Plain English Global Multi-Asset Fund

Today’s post looks at the launch of a new fund that could be used as the basis of an entire portfolio – it’s the Plain English Global Multi-Asset Fund.

Contents

Plain English Global Multi-Asset Fund

I heard about this fund, which launches later this month, because it is the brainchild of Andrew Craig.

- He runs a company called Plain English and will be one of the investment managers for the fund.

I first came across Andrew in November 2015, when I attended the “Summit meeting” of the Elite Investor Club, which I wrote about here.

- Andrew is associated with the Club, and writes a column in their bi-monthly newsletter.

Andrew is also the author of a book called “How To Own The World” which is aimed at DIY investors.

- I was lucky enough to win a copy of the book (and several others) in a Twitter raffle last year.

The book will soon be featuring in our “Required Reading” section.

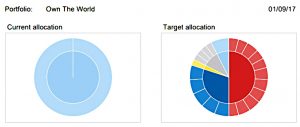

Own The World

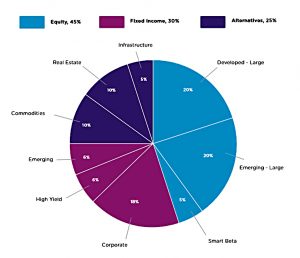

The central idea of Andrew’s book is that you should have a globally-diversified multi-asset portfolio.

- Andrew calls this “owning the world”.

- It’s something that I strongly believe in, too.

Now Andrew is launching a fund that will implement such a portfolio on your behalf, through a single fund.

The fund will rebalance once a month, or more frequently if the value of the assets in the fund increase or decrease by more than 5%.

Trend following

In addition, the fund uses a trend-following formula on each of these assets.

- This is run once a month to calculate whether the fund should be invested in that asset, or whether that part of the fund should be in cash.

Andrew doesn’t explain the detail behind the trend-following calculations, but they seem to involve comparing the current price to a historical moving average.

The fund summary document has charts showing how trend-following would improve performance in the S&P 500, the world equity index, commodities and UK property:

Back-testing

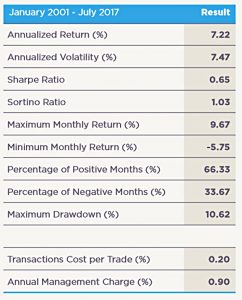

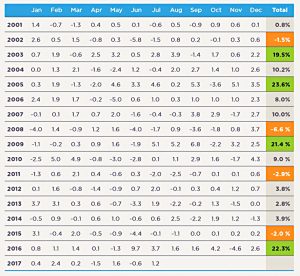

Andrew and his team have back-tested the fund’s approach from January 2001 and found that it would deliver 7.2% pa (after costs).

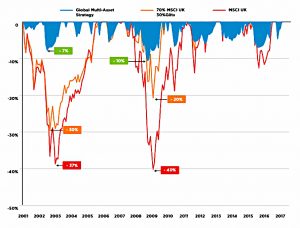

Returns were significantly higher than from UK stocks, or from a 70/30 UK stocks and UK bonds portfolio.

I’m not sure why they started in 2001 rather than 2000, but there was a nasty market crash in 2000 and perhaps that made the performance numbers look worse.

More impressively, this return came with low maximum drawdowns.

- The worst year was 2008, when the fund would have lost 6.6%, compared to more than 40% in most equity markets.

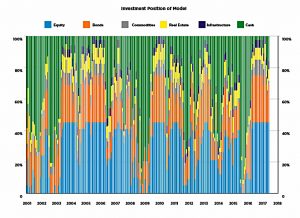

The chart below shows how the fund would have been invested during the period from 2001 to 2017:

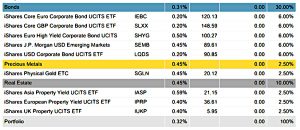

Underlying ETFs

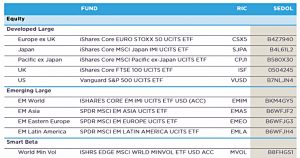

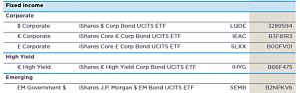

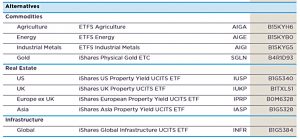

Andrew helpfully provides a list of the 24 ETFs that the fund will use:

A few observations on the choices:

- The five developed equity geographies are the standard ones.

