Lang Cat on Equity Release

Today’s post looks at a report from The Lang Cat on the UK’s Equity Release market.

Contents

Tom McPhail

The report is written by Tom McPhail, who for a long time worked at Hargreaves Lansdown.

- If I remember correctly, he left to join an electric bike startup, but now he works for The Lang Cat, running their weekly podcast (amongst other things – his official title is Director of Public Affairs).

The report was commissioned by Royal London and Responsible Life, who presumably offer Equity Release schemes.

- In the introduction to the report, The Lang Cat state that the sponsors had no editorial control over the paper.

Big Picture

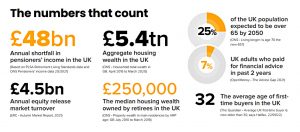

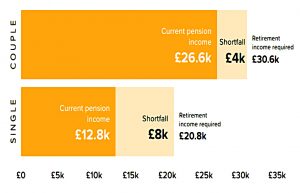

The big picture is that many pensioners are falling short of the PSLA income standards (specifically the “moderate” standard).

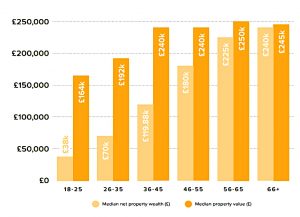

- At the same time, a lot of pensioners have around £250K of housing equity in their homes.

This could be used to supplement retirement income or to provide early inheritances to enable the younger generation to get on the property ladder, and more generally, to stimulate the economy.

The report includes a number of recommendations for the government, the FCA, the advice community and the equity release sector.

Most of these are not directly relevant to the average private investor, so I’ll just pick out a few of the more interesting ones:

- The Lang Cat (LC) would like the government to scrap the £175K home allowance IHT exemption, presumably to encourage the consumption of housing wealth during the owner’s lifetime

- Advisors should include housing wealth (and its consumption) in financial plans

- Regular income products should be developed to complement existing lump sum versions

The IHT allowance is already laughably low, so I’m not in favour of reducing it further.

- I’ll reserve judgement on encouraging the lifetime consumption of property wealth until we’ve been through the report in more detail.

History

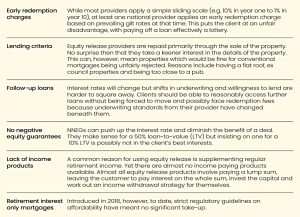

Equity release has a history of problems:

- Variable rate loans were taken out and invested in fixed rate income producing products; no-one seemed to think what would happen to the customer if the interest rate on the loan went up.

- Capital and interest roll-up products that ended up with debts exceeding the value of the property.

- Falling property values in the 1990s, resulting in negative equity.

- Home reversion schemes, where part or all of a property was sold without family members being informed, resulting in them being denied their anticipated inheritance.

But recently the Equity Release Council has done some cleaning up:

- Lifetime mortgage interest rates must be fixed or capped

- Clients can live in the property until they die or move into care

- Loan size is capped at property value net of fees (no negative equity – NNEG – at the cost of a higher borrowing rate)

- Clients can move to another property if the lender approves

- Clients can use their own solicitor

Around 70,000 customers use equity release each year, accessing £4.5 billion.

Since 1991 ERC member providers have lent £38.7 billion to 592,000 customers.

Typical LTV limits range from 20% (for those in their 50s) to around 50% for those in or above their mid-80s.

This sounds like a healthy market, but around 600K people access their DC pension pots each year.

The pension problem

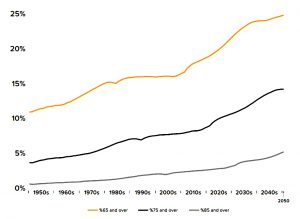

The UK population is ageing, putting pressure on the predominantly working-age taxes (income tax, NIC and VAT) needed to fund pensions and NHS care.

Unfortunately, many of those approaching retirement have inadequate pension provisions.

In particular, the average person falls short of the “moderate” level of income defined by the Pensions and Lifetime Savings Association (PLSA).

Median in-retirement household income sits somewhere between minimum and moderate on the PLSA scale. Comfortable is a long way off.

37% of couples’ and 56% of single people’s later life income being funded by benefits, primarily State Pension. Around a third (35% and 29% respectively) comes from occupational and personal pensions.

Care

The report highlights social care concerns as a barrier to “optimising” housing wealth (ie. spending it via equity release).

Individuals of modest wealth may still have to spend a significant portion of that wealth providing for their care in the last few years of their lives. Falling ill and needing to pay for care is the biggest financial concern in retirement for 37% of homeowners over the age of 55.

