5 Steps to Better Pensions

Today’s post looks at a recent report from the Pension and Lifetime Savings Association which recommends reforms to the UK pension system.

5 Steps

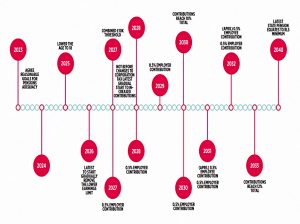

The report was released in October 2022, ten years after the introduction of workplace auto-enrolment (AE).

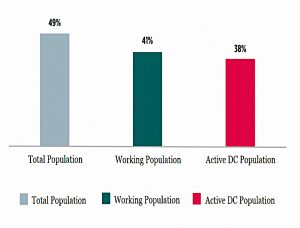

- 19.4M people now have a workplace pension, some 40% more than before AE.

- Opt-out rates are lower than anticipated.

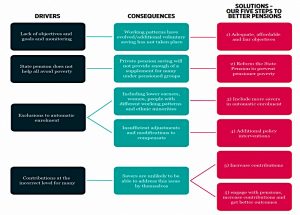

The main finding of the report is that more than half of savers aren’t on track to meet the retirement income targets set by the Pensions Commission in 2005.

- A fifth of households won’t even make it to the minimum level of the UK’s Retirement Living Standards.

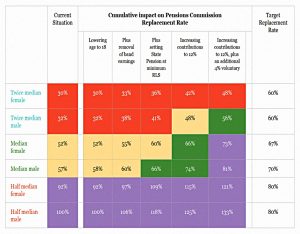

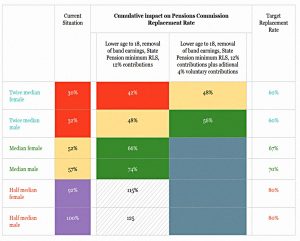

The Pensions and Lifetime Savings Association (PLSA) reckons that the five reforms it is proposing would increase the pension income of a median earner from £15K pa to £19K (above the target income).

Introducing the report, PLSA chair (and Aviva director) Emma Douglas said:

Now, in the middle of a cost-of-living crisis, is not the time for radical change but by providing a clear ‘roadmap’ for reforms, government will give employers and pension savers time to plan, which will help to ensure better retirements.

The expectation is that the roadmap would be implemented over 10 to 15 years.

PLSA director Nigel Peaple said:

Given the current cost of living crisis, we are not proposing any increases in pension contributions during the next three years and, after that point, only very gradual increases over the following decade until a point in the early 2030s when most people will contribute 12 per cent.

We hope to hear from all those who have an interest in ensuring everyone has a better income in retirement.

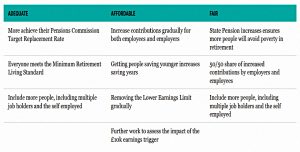

The five new measures are:

- National objectives – the pension system should be “adequate, affordable and fair, and there should be regular monitoring of progress towards these goals.

- The State Pension should provide the Minimum Retirement Living Standard, eliminating pensioner poverty.

- This seems to involve an increase of around £1K pa.

- Auto-enrolment should be reformed to include more people (younger people, multiple job holders and gig economy workers), and contributions should be increased from 8% to 12%, and extended to cover the “first pound” of earnings (by removing the lower earnings limit).

- The 12% would come equally from employers and employees, which means that employers are coughing up 3% of the extra 4%.

- Extra provisions are needed for “under-pensioned “groups (women, gig economy workers, self-employed etc.)

- Further actions to help people “engage” with pensions (and therefore get better pension outcomes).

I think the increase in the State Pension and the higher AE contributions are doing the heavy lifting here.

