Weekly Roundup, 12th September 2017

We begin today’s Weekly Report in the FT, with the Chart That Tells A Story. This week it was about new car sales.

Contents

New car sales

Gavin Jackson compared car sales in 2017 with those in 2017.

- It’s not clear if he compares just the month of August in each year, or the year to August, since the text says one thing, and the chart caption another.

In any case, sales are down overall, driven by a significant drop (21%) in diesel sales.

- Overall sales are down by 6%, and many manufacturers and dealers have launched trade-in “scrappage” deals.

Gavin puts it down to the VW emissions scandal, but there’s also been a lot of publicity about the damage diesel emissions are doing to the public’s health in big cities.

- And as a consequence, taxes on cars that emit a lot of the dangerous gases are going up.

In addition to this, there are two other factors:

- Brexit, which makes future UK growth less certain, and pushes up the price of imported cars

- A general consumer slowdown, as evidenced particularly by recent results from pub and restaurant chains.

Gavin also floats the idea that car finance is becoming harder to get, but data from the BoE suggests that deals are getting better rather than worse.

It could be that a glut of cars coming off their three year leases is depressing second hand prices.

- This makes the price gap that needs financing larger, and pushes up the cost of leasing.

A consumer slowdown would be bad news, but a fall in consumer credit (largely driven by car leases in recent years) would mean that this cloud has a silver lining.

Fund launches

Merryn’s column in the FT was about a couple of fund launches, but she began with a list of qualities to be found in a good fund manager:

- An all inclusive fee that includes trading costs

- An annual meeting to which all individual investors are invited

- A concentrated, high-conviction portfolio

- A stepped fee (falling as the fund rises in size)

- A clear investing style (that does not change constantly)

- Skin in the game

- An understanding of the long term role of the fund manager as a steward of the corporate world

- An active share of over 90 per cent (not tracking an index)

- A willingness to turn up at AGMs and vote down silly pay packages

The first of the two launches is CF Blue Whale, backed by Peter Hargreaves of Hargreaves Lansdown fame.

- This is a global concentrated conviction fund (25-35 stocks) with a fee of 1.24% pa

Merryn highlighted this one because of Peter’s belief that UK investors have too much home bias.

- She recommended Templeton Emerging markets and Fidelity China Special Situations, which are both trading on discounts to NAV.

The second of the two launches is The People’s Trust from Daniel Godfrey, the former head of the Investment Association.

- It’s another global conviction fund, with investment management outsourced to a few familiar faces.

It promises a long-term orientation, but the launch has provoked a few jibes, because:

- It’s charging 1.07% pa, which is not that cheap.

- Godfrey is on a £275K salary for doing not very much (( He’s waiving half of this for the first couple of years until the fund gets a bit bigger ))

Since he was pushed out of the IA for saying that fees and salaries were too high, it’s a touch embarrassing.

Help to Buy

Merryn’s column in MoneyWeek was on housing and executive pay.

- Nobody wants new houses built near them because they are ugly and low quality.

But another problem is that we have an oligarchy of housebuilders:

- More than 50% of houses built in 2016 were from 8 companies

And the state subsidises their profit through Help-to-Buy:

- H2B houses cost 5% more than others, which drops through to the company’s bottom line.

Over the past three years, the top two executives at Berkeley Group have earned £125M between them.

- Merryn calculates this at £20K per house built.

If they’d taken half the pay – £62.5M, remember – then an extra £10K could have been spent making each property less ugly and of better quality.

But fund managers are useless at corporate governance.

- Merryn wants small shareholders to vote at AGMs, and block these pay deals.

Value investing woes

John Authers looked at why stock markets continue to rally in the face of political uncertainty.

- It seems that interest rates and earnings still Trump (( My apologies for the pun )) sabre-rattling.

John feels that the booming markets aren’t the sign of confidence that some would think.

His theory is that factors perform when they are in short supply:

- when times are bad, investors want growth

- when the economy has momentum, value stocks are the cheapest way into the upswing

So the underperformance of value investing suggests that investors are feeling negative.

Andrew Lapthorne at SG uses five factors:

- profitability

- quality (strong balance sheet)

- momentum

- growth

- value

Growth has done best recently, with profitability and quality close behind.

- This is more evidence that investors are worried.

