Accelerated Dual Momentum

Today’s post looks at some tweaks to Gary Antonacci’s Dual Momentum strategy, from the guys at Engineered Portfolios.

Contents

Dual Momentum

We’ve looked at Gary Antonacci’s Dual Momentum before.

- It looks at the trailing 12-month returns for the US and global stocks.

You buy the asset with the highest returns, and if both are negative, you buy bonds.

- The other twist is that if US stocks are down, but global stocks are up, Gary buys bonds.

Note that Gary calls the strategy Global Equity Momentum (GEM).

The guys at EP make several critiques of Gary’s system:

- They don’t like the 1-year lookback – they want to get into trends more quickly

- They want to buy the accelerating asset rather than just the leading asset

- They think large-cap international stocks are too closely correlated with large-cap US stocks

- They prefer long-dated Treasuries to an intermediate total bond fund – again, for extra diversification

Accelerated Dual Momentum

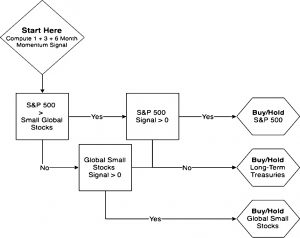

EP’s Accelerating Dual Momentum (ADM) strategy uses what they call an “accelerating momentum score”.

- This is the sum of the 1-month, 3-months and 6-month returns.

This score is calculated for both the S&P 500 and for international (ex-US) small caps.

- ADM buys the asset with the highest score.

If both scores are negative, you buy Treasuries.

- The process is repeated every month.

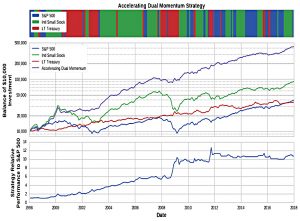

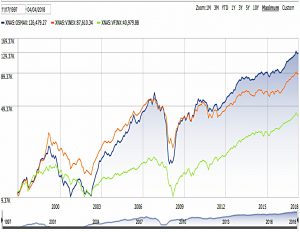

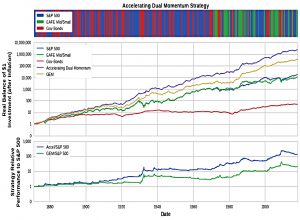

The performance of the strategy is good.

Analysis

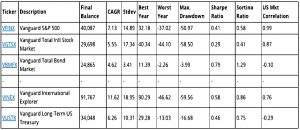

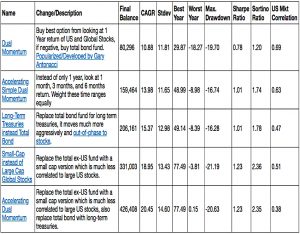

The table shows the returns for the asset classes (Vanguard funds) that the EP guys used in the various flavours of their dual momentum portfolios.

- The final balance is for 2018, for a $10K investment in 1998.

Note that VINEX is an active fund, chosen for its long track record (useful in online backtesting) and low costs.

- The passive fund Oppenheimer International Small-Mid fund (OSMAX) produces even better results.

The index of small-cap ex-US stocks does well in the strategy and seemingly any fund in that index would have also done well.

Here are the results for the various portfolios:

- $80,296 – Original Strategy

- $159,464 – Simple Accelerating Dual Momentum

- $206,161 – Replace Total Bond with Long-Term Treasuries

- $331,003 – Replace Global Large Cap with Global Small Cap

- $426,408 – Accelerating Dual Momentum proper – make both replacements

The table below has more details:

The average holding period for ADM is more than four months.

- This means that most months you are not making a trade.

Which in turn means low transaction fees and few tax implications.

- ADM could be implemented even in a taxable account, though a tax shelter would work better (especially in the US, where EP are based).

Tracking error

The EP guys use tracking error (variation to the benchmark) as an indicator of how difficult it would be to stick with a strategy).

- The big question is whether the strategy has any long periods of underperformance relative to the benchmark?

EP uses the S&P 500 as the benchmark, though I would be tempted to use a global index.

Tracking error is not a big concern for ADM over the period in question – there are no long losing streaks.

More assets

There’s an argument for using more than three assets in this strategy and the EP guys acknowledge this, but they prefer a simple strategy that they can easily stick with.

- When you use one of your three assets as the benchmark, adding more assets opens you up to a larger tracking error.

This is another argument in favour of using a global benchmark.

Another way to look at this would be to use ADM as one of several trend-following/market-timing satellites/overlays around a core passive “buy and hold” approach (itself based on a risk parity structure).

- This is much closer to the way I manage my own money.

Rising interest rates

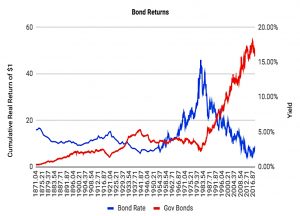

EP note that history Treasury returns are built upon falling interest rates since 1981.

- This trend may be about to reverse, with negative implications for real bonds returns.

The strategy is not telling you to buy and hold long-term Treasuries on their own but instead, buy them when stocks are heading down. Then sell them when/if stocks start recovering. We’re only trying to take advantage of the swings. That being said… I still am nervous about long-term Treasuries.

But don’t worry, he has a fix:

So you could consider playing treasuries against TIPS, specifically just looking at the trailing 1-month return between the two to decide.

Long term results

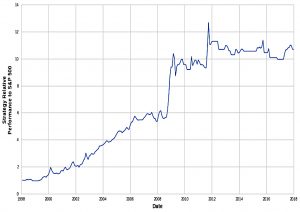

EP also did a long-term test going back to 1871, and ADM did well:

An investment in this strategy would have produced over 100x more return than an investment in the S&P 500 over that time.

There are a couple of caveats about the long-term data:

- There are no international data before 1970, and no international small-cap numbers before 1994 (so this is not really ADM).

- Bonds are just the 10-year since there is no data for longer durations.

Here are the numbers:

- Annual real (after inflation) returns:

- 10.5% – Accelerating Dual Momentum (ADM)

- 9.1% – GEM

- 6.9% – S&P 500

- 2.7% – Bonds

- Maximum drawdown (after inflation):

- -34% – Accelerating Dual Momentum (ADM)

- -43% – GEM

- -77% – S&P 500

- -57% – Bonds

- Worst 1-year loss (after inflation):

- -21% – Accelerating Dual Momentum (ADM)

- -33% – GEM

- -58% – S&P 500

- -22% – Bonds

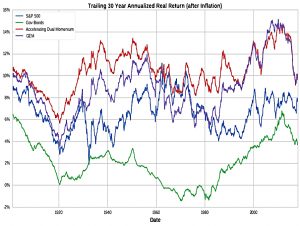

Here’s a plot of trailing 30-year returns:

Accelerating dual momentum beats the S&P 500 in virtually every 30 year period except the 30 years immediately following the great depression. The strategy only performed marginally lower and did so after just avoiding much of the carnage of the great depression (and some other bumps between then and 1963).

That’s it for today.

- It looks as though EP has come up with some useful tweaks to GEM, and ADM is worthy of consideration.

Until next time.