Benchmarks

The pension industry uses two benchmarks for retirement income:

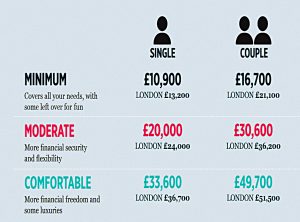

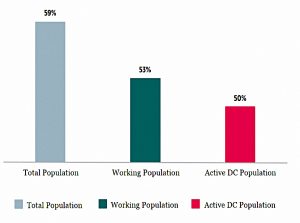

- The Retirement Living Standards (RLS), which is an absolute measure, and

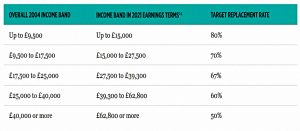

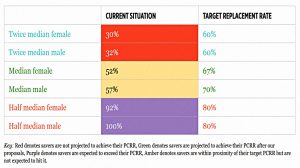

- The Pensions Commission Replacement Rates (RRs), which is a relative measure.

- It aims to provide 60% to 70% of pre-retirement income, with a higher proportion for lower earners.

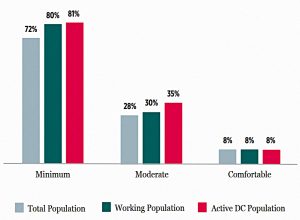

59% of households (6M) are not on track to hit RRs, and the numbers are worse for those in DC pensions.

20% will not hit minimum RLS, and face poverty in retirement.

Generational issues

The chart below shows projected pot sizes against the RRs for current 22-year-olds.

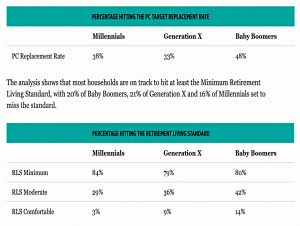

There are generational issues, but the picture is complicated:

- Generation X are on track to do much worse than Baby Boomers, but Millenials are fairly well positioned, at least for the minimum targets.

Property and inheritance

Property wealth won’t help much as the median property wealth (for the 60% who own their home) is just £58K and only 20% of households have more than £100K in property wealth.

Inheritances are received on average at age 47.

- The median inheritance in the highest quintile is £35K and that of the lowest quintile is just £3K.

The median financial wealth for the bottom half of the population is £2K. (( This is probably due in part to the inclusion of capital assets in means testing for many benefits ))

Poverty

The official poverty line of “destitution” is set at £8K pa, but the media generally use the “relative poverty” definition of 60% of median earnings, or around £20K pa.

- I think this is a useless measure, as the State Pension is never going to provide this level of income.

The report argues that the minimum RLS should be used.

- This currently stands at £10.9Km which leaves the state pension (at £9.6K pa) around 15% short.

The Triple Lock will probably get us to the minimum RLS over time, but the report wants a firm commitment to this goal.

- This seems fair to me.

AE

The other big change is increasing AE contributions from the current 8% pa to 12%.

- First, the employer contributions would gradually ratchet up from the current 3% to the employee level of 5%.

- Then both types of contributions would increase again to 6%.

Once again, it’s hard to argue with these objectives.

- I would go further and aim for 15% in total AE contributions.

The report also wants the lower earnings limit (LEL) removed, and the minimum qualifying age reduced from 22 to 18.

- I’m fine with both of these changes.

Impacts

The proposals would increase the pensions of median earners by around 25%, though the authors have some concerns that they could lead to “over-saving” by those on lower incomes.

Savers would be much closer to a moderate RLS and most would meet their RRs.

Under-pensioned groups would also benefit.

Conclusions

There’s little to argue with here, though I’m surprised it took a 64-page report to get the message across.

- AE and the triple lock have made a big difference to pension provision for the UK since the decline of DB schemes, but there’s still a bit more to be done.

Until next time.

Re: “though I’m surprised it took a 64-page report to get the message across”

Welcome to 2022 GB – where people (inc. MP’s, police, NHS, etc) get paid to commentate/criticize rather than innovate/work/create. IMO, the answer to the UK’s appalling productivity is therein contained! The amount of pointless naval gazing and internal machinations often subsequently hyped by the press as scandals these days is ….. rant off!!