Weekly Roundup, 21st February 2022

We begin today’s Weekly Roundup with crashes.

Crashes

The Economist had three articles about market crashes.

- The first looked at what would happen if there was a crash, using history as a guide but conceding that next time will be different.

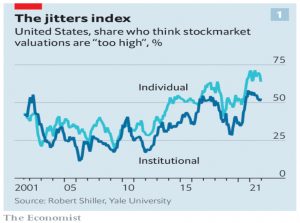

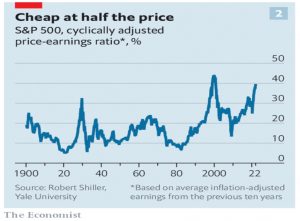

Asset prices are high: the last time shares were so pricey relative to long-run profits was before the slumps of 1929 and 2001, and the extra return for owning risky bonds is near its lowest level for a quarter of a century.

Rising interest rates will lower the present value of “long duration” assets.

If big losses do materialise, the important question is whether the financial system will safely absorb them or amplify them.

Whilst banks take less risk these days (because of new capital rules), trading costs are now close to zero and stock markets are dominated by automated trades and increasingly by ETFs and retail traders.

- Share trade volumes are 3.8X what they were a decade ago.

Banks are less central to the financial system, better capitalised and hold fewer highly risky assets. More risk-taking is done by funds backed by shareholders or long-term savers who, on paper, are better equipped to absorb losses.

The Economist worries about hidden leverage in hedge funds and “shadow banks”.

- A second problem is the centralisation of the system, which threatens its ability to cope with volatility.

ETFs rely on a few small market-making firms to ensure that the price of funds accurately tracks the underlying assets they own. Trillions of dollars of derivatives contracts are routed through five American clearing houses. The Treasury market now depends on automated high-frequency trading firms to function.

The GameStop frenzy of 2021 led to margin calls and halted trading (RobinHood took a lot of flak from the Reddit traders).

- The Treasury markets have seized up in 2014, 2019 and 2020.

Ever since 2008-09 central banks and regulators have had two unspoken goals: to normalise interest rates and to stop using public money to underwrite private risk-taking. It seems that those goals are in tension: the Fed must raise rates, yet that could trigger instability.

The second article adds more detail to these arguments.

The third article was from Buttonwood, who looked at how the valuations of unlisted startups would adjust to falling share prices.

- The answer is surprisingly slowly.

In venture circles, mistakes carry no shame. If your startup is a bust, you learn lessons, move on and back a new firm.

Buttonwood sees some signs that IPOs are being pulled and companies are conserving cash.

- But VCs have a lot of money to deploy.

The lower interest rates are, the less investors care about whether they receive a dollar today or a dollar tomorrow.

Rates are heading higher, so valuations should fall.

[But] a VC firm that tries to align a funding round with the prices paid in public markets may find that another vc firm comes over the top with a better offer.

What founders think will also matter.

Founders grew up in a world of near-free money. It will take time for them to adjust to a different landscape.

On the other hand, a big fall in listed stocks might put investors off VC:

Were VCs themselves unable to raise capital for new funds, they would surely be forced to be less generous in the prices they paid.

That might not happen this year.

Bubbles

As the bubble in profitless tech firms, meme stocks and lockdown darlings start to burst, Steve Russell from Ruffer looked at whether safety could be found in the big winners of the last decade.

- The conclusion was that it can’t, owing to very high valuations.

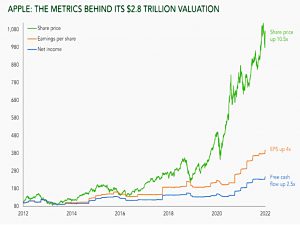

Apple is the case study, valued at $2.8 bn.

Over the last decade, free cash flow has increased by 2.5X, and earnings per share by 4X (boosted by share buybacks).

- But the share price is up by 10.5X, driven by an increase in valuation.

Can this be relied upon in an environment of higher inflation and rising interest rates? We fear not.

Redwood

In his regular review of the ETF portfolio he runs for the FT, John Redwood said that the markets have lost trust in the central banks.

They show growing remorse for the inflation they see around them while being reluctant to accept the blame for it. There is a danger they end up doing too much too late.

John is even more convinced than last month that 2022 is all about (non-transitory) inflation, monetary tightening and political tensions.

We could see the worst of the price rises this spring. This assumes wage growth stays below the high price rises of the peaks, and many of the shortages are gradually resolved by adding more capacity.

The dangers are wage inflation (caused by labour shortages and a reluctance to return to work) and too many hikes, which could lead to stock crashes, a yield curve inversion and a recession (presumably accompanied by rate cuts to reverse the situation).

The shortage of energy (particularly in Europe) is the hardest problem to solve.

The West’s wish to transition quickly to green energy has set in train major reductions in coal and nuclear generating capacity which needs replacing with something better.

John has now moved to 22% cash, having sold some clean energy and digital holdings.

Freetrade

Freetrade is in trouble with the FCA after one of its Tik Tok influencers (I have never used Tik Tok, so I don’t know who) suggested that consumers in debt could use Freetrade to make money.

- The FCA has ordered Freetrade to get rid of all paid-for social media influencer posts.

I’m not sure this will make too much difference – in my experience, a lot of the popularity of Freetrade (which I no longer use personally) comes from people who are not being paid directly to recommend it:

- Those who bought (unlisted) stock in one of Freetrade’s seven equity crowdfunding rounds

- Those who benefit from a free share when a new user signs up using their affiliate code.

The FCA’s supervisory notice against Freetrade says that all financial promotions issued or approved by a firm must be “fair, clear and not misleading”.

- Freetrade had previously been warned about its use of social media in 2020 and 2021.

The FCA said:

The authority considers that the promotions provide consumers with the impression that they could reduce debt by following the steps taken by the social media influencer and use the firm as a mechanism to make money.

However, the authority considers this to be misleading as there are no guarantees that any investment will result in positive gains in the short or long term. Consumers already in debt are likely to be particularly vulnerable to this.

LightYear

One of the trading apps that I use – Lightyear – has announced a move into “social investing”.

- I’ve dipped my toe into this area with eToro, a platform that offers easy copying of other traders with public profiles (( Admittedly, I didn’t choose the best time to start this experiment, having begun in the second half of 2021 ))

You don’t have to make your own profile public (the default is private), and this seems to be the route that LightYear has chosen.

- Customers will have their own “home page” that they can share with friends and family.

This will show portfolio holdings, watchlists and recent trades, but not portfolio balances, or transaction amounts.

There’s no mention of copy trading, which is the key feature on eToro.

- You allocate a set amount of capital to a trader you want to follow, and their current positions and future trades are duplicated for as long as you follow them.

Even without copy trading, public portfolios are interesting, and I wish more apps and platforms (and even portfolio management tools like Stockopedia) would support them.

Quick Links

I have seven for you this week, the first four from The Economist.

- The newspaper looked at the true cost of empty offices

- And forecast that fast fashion might be squeezed again.

- The Economist also wondered whether the ed-tech boom could last

- And said that workers have the most to lose from a wage-price spiral.

- UK Dividend Stocks asked whether Unilever’s dividend can be trusted after the GSK disaster

- Pragmatic Capitalism asked whether the Bond Bear Market is over

- And Noahpinion said that the NYT article on MMT is really bad.

Until next time.