Here Today, Gone Tomorrow – More Industry Spin

Today we’re going to take a look at Here Today, Gone Tomorrow – another scare-mongering report from the annuities industry.

Contents

International Longevity Centre

The report is published by the International Longevity Centre (ILC), which describes itself as “the leading think tank on longevity and demographic change.” The ILC claims to be non-partisan, but its website is sponsored by Legal and General and today’s report was funded by Aviva. We’ve met the ILC before, when we looked at their report calling for a Pensions Commission.

That report was funded by Prudential. At the time we gave the ILC the benefit of the doubt, but there’s a clear pattern emerging: the ILC is funded by the insurance / annuities industry, who stand to lose out financially as people move away from annuities and towards drawdown under the new pension freedoms.

Our conclusion was that the last report amounted only to deck chairs on the Titanic. The real problem with pensions is that we don’t save enough and we don’t understand the consequences. So we were not optimistic as we turned to the new 36-page report.

Objectives and approach

The stated goal of the study was to explore what “choices made today could mean for overall levels of retirement income adequacy over the next 30 years.”

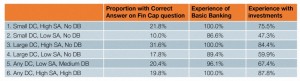

The authors used the English Longitudinal Study of Ageing (ELSA) to examine the “consequences” – essentially the risk of income shortfall – of various decisions in retirement across a set of “consumer segments”.

The New Pension Freedoms

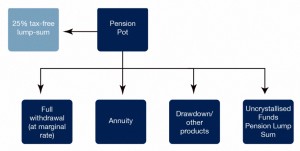

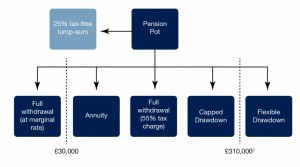

The diagrams above and below illustrate the impact of the recent pension changes (implemented this month):

- The 55% tax charge on cash withdrawals over the 25% tax-free tranche has been replaced with taxation at the retiree’s marginal rate of income tax.

- The 25% tax free sum can be withdrawn all at once, or gradually as part of each withdrawal.

- The compulsion to annuitise has been abandoned, though it was already possible to defer this to age 75 via flexible drawdown.

- Free guidance will be provided by the Citizens’ Advice Bureau (face to face) and the Pensions Advisory Service (online and phone, via PensionWise)

Retirement Strategies

As might be expected the ILC are fond of annuities, a big profit maker for the industry that funds them. They correctly point out that on average they provide the highest risk-free return.

But it’s worth looking at the “on average” part of that sentence – annuities are “death pools” operated by a middle-man. People who die early subsidise those who live a long life, with the insurance companies taking a cut for arranging the transfers. ((This is known as the “mortality premium.”))

The “risk-free” part is important, too. Risky assets produce better returns than risk-free ones, and annuities are irrevocable. ((Though there are plans to set up a market for second-hand annuities, the likely 20% spread will mean that they effectively remain a one-way street))

Advising someone with a life expectancy of 30 years to stick their money into the best risk-free asset is like telling a 25-year-old that they can save for retirement using Cash ISAs. They will end up a lot poorer than their friend who bought stocks.

Prior to the reforms, 75% of UK retirees with DC pension pots annuitised. In contrast only 2% in the US and 2-10% in Australia – two countries where annuitisation is voluntary – do this. Although people say that a secure guaranteed income is the most important thing in retirement, in practice people prefer a liquid pension pot.

They also don’t like the thought of dying young and not getting back the money they have spent. This feeling is exacerbated by the tendency of retirees to underestimate their life expectancy by between 4 and 6 years.

There are further problems arising from increasing longevity and declining interest rates. Annuities offer much worse value than they did 20 years ago.