- Emerging markets are split into Asia, Eastern Europe and Latin America, but China is not separated out.

- Smart Beta is only represented by minimum volatility – where are value and momentum?

- Fixed income is all corporate bonds, apart from in emerging markets – where are the developed markets government bonds, and the index-linked bonds? (( Yields on government bonds are at historic lows, but they should still be included ))

- The four commodities funds look reasonable.

- As do the four real estate funds.

- Private Equity is missing.

Costs

So far, there’s a lot to like about this fund.

- The problem is the cost.

The fund will have an initial OCF (ongoing charge) of 1.14% pa.

- Andrew hopes this will fall to 1% pa when the fund reaches £75M in assets.

Depending on where you hold the fund, there might be additional platform charges.

- The table below shows the platforms on which the fund will be available.

Some of these (eg. interactive investor) are flat-fee platforms, so if you hold the fund with them, there will be no extra charge.

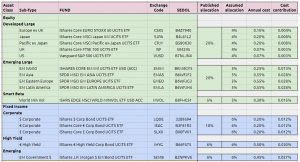

The markup

Because we know the names of the underlying funds, we can make a few assumptions and work out what the markup from Plain English is.

I had hoped to do this using the very helpful service at justETF.

- They recently added UK ETFs to their platform, but not, it would appear, all of them.

- Three of the commodities funds were missing.

So instead I worked it out manually in Google Sheets:

The underlying funds cost 0.35% pa, which means that the Plain English markup is 0.79% pa.

- For that you get rebalancing and trend-following.

- Only you can decide whether that is good value or not.

Conclusions

I like this fund, but it’s just too expensive for me.

- An annual charge of 1.14% pa puts it well in the red zone of our table.

- It’s even more expensive than the similar offering from Scalable Capital.

It’s good to see global multi-asset trend following funds arrive in the UK (( Shout if you know of any others )) but it will be much better when they cost half as much, or even less.

Until next time.

My bigger concern would be exactly how the trend forecasting works- the -6.6% loss in 2008 I think it is is predicated on being largely in cash at that point- what would have led to that decision and what lays beneath it? I like investments I can understand especially if it is a costly fund!

As a novice I’m intrigued as to why it is considered too expensive as long as it brings home the bacon, I.e earns enough to make a decent net return. Like electricians surely it’s not how hard they work, but what disasters do they avert for the clueless.

Hi Yvonne,

It’s not much the absolute level of charges as the comparatives. If Andrew wants 1.14% pa from my money and I can do something similar for 0.23% pa (or use Andrew’s exact same funds for 0.35% pa), that’s an extra 0.8% / 0.9% pa I can save.

Over a 50 year investing career (ignoring growth) that would mean that Andrew took 45% more of my pot that I could keep for myself. Low costs are crucial to long-term investing success.

Many thanks for this article Mike. I hope you won’t mind my coming back on your conclusion about the fund being ‘too expensive’.

I know it is perhaps a bit of a cliche, but I do believe that the idea that of the difference between cost and value is relevant here.

You highlight that the use of the same underlying funds we use would ‘only’ cost 0.35% and therefore our ‘mark up’ is excessive. Presumably you are advocating buying and holding the same 24 assets we have in our portfolio when you make this comparison.

