Crisis-Proofing Your Portfolio

Today’s post is about crisis-proofing your portfolio.

- It was drafted back in February before the coronavirus hit Europe.

So you will obviously have to wait for the next crisis in order to take advantage of any lessons it contains.

The LQG

As I have mentioned before, one of the best investing groups that I attend is the London Quant Group or LQG.

- They hold around eight evening seminars throughout the year, plus an all-day seminar in the spring and a long weekend away in Cambridge (which is not free) in the autumn.

Many of the meetings are held under Chatham House rules – usually because the papers being presented have not yet been published.

- Which means in turn that I can’t write about them.

But sometimes we look at a paper that’s already been published.

The February 2020 meeting was a talk from Otto van Hemert, one of the authors of a paper from Man AHL that was published last year.

- The relevant page on the Man website is called Can a Portfolio be Crisis-proofed, but I prefer the longer title of the paper itself: The Best of Strategies for the Worst of Times.

As we are now at the end of an eleven-year bull market, I only wish the paper had been presented a few months earlier.

- But there is never a bad time to investigate a topic like this.

The strategies

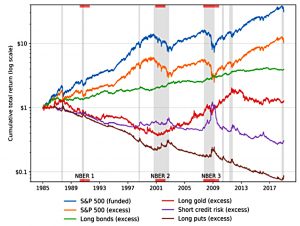

The paper looks at six defensive strategies from 1985 to 2018, a period which includes eight drawdowns in the S&P 500 of more than 15%, and three US recessions:

- Buying put options on the S&P 500

- Being long credit protection (or short credit risk)

- Bonds (US Treasuries)

- Gold

- Trend-following (momentum)

- Long/short quality stocks (to benefit from any flight to quality)

The first four strategies can be described as passive strategies, whilst the last two are dynamic strategies.

- Numbers three and four on the list – and, in a different way, number six – involve safe-haven assets.

The chart above shows excess returns (over cash) from the passive strategies over the period.

- The grey areas are drawdowns of more than 15%, and recessions are marked in red at the top and bottom of the chart.

It should be noted that not all of the passive strategies have positive return expectations over time.

- Bonds are positive, and so is gold (though it spends a lot of time underwater).

Both underperform stocks, however.

Puts and short credit risk will both lose you money over time.

- So some element of market timing would be needed to make use of these.

Puts

Puts offer good protection in all the drawdowns but are expensive.

- They have a return drag of 8% pa.

This is consistent with our previous findings that buying options has a negative return expectation, but selling (writing) them has a positive return expectation.

- People are happy to over-pay for insurance.

Short credit risk

Being long credit protection also works during all the drawdowns, but particularly in the 2008 crisis, which was a credit crisis.

- Short credit risk is cheaper than puts but still loses money.

Bonds

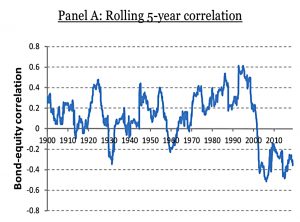

Bonds have worked well since 2000, but not before that.

- This is because equity/bond correlations used to be mostly positive, but have been negative for the last 20 years.

As Man put it:

As we move beyond the extreme monetary easing that has characterized the post-Financial Crisis period, it is possible that the bond-equity correlation may revert to the previous norm, rendering a long bond strategy a potentially unreliable crisis hedge.

So if you feel that there’s any prospect of that happening, you might want not to rely on bonds fo protection.

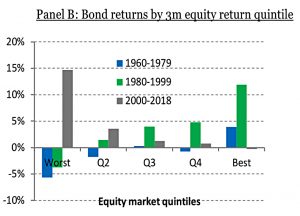

Consistent with the positive bond–equity correlation before 2000, a long bond position does not provide a drawdown hedge before 2000.

In fact, bond returns are negative in quintile one (the worst periods for equities) for both the 1960–1979 and 1980–1999 periods.

Gold

Gold does not provide a dividend, but, as a real asset, it can help offer protection against certain sources of long-term inflation.

Gold is typically priced in US dollars and so its price is partly driven by fluctuations in foreign exchange rates. This then links gold to US monetary policy.

Gold works in a crisis, but it’s long-run returns are so close to zero – and so unpredictable over the short-term – that it doesn’t make sense to hold it as a large proportion of your portfolio.

Trend

Man used multi-asset futures to implement trend-following.

We target an annualized volatility of 10% and allocate risk to six groups as follows: 25% currencies, 25% equity indexes, 25% fixed income, and 8.3% to each of agricultural products, energies, and metals. Within each group, markets are allocated equal risk.

Trend (ride winners and cut losers) worked well in recessions and drawdowns.

- Removing long equity positions improved protection during downturns, but lowered returns overall.

Three-month momentum worked best.

Stock factors

Some of the intuition behind futures trend-following providing crisis alpha may carry over to stock momentum.

The investment factor [Fama-French], which goes long the stock of conservative companies with low growth in book assets while shorting aggressive, high-asset-growth companies, performs about as well as the stock momentum factor during equity drawdowns.

In contrast, the value factor has been much less effective as an equity market drawdown hedge.