Stylised scenarios

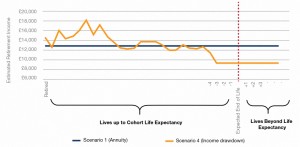

The report looked at four ways of handling retirement funds, two of which are straw men designed to make annuities look good. The real choice is between drawdown and annuitisation:

- annuitising

- this provides a constant income and removes longevity risk

- it is inflexible and not usually inflation protected

- returns are likely to be lower than drawdown, particularly in the current environment

- blowing the pot

- a straw man – obviously if you spend your money today, you won’t have it tomorrow

- moving the money into a cash savings account

- another straw man – real returns from cash will be zero or negative in the long-run, and this group is bound to run out of money

- education is key here – people need to be told that cash is a bad long-term investment

- income drawdown

- the key risk here is underestimating longevity and spending the money too quickly

- people need to be educated about what constitutes a sustainable rate of withdrawal

- they also need to be realistic about how big a pot they need to accumulate

Consumer Segments

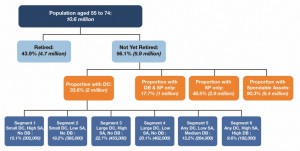

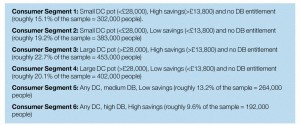

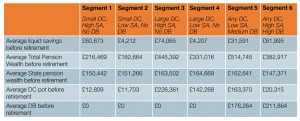

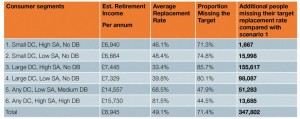

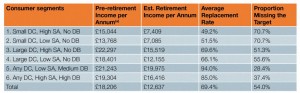

Using ELSA data from 2010, there are 6 million people in the UK aged between 55 and 74, and not yet retired. Of these, 2 million have a DC pension pot, with an average (mean) size of £103K. The median is only £37K however, and the bottom quartile have less than £12K.

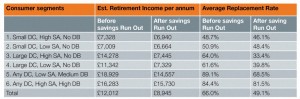

The ILC divide future retirees into five segments, as shown in the table above. Wealth by segment is given in the table below.

They also analysed financial capability across the segments:

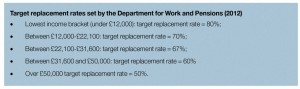

Replacement rates

The ILD defined adequate retirement income in terms of replacement rates – the proportion of pre-retirement income available in retirement. Government targets by pre-retirement income range from 80% for those earning less than £12K down to 50% for those earning more than £50K:

The straw men fail the test

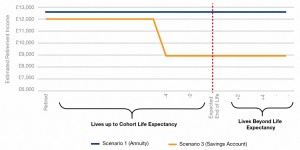

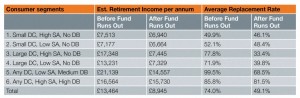

The savings account approach works reasonably well until the money runs out. Average replacement rates then fall from 66% to 49%. Before the savings money runs out, the proportion with adequate income is the same as under annuitisation (around half); this falls to 30% for the final four years.

The group with the largest DC pots is of course the most badly affected (they have nothing else to fall back on); their replacement rates fall from 60% before to 40% after.

Blow it all provides an average replacement rate of 49%, with 71% missing their target. Not good enough.

Annuities and Drawdown

Annuities fare reasonably well, with an average replacement rate of 70%, but still with 54% of retirees missing their targets.

Drawdown, like the savings account scenario, is presented as a before and after situation. Before the money runs out, drawdown provides the highest replacement rate, at 74%. After the money runs out, this falls to 49%. Average income drops from £18K to £12K.

It’s important to understand the assumptions behind this:

- the DC pot is invested 60% in 10-year UK gilts, and 40% in the FTSE-100

- each year, retirees drawdown the value of the pot divided by the remaining number of years they think they will live (they plan to exhaust the pot)

- retirees underestimate their longevity and so run out of money before death

We would argue that this asset mix is ludicrously conservative for investors with a 25 to 30 year time horizon, and also insufficiently diversified. A multi-asset, international portfolio with a much higher weighting to risk assets would be far more suitable, and would produce higher returns.

