Near Perfect Portfolio

Today’s post looks at a defensive strategy called the Near Perfect Portfolio.

Near Perfect Portfolio

I don’t spend much time on Seeking Alpha, but I came across the Near Perfect Portfolio (NPP) while browsing there late last year.

- It’s from an anonymous author, the Financially Free Investor (FFI), who offers a subscription service called High-Income DIY Portfolios, based around high-income yet low-risk portfolios (a tricky combination).

It has been in place since the start of 2020.

The NPP strategy tries to avoid the pitfalls of index investing and its roller-coaster rides. The principles of NPP revolve around sustainable income, lower drawdowns, capital preservation, and reasonable growth over the long term.

The approach assumes that most investors would prefer to avoid the high volatility and deep drawdowns of pure stocks, and also sets out to address the sequence risks of regularly withdrawing income during retirement (in part by providing a decent income).

- Like other “lazy” portfolios, it’s designed to work fairly well under most economic environments.

It’s also intended to take only a few hours per month to manage.

- The other stated requirement from investors is a long-term outlook/patience.

There are three formal goals for the NPP:

- Limit drawdowns to less than 20%

- Provide consistent income of around 5%

- Grow the capital at 10% pa over the long term (5% after taking the income)

These are ambitious targets.

- I would happily substitute 15%, 3% real and 6% for those numbers, so even if the NPP falls short of its own goals, I might find it useful.

Divergent components

The NPP has three components, to target the three goals:

- Dividend Growth Investing (DGI) – 40%

- Rotational Bucket (what I’m calling TAA) – 45%

- CEF (closed-end funds) high income – 15%

So at this point, the dividend focus makes me sceptical.

- I would also need to swap out the US CEFs for similar UK investment trusts.

The S&P 500 was in a downtrend during 2022, but the 1-year relative performance of the NPP is good – lower drawdowns and lower volatility.

The long-term performance (since 2008) is even more impressive.

And the best result of all is comparing the two strategies when taking an annual 6% real income.

- The S&P 500 never recovers from the 2008 downturn under this scenario.

DGI

The first pot within the NPP is the DGI COre, which is made up of individual stocks selected according to three rules:

- 3% to 4% dividend income

- long-term returns in line with the market

- drawdowns around 70% of the market (low beta)

The table lists the fifteen stocks chosen for 2022.

Rotational

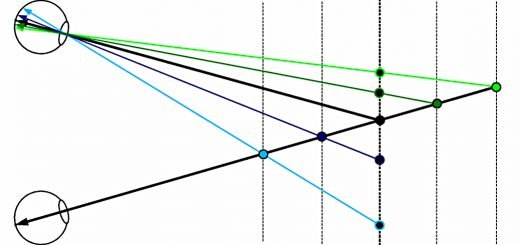

The rotational bucket is intended to reduce volatility, but also to match (or outperform) the S&P 500 over the long term.

- It rotates between eight ETFs on a monthly basis, using a relative strength indicator.

The top two funds over the preceding three months are the ones that the system holds.

High Income

This bucket includes 11 CEFs (one of which is a partnership fund).

- The idea is to have funds from many different asset classes.

The average yield of these funds is around 9% pa.

Drawdowns

The article also looks at the drawdowns for the NPP during four bad times for the S&P 500:

- Jan-2008 to Mar-2009

- Oct-2018 to Dec-2018

- Jan-2020 to Mar-2020

- Jan-2022 to Dec-2022

The NPP drawdown is often less than half that of the S&P (around two-thirds in the 2022 drawdown).

CAGR

The CAGR of the NPP since 2008 is 13.6%, compared to 8.9% for the S&P 500.

The breakdown for the three buckets is as follows:

- DGI bucket = 13.69%

- CEF-High-Income bucket = 10.09%

- ROTATION bucket = 14.43%

Comment

My takeaway from this article is that a relatively simple rotational overlay can have a very beneficial effect on an underlying long-only portfolio.

- In the example used for the article, the underlying portfolio is a high-income / dividend strategy.

The rotational overlay has an impressive effect on the case where a high annual income (6%) is taken from the portfolio, but I don’t have this requirement.

- My goal is to add a rotational/TAA overlay to a long-only portfolio based on risk–parity/maximum diversification principles.

I will add the rotational element of the NPP to my list of input signals for my “continuous” TAA system (which is yet to be built).

- Until next time.