100 Baggers 5 – Miscellany, Depression and Essentials

Today’s post is our fifth visit to 100 Baggers by Christopher Mayer.

Miscellaneous Mentation

Chapter 13 is full of bits on 100-baggers that didn’t fit anywhere else in the book.

- The title comes from Thurber.

Most of the chapter doesn’t seem to have much relevance to our search for 100-baggers.

- For example, the first section tells us not to chase returns.

We can rephrase this as having a long-term perspective or patience, or staying the course.

- You can even take it as a recommendation to Cut Out The Noise.

And whichever way you put it, it’s sensible advice – but it’s not specific to 100-baggers.

- Mayer is also disdainful of benchmarks, but that won’t help us.

Other advice includes:

- don’t get bored (and act rashly – patience again)

- avoid scams (which means avoid contact with management)

- ignore forecasts

- the best ideas are often the simplest (Peter Lynch: “Never invest in any idea you can’t illustrate with a crayon.”)

- be suspicious of abstractions (“big ideas”)

- investing abroad is often trading risks we can see for risks we can’t

- inflation (a la the 1970s) is a threat to stocks (especially asset-heavy ones)

The next depression

Chapter 14 looks at what happens when the next 2008 crash happens. (( Some would argue that the 2020 Covid crash was that event ))

Hunting for 100-baggers is completely independent of whatever is happening in the market. You should never stop looking for 100-baggers, bear market or bull.

Lower prices, as found in such disasters [as the Depresssion], create “easier” opportunities to make hundredfold returns. But bad times discourage people from investing.

Mayer quotes Marty Whitman’s three rules for which stocks won’t participate in a recovery:

- stocks that were grossly overpriced, to begin with

- stocks that suffer a “permanent impairment” (something that means that the business is no longer capable of doing what it once was)

- stocks subject to massive dilution during the meltdown.

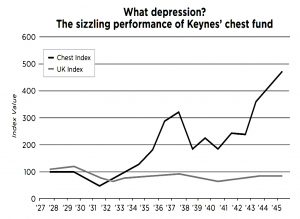

Mayer describes Keynes great performance with the King’s College endowment during the Depression and World War 2.

He did it using similar principles to Graham and Buffett:

My purpose is to buy securities where I am satisfied as to assets and ultimate earnings power and where the market price seems cheap in relation to these.”

And he became more patient and more contrarian.

- But he retained a concentrated portfolio.

Again, it’s interesting to hear of investing success against an unpromising macro backdrop, but this has little to do with 100-baggers.

Mayer tells the stories of several other investors who did well during the same period:

- Floyd Odlum

- David Feldman

- John Dix

Essential Principles

Chapter 15 is an attempt to distil the essential principles of 100-baggers.

- It starts with Mayer interviewing Charles Akre, whose speech originally inspired Mayer by introducing him to Phelp’s book.

Akre looks for three things:

- businesses that have historically compounded value per share at very high rates;

- highly skilled managers who have a history of treating shareholders as though they are partners; and

- businesses that can reinvest their free cash flow in a manner that continues to earn above-average returns.

This sounds like the Buffett / Terry Smith approach, but it’s not clear how to choose the subset of firms that will 100-bag.

- The third item on the list is the most predictive, but also one of the more subjective measures.

It’s probably worth looking for a relatively low (dividend) payout ratio, too.

Here are the other principles Mayer picks out:

- keep looking, and focus on stocks with the potential to 100-bag

- you need lots of growth (in sales and EPS)

- you want a high and stable ROE

- lower PE multiples are preferred (and a PEG close to 1)

- an economic moat is compulsory

- dividends are a drag

- debt is an accelerant (but raises the risk level)

- smaller companies are preferred (median sales $170M, market cap < $1 bn)

- owner-operators preferred

- you need time (patience / coffee-can)

- you need to filter out the noise (all big winners have big drawdowns)

- be a reluctant seller (sell only when you think you’ve made a mistake; you can’t use stop losses on 100-baggers)

And that’s it – we’ve made it through the book.

I’ll be back in a couple of weeks with a summary, and then perhaps we’ll have a go at making a stock screen from the book’s principles.

- Until next time.