The only exception to the value underperformance is China, suggesting there is growth there.

Lapthorne says that the best value indicator is free cash flow yield, an ultra-conservative strategy.

- It worked well until three years ago, but has since underperformed by 15%.

- The only other time it underperformed was in the dot com boom.

We don’t have that mania this time around, but we have the same disregard for value.

John concludes that monetary policy is the underlying cause:

- With bonds so expensive, people buy stocks, but without enthusiasm.

- And they anticipate interest rate rises that will hit the most indebted stocks the worst.

Relaxed investors

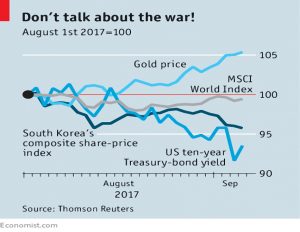

The Economist had an article looking at the same issue – why isn’t North Korea worrying investors?

- It’s true that gold is up a bit, and stocks and bond yields are down a bit.

- But the moves are not huge.

The newspaper offers a couple of explanations:

- Markets are great at assessing political risk (see Brexit, Trump)

- Investors know that geopolitical events have only very short-term effects (9/11, Iraq invasion etc.)

But the Chinese and Russian revolutions did have lasting effects, and a Korean war might drag in Japan and China.

So investors don’t believe this will happen.

- This may be because more countries nowadays are run by professional politicians who see economic success as the route to staying in power.

The Economist hopes that this is one case where the wisdom of crowds is proved right.

FX movements

The Economist also looked at how FX movements have helped the global economy.

- The euro has risen 15% against the dollar – from $1.04 to $1.19 – bringing it much closer to PPP parity ($1.33).

The dollar has fallen 6.5% against a trade-weighted basket of currencies.

- This has helped the recovery in emerging markets.

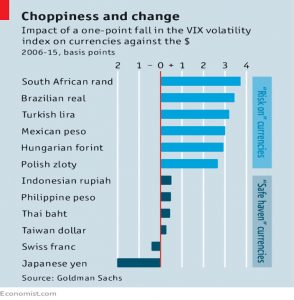

The fall in the VIX has also helped these “risk-on” currencies:

The Economist expects the mood to change soon:

- the reversal of QE in the US should strengthen the dollar

- and there is no fear in the eurozone at the moment, so any bad news will hit the euro.

US tax reform

John Cochrane, an Economics professor who blogs under the name The Grumpy Economist, had an interesting article about tax reform in the US:

- He wants to replace everything with a national VAT (which the US doesn’t have at the moment).

- That would mean getting rid of income tax, capital gains tax, corporation tax and estate taxes (IHT).

His point is that income tax causes all the mess:

- if you tax individual income, you have to tax companies, or people would incorporate to avoid tax

- but corporation tax is paid as higher prices, lower wages and /or lower payments to shareholders

- corporations don’t pay the tax, individuals do

Income tax also leads to capital gains tax, and taxes on dividend income (or people would get paid in stock options and the “carried interest” favoured by private equity.

- These taxes discourage savings and investment.

Estate taxes (40% in the UK, close to 50% for the rich in the US) produce an incentive to spend the money before you die, perhaps on things (and in places) that don’t produce the maximum benefit to the economy.

And all this complexity is doubled (in the US in particular) with the many exemptions and shelters.

VAT just taxes spending (consumption) and it’s hard to avoid.

- You don’t need any deductions, exemptions or shelters.

John also talks about the problems with making tax reforms.

He thinks this is because we try to do too much with tax:

- raise revenue for the government

- redistribute money from the less worthy to the more worthy (usually from rich to poor)

- subsidize (encourage) various activities and industries

- John says that the US “simultaneously taxes, subsidizes, regulates and promotes most industries”.

Switching from income tax to VAT would stop all this, leaving only the first objective.

So what happens to redistribution?

- John would make the VAT progressive, by offering a full rebate on the first $10K of an individual’s annual spend, a 50% rebate on the next $10K, and so on.

- In practice this would operate like a rewards program on your credit card.

More generally, John thinks that income is a terrible measure of someone’s needs.

- His own children (still in their 20s) are “low income”.

- Consumption is a much better measure of someone’s place in society.

This sounds like a great idea to me, so it’s clearly doomed.

Until next time.