Spread Betting on Options

Today’s post is about Spread Betting on Options.

Contents

Spread Betting on Options

It sounds risky, doesn’t it?

- Why would we be interested in combining two leveraged products in one strategy?

Let’s start with options.

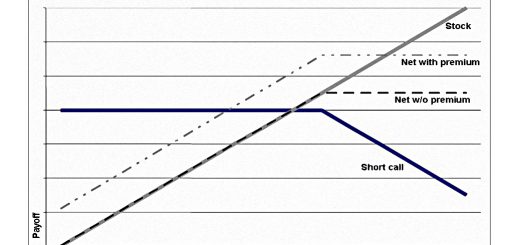

- Yes, they are leveraged, but more importantly, they have asymmetric pay-off profiles – the reward for a one-point move in a favourable direction can be different from the penalty for a one-point move in the opposite direction.

And their optionality (they provide the right to trade, but not the obligation) means that you can get into the market if conditions develop as you expect, but not if they don’t.

- Combining multiple options together allows you to construct even more tailored (or complicated if you prefer) return profiles.

Of course, this comes at a cost:

- if you buy an option and things don’t work out, you will lose the up-front premium that you paid for the option (but no more than this)

- if you sell an option, you are potentially on the hook for unlimited losses (though combinations of options can be used to protect against this).

Spread-betting is much simpler – you make a bet with a financial bookmaker and win or lose according to the outcome.

- The chief attraction of spread betting is that profits are tax-free.

Another plus in the context of options is that spread-betting is easily accessed.

- Trading real options involves opening a US account (TastyWorks and Interactive Brokers are the two popular providers) and getting dollars into that account.

Objectives

All I want to cover today is how options work on the IG platform, the UK’s biggest spread bet provider and the one that I use the most.

- I’ll be leaning quite heavily on the materials on their site.

In the medium-term, I want to explore a number of options strategies:

- ERN’s options strategy

- “wheeling” and theta gang strategies

- trend-following using straddles

In the short term, I want to use options as hedges against sharp declines in the major stock indices as interest rates continue to rise during 2022.

- I expect to do this through buying out of the money (OOTM) puts.

Calls and puts

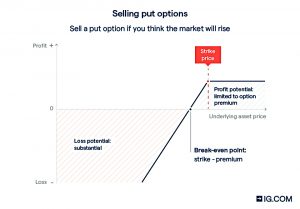

Calls are bullish, so we buy them when we think the market will go up.

Or we sell them when we think the market will go down.

Puts are bearish, so we buy them when we think that the market will fall.

Trading on IG

IG will let us use spread bets or CFDs to trade options, but CFDs are taxable, so we’ll stick to spread bets.

Spread bets and CFDs are cash-settled at close, you’ll never have to deliver, or take delivery of, the underlying. However, these are both leveraged forms of trading options.

So we’ll be buying (selling) the option with an up-front margin, but profits (losses) will be calculated on the underlying position (as with regular spread bets).

- This means profits and losses can potentially be bigger than the original margin, though with regular spread bets this can be controlled by using stop losses.

When buying call options as spread bets or CFDs with us, your risk is always limited to the margin you paid to open the position. But when selling call options your risk is potentially unlimited.

The payoff diagrams imply that the same is true of put options, but the article doesn’t say this explicitly.

Price drivers

We have three main variables here:

- Price of the underlying (relative to the option strike price)

- Time to expiry (a long time means more chance for the option strike price to be hit, so higher option prices)

- The volatility of the market (high volatility means more chance for the strike to be hit, so higher option prices)

Greeks

There are a few of these bandied about, some more important than others:

- Delta – this is the price sensitivity of the option to a unit move in the underlying price

- Gamma – this is the derivative of the delta, the rate of change of delta with a change in the underlying

- Theta – this is the time decay of value and accelerates as we get closer to the option expiry

- Vega – this is the price sensitivity to changes in volatility

- Rho – this is the price sensitivity to changes in interest rates

Markets

IG offers four asset classes:

- Indices

- Stocks

- FX and

- Commodities

Of these, indices and potentially commodities look of most interest.

They also offer three sets of timeframes (maturities):

- Daily

- Weekly and

- Monthly

I intend to hold my positions for weeks (my spread bets average around a five-week holding period), so monthly will be of most interest to me.

Let’s look at the markets in detail. The indices are what you might expect:

- US Tech 100 (Nasdaq)

- US 500

- FTSE 100

- EU 50

- Japan 225

You also had the Dow, Hong Kong Taiwan, Australia and a lot of individual European indices.

- And there is a volatility index.

The fourteen individual stocks are all US-listed tech, e-commerce and biotech.

- I’m not sure how I would use these at present.

Commodities are limited to gold, silver and oil, which is probably a good thing.

An example trade

Let’s get back to my short-term hedging strategy.

- The S&P is the biggest index, so let’s start there.

The S&P sits at around 3900 at the time of writing, but I think it will fall through this year as interest rates rise.

- So I want to make several bets in the 3700 to 3100 range, using the December 2022 options.

Let’s start with buying a put at 3700.

Here’s the options chain for December.

- If you click on a price, a deal ticket pops up.

I clicked on the buy price for the 3700 put.

- With regular spread bets, I use historical volatility to size my position, but for now, I can just work out how much margin (premium) I want to risk.

The option is trading at 212, so at £2.25 per point, I would risk around £475.

- Once I’ve opened the position, it just appears like a regular bet in my open positions table.

That’s it for today – I’ve placed my first spread bet on an option.

- I’ll be back with more on options as part of my ongoing series on the topic.

If I can think of an interesting angle which uses spread bets on options, then I’ll write more about that, too.

- Until next time.