Quality

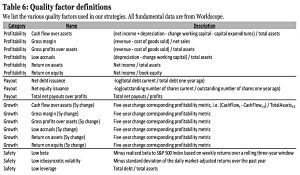

Long/short stocks using various quality metrics also worked well and was not closely correlated to trend.

Man stressed the importance of beta-neutral portfolio construction, rather than more normal dollar neutral.

- This is because dollar-neutral portfolios can have low beta – they protect in drawdowns by having low equity exposure.

The problem with this is that they would then underperform in bull markets.

Conclusions

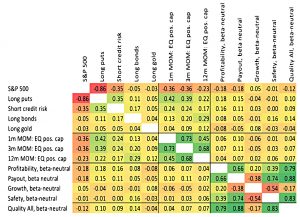

The next table shows the correlations between strategies.

Man’s conclusion is that crisis hedging is possible:

Although a 50% allocation to the hedge strategy is required to achieve a positive return over the equity market drawdown periods in our simulations, a 10% allocation improves the return in each of the eight historical equity market drawdown periods, resulting in more than a seven percentage point improvement in the annualized drawdown-period return (from -44.3% to -36.8%).

But they also note:

Every crisis is different. For each crisis, some defensive strategies will turn out to be more helpful than others. Therefore diversification across a number of promising defensive

strategies may be the most prudent strategy of all.

It looks like we have four plausible approaches, some of which are easier than others for private investors to implement.

- Most people will have some bonds (or bond-like substitutes) and a bit of gold.

Trend and long/short quality are less straightforward.

- I already have some trend-following portfolios in stocks, but I should look at adding other assets.

I also probably need to pay more attention to 3-month momentum and less to 12-month.

I’m not doing much with quality at the moment, beyond a few factor funds.

- So I think my next step will be to build some long and short quality screens, based around the detail of the Man paper.

Until next time.

Hi Mike-interesting article! Although I think it is right that each crisis is different, one major lesson that I have learnt has been that for the last 30 years in which I have been investing, that although you really should be invested in all things it has tended to be the two ‘G’s that have been the most succesful defensive strategies at times like this- Gold and Gilts.

If you look over the last 3 months Gold is up 14% whilst the best of the actively managed Global Government Bond funds are up 9% . Over the same period, the MSCI World Index is down close to 20% whilst the FTSE 100 is down close to 25%.

My own experience has taught me that you do need something of everything (equities/bonds (junk, gilts and investment grade)/Infrastructure/ commercial property & gold)- the trick is finding the right asset allocation so that you do well in both bull and bear markets. Tricky!

Hi Bryan,

The article is clear that the bond/stock correlation was positive until 20 years ago, and will likely revert once interest rates rise. Gov bonds are safe but pay no interest, and corporate bonds look very unsafe to me. If I were to be buying bonds, I wouldn’t start with gilts as I already have more sterling exposure than I want. Gold is fine, but I think more people are buying it now than were buying 6 months ago.

I don’t think there’s a static allocation that works best under all regimes, particularly in decumulation. You need to decide where you are, set a course and keep making adjustments. Accumulation is simpler – decide on a risk level and wait until you have enough money to retire (plus a margin of safety).

I totally agree that things are tricky at the moment and are likely to remain so for some time.

Cheers,

Mike

Interesting paper.

I had a not dissimilar long gilts/stock discussion only a couple of days ago at:

https://ace-your-retirement.blogspot.com/2020/04/did-your-portfolio-survive-covid-19.html.

Also, IIRC, you and Bryan have debated bonds before?

Nice link. Indeed we have – I think we must agree to disagree. I’d rather nobody owed me money at present as credit risk is clearly sky high. When you fear that a third of your stocks might go bust, you don’t feel like lending people your cash.

I’m all for diversification, I just think that it’s more of a moving target than the industry would have you believe. I don’t think that any of the lazy portfolios were designed to deal with a pandemic-driven economic shutdown.

FYI, in the event of an insolvency, it is my understanding that bond holders usually rank ahead of share holders for payment, see e.g. https://hjsolicitors.co.uk/article/who-gets-paid-first-in-insolvency/

Of course, they do, but that doesn’t prevent bond defaults. I wouldn’t buy equity in a firm that I thought was going bust, either.

Yes, I should explain that my argument for bonds is based on less than love for them as a particular asset class in themselves, but more on the fact that I believe that any serious investor should have money invested in all the major asset classes -ie, something of everything (even if you think at a given time that they hold little value)- so you should do ‘well’ in the good and bad times.

Within my bond allocation (around 50% of my portfolio) I tend to split my money 50% Corporate Bonds, 25% High Yield and 25% Gilts -although gilts have done so well recently that my gilt allocation has risen beyond 40% so some rebalancing is now needed!

I think Gilts are becoming closer to Gold in that there is no income yield (or very little) but they are excellant insurance (no UK government has defaulted on any gilts) and in this crisis (like the finanical one) people want return of money not return on money!

Apart from rebalancing I avoid making any judgements on which asset classes will do well (as no one knows) so for example in the last 4 weeks infrastructure trusts that I hold (HICL & BBGI) have gone up by between 20-25%, whilst High Yield trusts like NCYF has rebounded by almost 90% over the same period: who knows!