I would offer the following thought – which is that the £7.90 extra of ‘mark up’ here out of every £1,000 invested is a small price to pay:

a) To remove the significant administrative and trading hassle of owning no less than 24 underlying assets (worth noting that we have also back-tested 97 assets to get to those 24 in the first place – so to a certain extent you’re ‘paying’ for a huge amount of analytical / optimising work to get to the right portfolio that should work through the economic cycle).

b) Even though you can of course copy the list (because we provide it – with total transparency) – how will you decide specifically when to buy and sell those underlying assets to avoid those 50% losses when the next dot.com / 2008-style crash comes? If you just copy our portfolio on a buy and hold basis you will likely not achieve anything like the performance we will. Without the trend following, those assets fell 26% in 2008, with it, this was only 6.6%. Bryan Matthew captures this point above when he notes that the fund was over 90% cash in 2008 (hence why the strategy was only down 6.6% vs. stock markets and the ‘cheap’ ETFs that track those markets which were down more like 50%). He asks what led to that decision to go to cash. The answer is an elegant trend following overlay which we have explained in our Fund Overview document here: https://plainenglishfinance.co.uk/funds/ . This overlay comes from two of the world’s leading experts on the subject. Do you have the skill set to do the same? Arguably more important – how much time will you have to spend to achieve the same result even if you did? I would argue that 1.14% is actually great value to protect against that AND own get rid of the administrative pain of owning and monitoring no less than 24 different assets. You’re paying £7.90 extra p. £1,000 and over time this number will come down as I explain in the document referenced above.

With an OCF of 1.14% – of every £1,000 someone might invest in our fund, they’re paying £11.40. My view is that if you might consistently make £70 – £200 per each £1,000 off the back of that (see back-tested numbers) and, far more importantly, the strategy will very likely prevent you losing as much as £500 per £1,000 invested or more in those big down years (past performance being no guide and all that of course). I think that is good value to say the least (I would think this of course seeing as I’ve spent two years designing the product but I think these are fair arguments).

Finally, I confess I don’t understand your workings saying that “45%” of your money would go to us over 50 years ‘ignoring growth’. First, why would you ignore growth. That’s the whole point of investing in a fund surely? Secondly, calculating anything over fifty years isn’t v. real world is it? That number would be way smaller over 10, 20 or even 30 years which is a far more realistic time frame for most people reading this article. Many thanks for the rest of your article though and I hope you don’t mind my responding! Andrew Craig.

Hi Andrew,

I’m delighted that you’ve come to defend your corner.

You’re completely right that everyone needs to make the cost / value trade-off for themselves. You call it £8 per £1,000, I call it £8K per £1M, so I’d rather do it myself. If you had a capped fee, things might be different.

To buy and sell, I’ll use moving averages, as I suspect you are doing. In the interests of total transparency, would you like to tell us your mechanism?

To answer your next point, yes I have the time and the skills.

The 45% gap is based on me using cheaper funds than you do, so that the annual gap is 0.9%. Over 50 years, ignoring growth (as it says in the comment) that leads to a 45% shortfall.

I couldn’t be bothered to model the gap under a range of growth scenarios at the time that Yvonne commented but maybe I’ll get around to it one day. The bottom line is that 1.14% on my personal portfolio is an obscene amount of money that I’m not prepared to pay.

I think 50 years is entirely realistic since I started investing my own money at age 24 and expect to be investing it beyond age 74. Readers are perfectly entitled to apply their own time horizon, but that is mine.

Please understand that I like your fund a lot, but the charges are ridiculous for a large investor. Why not have a £1K pa cap?

Thanks for commenting and feel free to come back with more.

Best,

Mike

Mike. Many thanks for the above. I’d just say that you are a very, very rare individual – a) With the skill-set / ability, time and inclination to do this work yourself b) With millions to invest. c) With a 50 year investment time frame. The vast majority of people don’t possess any of a, b or c, let alone all three of them together – so for them ‘around 1%’ is arguably a fair cost to very possibly get a far better result for their finances than with many other approaches . In terms of why we don’t cap the fee – I think you’re being naive in terms of the extreme difficulty and economics of setting up and running a fund management business. I have been at this for 6.5 years, never taken a salary (neither have any of our board), and invested a significant amount of my own money. If you had a real grasp of how unfeasibly successful we would have to be in winning clients to in any way monetise those years of hard work, personal risk etc by capping the fee at £1,000, I don’t think you would make that suggestion, truly.

Hi Andrew,

Once again, genuine thanks for coming back to me. I’ll take the compliment that I am a very, very, rare individual.

However, the average investor should have a 50-year time horizon and be targeting at least a £1M portfolio. That they don’t reflects the sorry state of financial education in the UK.