Not only is care phenomenally expensive (assuming you have more than the £20K asset cap below which the council will pay for everything), it is almost impossible to predict how much you will need to put aside to fund it. (( It’s worth also noting that self-funders subsidise council places – they are charged an average of 41% more ))

- One in seven will spend more than £100K on care costs.

The report claims the average care home in England costs around £40K, but here in London I am currently paying more than double that.

- The new care system will cap individual spending at £86K, but “hotelling” costs are not included in this cap.

Intergenerational wealth

One of the secondary themes of the report is that the younger generation is hard done by and that equity release offers an opportunity to “accelerate the cascade of wealth down through the generations”.

- I don’t buy this underlying thesis, and I won’t waste too much time on it.

It is certainly the case that when the modal age of death is 86 to 89, a lot of people will be receiving their inheritance when they are already in their 60s, and it isn’t that much use to them.

- Using equity release to bring forward “inheritance” into people’s 30s sounds attractive, but it will exacerbate wealth inequality within the younger cohort.

Not every family has a £500K+ property in the south of England that they can tap into.

Current IHT tax rules favour hanging on to the family home until death and keeping as much of the remaining balance as possible in pensions.

The report sees this as:

A tax system which helps people accumulate wealth (generally a good thing) but then discourages them from using that wealth in later life.

There’s some truth in this – the accumulation phase is much simpler than the decumulation phase.

Property wealth

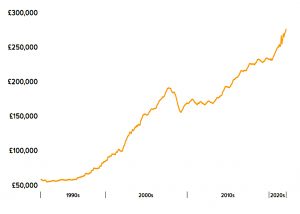

Most people will be familiar with rising property prices in the UK.

The compound annual growth rate for UK property over the last 30 years works out at over 5.5%.

Which is not that much, really.

- In the report’s context, this growth rate provides headroom for borrowing at rates typically lower (as of mid-2022, say 4% for borrowers in their 50s).

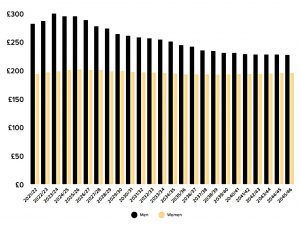

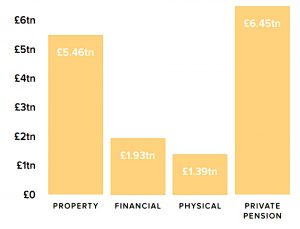

And property makes up a good proportion of household wealth, second only to private pensions.

As you might expect, property wealth increases as people get older.

Attitudes

Pensioners don’t seem ready to use equity release.

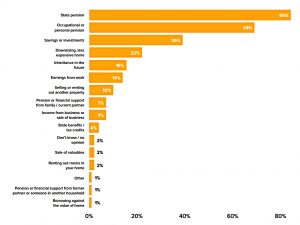

- Only 1% expect to borrow against the value of their home, though another 10% are using (second) property rental income and 22% expect to downsize.

The lang cat commissioned a follow-up survey from YouGov, which produced the following responses:

- 32% said I don’t expect to need to use equity release

- 23% said I want to pass the house on to children/grandchildren

- 22% said I wouldn’t feel comfortable using equity release

- 21% said I will prioritise leaving an inheritance for my children over using housing wealth for my own benefit

- 21% said I would rather downsize

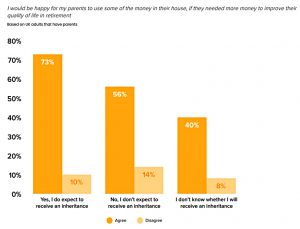

When the children were asked, they seemed very happy with their parents spending any potential inheritance.

There is still a lot of misunderstandingaround equity release, both in terms of how

products can help people and also how family members might feel about their using housing wealth in this way.

Costs

Transaction costs are also a potential stumbling block in the same way that IFA fees put off most people.

- Typical fees are around £3K, which makes borrowing less than a couple of hundred thousand expensive.

It’s also true that downsizing expenses are likely to be even larger (say £5K).

Conclusions

It’s hard to see equity release catching on, other than as a last resort for those who can’t fund their retirement in any other way.

- Once you start to borrow, there’s no realistic prospect of repaying the debt, and in the worst-case scenario, there will be no property equity to pass on.

I think this is part of a more general problem that people are reluctant to spend their money in retirement as they can only spend it once, and they don’t want to run out.

- For similar reasons, people prefer pension drawdown to annuities.

Until next time.