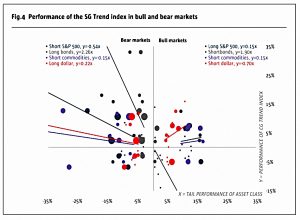

The next section looks at bull and bear regimes across four asset classes:

- stocks

- bonds

- commodities

- FX

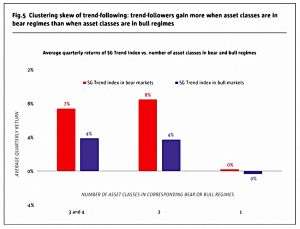

The SG Trend index benefits from either bull or bear regimes in all asset classes on average. On average trend-followers benefit more in bear regimes than in bull regimes.

Bonds don’t contribute in bear markets:

One possible explanation is that over the past two decades, bonds have been in a sustained bull market with occasional dips which trend-followers have not been able to capture.

This chart shows that gains only occur when more than one asset class has a bear or bull regime.

- In particular, regimes across two asset classes perform best, and more so in bear markets.

We call this effect the clustering skew of trend-following.

Regime conditional model

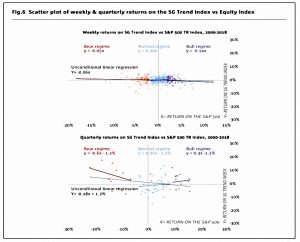

We propose a regime-dependent regression model to explain and illustrate key differences between risk profiles of ARP products, hedge funds, and CTAs.

I’ll spare you the complete details of the model, and most of the maths.

- A one standard deviation of returns threshold is used to define bull and bear regimes.

- A segmented conditional regression model is constructed.

- The alpha is constant over regimes.

We are interested in the overall alpha that a strategy can produce over the full life-cycle of equity markets including bull and bear regimes.

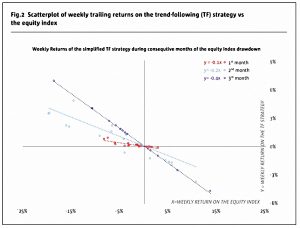

Trend-followers are more likely to deliver negative crisis betas during crises lasting over extended periods as most of trend-following CTAs apply medium- to long-time time horizons for signal generation.

Most of the time, trend-following strategies cannot deliver diversification during short-lived corrections.

Returns of trend-followers should be measured at a relatively low frequency (at least quarterly) to analyse the diversification benefits.

Crisis alpha

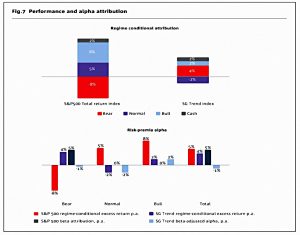

The paper spends some time discussing whether the trend-following outperformance should be described as crisis alpha or crisis (negative) beta.

- But we don’t need to worry too much about that – it’s the outperformance that counts.

The performance of the SG Trend Index in the bear regime can be solely attributed to its significant negative index beta.

Positive returns in bear regimes may be attributable to actively managed market betas, or market timing, rather than crisis alpha.

It is a special skill provided by trend-followers to deliver equity market betas that change conditional on market regimes without compromising too much of the long-term alpha.

As a result, trend-following CTAs are a niche asset class that well deserve a place in traditional and alternative portfolios.

ARP

The paper points out that trend-following is not the same as alternative risk premia.

Our model implies that the ARP index is leveraged to the downside and to the upside. In contrast, the SG Trend index has a small beta in the normal regime but its beta changes to negative in bear regime.

Portfolios

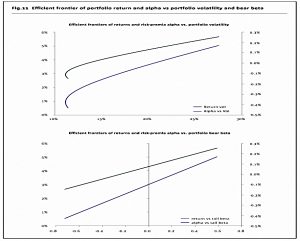

CTAs produce defensive equity betas in bear markets with insignificant risk-premia alphas. In contrast, most hedge fund and ARP products produce positive risk- premia alphas as compensation for positive marginal bear betas.

TAs and trend-following CTAs may serve as diversifiers for a portfolio of alternatives. Alternatives portfolios must be viewed as a trade-off between the expected risk-premia alpha and bear betas.

This trade-off must be matched by the risk profile of each investor.

Conclusions

It’s been pretty technical today, but I promise not to make too frequent a habit of it.

The key points for me are:

- Trend-following is not the same as ARP or hedge fund strategies.

- Trend delivers in a crisis if that crisis lasts long enough.

- Trend only works when there is a crisis in more than one asset class.

The tricky thing remains working out what proportion of a portfolio needs to be allocated to trend for the best protection/return trade-off.

- Until next time.