Consolidating DC Pensions

Today’s post looks at a recent paper from LCP on whether you should consolidate your DC pensions.

Contents

LCP

The paper is called “Five reasons to consolidate your DC pensions – and five reasons to be careful” and was published in August 2022.

- One of the authors is former pensions minister Steve Webb.

The other is Dan Mikulskis.

- They are both partners at LCP (Lane Clark & Peacock).

The report focuses on DC pensions, even though a lot of the noise around pension transfers in recent years has been about DB transfers (particularly scandals surrounding ill-advised DB transfers).

- I’m a fan of DB transfers in principle since until very recently, historically low interest rates meant that the cash values on offer to transfer were very high.

Depending on the valuation methods you use, the typical multiple on a DB pension (the value divided by the annual payment) is around 25, but recent offers have been in the 35 to 40 range.

- These would be hard to turn down.

The snag is that to transfer a DV pension worth more than £30K you need a recommendation from an IFA, and following the recent scandals, this is difficult and expensive to obtain. (( The DB pension that I managed to transfer had the IFA review funded by the employer, as they were keen to slim down the scheme before paying an insurance company to take it off their hands ))

The other reason for the focus on DC schemes is that workplace auto-enrolment has been around for 10 years now.

- Every time a worker changes jobs, they get a new DC pot from their employer.

So a lot of people will end up with a lot of small pots – the number of deferred pots in the Master Trust sector is expected to rise from 8M in 2020 to 27M by 2035.

A third issue is that the increased visibility resulting from the rollout of pension dashboards in 2024/25 is likely to motivate many people to reduce their number of pensions.

- Dashboard providers will likely try to persuade people to consolidate with them.

At first glance, lots of small pots sound inefficient, and consolidation seems like a good idea.

- Yet there is no automatic or large-scale process for consolidation, which needs to be requested by the individual pension member.

Let’s dig deeper.

Reasons to consolidate

Lower charges

Charges on default funds within auto-enrolment are capped at 0.75% pa, but there are cheaper options.

- A DWP survey in 2020 found that the average charge was 0.48% pa.

Pre-auto-enrolment pensions are likely to have higher charges.

The paper mentions NEST as a good home for consolidation, since the 1.8% initial charge does not apply to transfers in, and the annual charge of 0.3% is low.

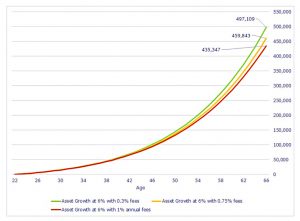

Costs are important – the chart shows the auto-enrollment pot for someone earning a median UK salary and 6% returns pa (before fees).

- Charge levels have been chosen to reflect NEST, the charge cap, and an illustrative 1% pa for legacy pensions (many will be higher than this).

At age 66, the person who saves in a pension charging 0.75% builds up around an extra £24,500 compared with the person paying a 1% charge, whilst the person who saves in a pension charging 0.3% builds up around an extra £61,700.

Clearer asset allocation

Along with costs and taxes, asset allocation is the biggest driver of investment outcomes.

Appropriate risk levels vary by individual (and by age), but:

Whatever the right level may be for a given individual, if they have multiple pots, scattered with different providers, it’s quite unlikely that they would even know what their asset allocation is at a point in time, much less be able to adjust it to the right level.

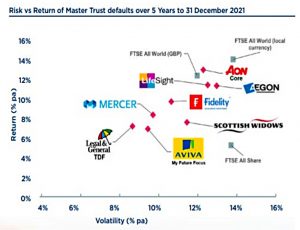

The chart shows that the risk and return levels of default funds vary significantly across providers.

- Lifestyling (shifting to bonds with age) is also an issue as some providers start the transfer earlier than others.

Innovation

Investment best practices will evolve over the course of a working life, and not all providers will adopt improvements at the same rate.

- Leaving money in old schemes could mean missing out.

Examples that the report provides are excessive home (UK) bias, lack of EM exposure and new asset classes like (renewable) infrastructure.

This means, however, that the individual needs to be able to evaluate the relative levels of innovation across providers.

Annuity rates

I’ve never bought an annuity, though I do check the available rates once a month as part of my portfolio valuation.

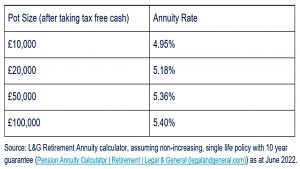

- But I always check the rates for one size of purchase (£100K), so I was surprised to learn from the report that annuity rates vary with pot size.

These are rates for level annuities rather than index-linked, but combining a few small pots should lead to thousands of pounds in gains over the length of a retirement.

- It should be noted that even as interest rates start to rise again, annuities remain very bad value and are almost never preferable to drawdown. (( My personal breakeven age for taking an annuity today is 96, and that ignores more than 30 years of investment returns on the capital given up to buy the annuity ))

Easier management & engagement

This is less of an issue unless your circumstances change:

- You might have a new relationship and want money to pass to this new person on your death

- You might decide to retire later and need to change your glide path

- You might have more mundane changes like a new address or email

All of these are easier to keep updated with fewer providers.

Reasons to be careful

Guaranteed Annuity Rates

This won’t affect many people, but some legacy DC pensions included guaranteed annuity rates (which would be much higher than today’s rates).

- A transfer would lose this guarantee.

Small pot privileges

Pots below £10K can be cashed in without impacting the LTA.

- So those near or above the LTA might want to avoid transferring pots worth less than £10K.

Cashing in small pots does not trigger the MPAA (the reduction in the annual pension contribution allowance from £40K to £4K).

A-Day protections

Some pensions that existed before A-Day (6th April 2006) have protection around higher tax-free cash lump sums than the standard 25%.

- Again, this will only affect a small minority of people.

Similar protection applies to earlier than normal minimum pension ages (the NMPA)

- Access is currently restricted to those over 55, and the age will rise to 57 in 2028.

When the NMPA was increased to 55 in 2010, existing schemes could retain the previous age of 50.

- There will be similar (but even more complicated) protections when the NMPA rises to 57.

Exit charges

Auto-enrolment pensions don’t have exit charges, but some legacy pensions might have them.

- Once again, this won’t affect many people.

Lack of diversification

This issue applies more to “passive pensioners” than to DY investors with an active interest in their retirement.

For those who intend to leave the management of their money to their new single provider there is a risk in trusting all of their pension savings to a single investment approach. The lay person may have little idea how to choose between different providers and may find it difficult to judge who will do a better job of managing their money.

Such people might prefer to keep two or three pots from different providers.

- It’s worth mentioning here that the risk analysis should be a top-down one – if DC pensions make up only 10% of total wealth, having that 10% with a single counterparty may not be such an issue.

For those with larger pots, there’s also the issue of FSCS compensation, which is limited to £85K per scheme.

- If your pot is £250K, you might want three providers.

But if your pot is £1M, you probably won’t want a dozen.

Conclusions

There are two main reasons to consolidate:

- Lower charges

- Clearer asset allocation

Some people (those near the LTA) won’t want to consolidate small pots, and a minority won’t want to give up legacy features.

But for most people, consolidation is a good idea, so long as you are comfortable with reducing your diversification across counterparties.

- Until next time.