We would also argue that the key to drawdown is taking a sustainable (replaceable) income each year, so that the pot is not depleted. This does of course require the pot to be much bigger in the first place.

ILC Findings

The report, apparently direct from the Ministry of the Bleeding Obvious, has four main “findings”:

- the new pension freedoms will not fix the problem of under-saving

- “blowing the pot” is a bad idea

- obviously, people who spend their pension savings on holidays and cars will not have an adequate retirement income

- those with larger DC pots would be most impacted, as they tend to have no DB pensions

- the ILC believe that many in this group have low financial capability ((We would argue that people who have saved diligently to build up large DC pots are likely to have high financial capability and are probably the least likely of people to “blow the pot”))

- underestimating life expectancy impacts income

- the ILC assume that those who go into drawdown, or who put their pot into a savings account will underestimate their life expectancy by the historic average of 4 years

- this means of course that they will have an inadequate retirement income for those last 4 years

- income drawdown is volatile

- average replacement rates for income drawdown are initially higher than the other options but drop significantly when the money runs out

ILC Recommendations by Consumer Segment

- Large DC, low savings, No DB

- regulators should protect this group from decisions that could lead to substantial income shortfalls ((The exact opposite of the philosophy behind the new pension freedoms))

- a blended solution may be best, with part of the pot used to buy an annuity and the rest in more

flexible savings vehicles (presumably drawdown)

- Large DC, high savings but no DB

- high savings can provide flexibility, so an annuity is best

- Some DC, low savings and medium DB

- more complicated for this group, with no general solution

- High DB, high savings and some DC

- the lowest risk segment – even blowing the has little impact on the proportion making their target replacement rates

- able to take market risk, so drawdown is suitable

- Small DC, high/low savings, no DB

- these people (the largest segment) have too little money saved to generate an adequate retirement income whatever they do

- they may be tempted into risky assets and / or scams to boost their income

- they need to work longer or access any available housing wealth

ILC General Recommendations

- The ILC still believes that annuities should be part of the default solution, especially for those with large DC pots

- they recommend that 75% of the pot be annuitised at state pension age

- before then the pot should be invested in a mix of risky and safe assets ((Presumably the “standard” mix they mentioned previously))

- Annuities need to be rebranded as safe (because they provide guaranteed income for life) rather than risky (because you could die early and not get your money back)

- the industry should focus on the risk of falling back on non-pension assets (the family home, or relatives) if retirees do not annuitise

- the ILC believes that annuities are not bad value for money (but we know that they are)

- Free guidance should be provided in advance of retirement (from age 50)

- An independent Pensions Commission is needed to tackle increasing income inadequacy

Conclusions

This report is just more smoke from the annuities industry. It attempts to put mathematical modelling around a few self-evident points about pension pots, and the impossibility of spending money twice. But the slant behind the models reveals the true objective – to pretend that annuities are still a good idea for most people.

They aren’t. A properly managed drawdown solution will provide a higher income, and also last indefinitely. Regulators and the industry should work towards the creation of a low-cost, multi-asset, internationally diversified retirement product. A properly constructed element of death pooling would additionally boost returns.

But the real problem is that people don’t save enough, and their DC pots aren’t large enough to be managed properly. We need to educate people about what retirement income they should be targeting and to help them to save the money they will need to generate that income. Free guidance needs to start in school, not at age 50.

Let’s take the government target of 67% replacement income for those earning between £22K and £31K as a starting point:

- 67% of the average wage of £25K is around £18K

- of that £18K, £8K will come from the new state pension

- so an additional annual income of £10K is needed

- using a safe withdrawal rate of 3.5%, a pot of £286K is needed

So we need to get people who currently save £37K by the age of 55 to save £286K instead. This is a much bigger problem than the risk that a few people will blow their pension pot, or the potential loss of profits for the annuity industry. There’s a mountain to climb.

Until next time.