The time needed to run your multi-asset trend following portfolio is a few hours at the weekend or in the evenings, so that shouldn’t be a barrier, either.

You’re still looking down the wrong end of the telescope. If you are investing money on behalf of thousands of investors, and your scale economies can’t bring the costs below mine, then you are doing something wrong. But of course your costs are lower than mine, the difference in fees is your profit.

I plead guilty to naivety in terms of setting up a fund, as I’ve never done that, but I maintain that ad valorem fees are unfair. It takes the same amount of work for you to invest £1M as £1K, so why should you make more profit? You are coming across like an estate agent here.

I don’t doubt that you’ve put in a lot of hard work, but so have we all. I’m not looking to monetise your effort, I’m looking to invest my money as cheaply as possible.

More that 1% pa for a robot fund (essentially a glorified tracker) just doesn’t stack up.

Best,

Mike

I don’t think our respective views are that far away other than the fact that v. few people will invest for 50 years (you know that I agree with you that we should, but the reality is that for most people 30-60 is probably the most realistic time frame in that they probably won’t start investing until 30 and will quite likely want to start taking money from their pots around 60. What percentage of folk in the UK do you think will invest proactively for 50 years?). Tiny I’d say. Similarly – it might only take you a few minutes at the weekend but, again, that is true of probably less than 0.1% of people. In a similar vein, I agree with the need for people to get to a million (or significantly more) by the time they retire – so an ad valorem fee will only start being as ‘obscene’ as you think it is a long way down the road for most folk. If they have got to a significant seven figure sum by virtue of the success of the strategy – again, there lies value vs. cost but – I can assure you that if we get big enough and can afford it then, a long way before said people retire I’d certainly hope that we would have got the point that we can offer a capped product. I’ll be sure to let you know when we do! In the meantime, however, I think it is a little bit brutal to call it a ‘glorified tracker’. As I’ve mentioned above, the Professors have done a great deal of work to get from 97 assets to 24 and our process with trend following is a fair bit more involved than just holding some passives in perpetuity even if you are confident you can replicated that in 5 minutes every Sunday (again – I’d say you are pretty rare in being able to do that). Best wishes, Andy.

They may take money from age 60 but they will hope to live to age 80, which is 50 years.

I said a few hours a week, not 5 mins, and I didn’t mention holding passives in perpetuity. All systematic strategies are trackers in the broad sense.

1% pa is obscene on any sum.

I look forward to your fee cap.

Once again, thanks for contributing to the debate.

Best,

Mike

Am I correct in saying that the fund has no live cash track record? If this is the case then a lot of research into the back-test needs to be done. The bad ones never see the light of day so how has the investment process been framed with reference to history, how has it been stress tested and why, as has been alluded to, is 2000 not included?

John. Please have a look at our Fund Overview document here: https://plainenglishfinance.co.uk/funds/

In particular, you might have a look at “A note on back-testing” on p. 15 of the document and the pedigree of the team behind the back-testing (see p. 24). The back-testing actually does go back to 2000 (because the moving averages are backward looking) – but the performance track-record from Jan 2001 because that was when 23 of the 24 silos we use were all in existence. I would also note that the back-testing used trading costs of 20 basis points vs. the reality of our paying 5.

Hi Mike, just wondering if you can suggest alternatives to global multi asset funds? I am not hugely experienced in funds and I know I would lack the means currently to analyse and re-balance myself. I am looking to make use of multiple funds (one such being the Vanguard LifeStrategy funds) and spreading my money across that way. I also wanted to have a portion in this fund as well but definitely keen to continue educating myself on options. Thanks for a great article.

Hi Jay,

I’m not aware of a cheaper version of Andrew’s fund – you would have to go DIY.

I like Andrew’s fund, I just wish it were cheaper. I think that the scale economies of running funds should be passed on to private investors – they should be cheaper than DIY but often they are not.

It’s the same story with Robo Advisors for the most part.

Best,

Mike

Many thanks Mike. I think I will put some of my funds into this and mix it up with your other suggestions in other articles. Thanks again!