Budget 2015

Yesterday was the final Budget of the Parliament, so let’s take a look at the major changes from the perspective of a Private Investor in the UK.

Contents

Expectations

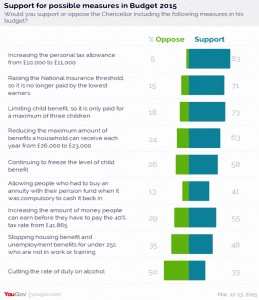

As always there were plenty of leaks in advance. The table above shows the public reaction to a range of proposed policy changes. In the end we only got four of the nine in the opinion poll. For a lighter take on the same speculation, take a look at the budget bingo card below. We got seven of those twelve in the speech.

The speech

Osborne was on great form, with plenty of jokes against Milliband in his speech, but it was more about electioneering than economic policy. The bulk of the speech covered the coalition’s achievements over the past five years, with broad brush indications of how the next five would proceed.

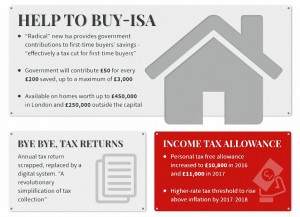

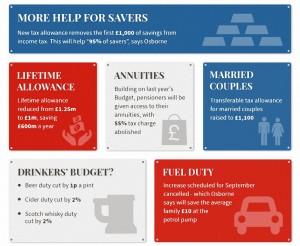

When the policy changes came, they were a mixed bunch. The infographics above ((From City AM)) give a high-level overview, but I will concentrate on the policies that most impact investors:

- Pensions (Lifetime allowance change)

- Annuities

- ISAs

- VCT & EIS

- Income tax

- Housing

- Oil tax cuts

If you like to look at the detail, you can download the documents here.

Pensions

The Lifetime Pension Allowance (LPA) has been cut from £1.25M to £1M. Until recently this was a Labour policy, but George obviously decided to steal their thunder. Back in 2011 the allowance was £1.8M, so that’s a drop of 45% in four years. Will it stop here? The promise to index the limit from 2018 means it probably will for the Tories, but what do Labour think now?

This is the biggest change in the budget for investors, but since it only affects 4% of us, that won’t be the way the media sees it. There are four problems with the new limit:

- The government presents it as a contribution limit ((Which I would be much happier with)) but it’s actually a limit on how much is in your account when you start taking money from it – at crystallisation as they say. This is a much bigger problem for the talented investor than for other people – once you get to £1m you have to stop. ((Presumably drop into cash))

- It isn’t enough: taking the somewhat risky 4% rule as a guide, someone with a £1M pot can draw £40K a year. Not bad, but not a king’s ransom. Using a more conservative withdrawal rate of 3.5%, you get £35K a year. Still more than the average wage, but not a luxury retirement.

- It isn’t fair: the government still uses a 20 times multiplier for DB pensions, when 25 or 28 would be more accurate. The current method means that a DB pension from a £1M pot can be £50K pa, almost 50% higher than a conservative DC drawdown.

- It’s another kick in the teeth for those of us attempting to persuade the young to think long-term and invest in a pension. Even if they can’t believe they could ever build up a pot worth £1M, the constant tinkering with limits and access rules makes people wary of locking their cash away for thirty years.

There’s also a slight confusion here, since the Chancellor announced that the punitive 55% exit tax on withdrawals from pensions was being replaced by tax at the marginal rate. If this applies to SIPPs then the reduction in the limit has no impact, so logically it must only apply to annuities (see below). I’ll update this post when the situation becomes clearer.

Annuities

As widely trailed, existing pensioners with annuities will be able to cash them in, and the 55% penalty access rate is being abolished. We’ve previously written on the likelihood that cash values will be marked down by 20% plus any payments already received.

In theory this should make the freedom more appealing to recent annuity purchasers, but with the average annuity in the UK worth only £20K, the difference in cash terms may be so small that anyone in need of a lump sum is tempted.

ISAs

There were three changes to ISAs:

- Cash ISA withdrawals are now allowed within the tax-year; as long as you put the money back in the same year they won’t count against your allowance.

- The Chancellor mentioned that the range of ISA eligible investments would be widened. I hoped that this meant P2P loans, but it was actually “listed bonds issued by a co-operative society and community benefit society and SME securities issued by companies trading on a recognised stock exchange.” There will be further consultation on P2P.

- There will be a new Help To Buy ISA for first time buyers (see Housing below).

We can safely ignore these changes. To the long-term investor, dipping into this year’s ISA instead of your emergency fund is not a great advantage.

It’s amazing to me that P2P loans are still not ISA-eligible. Zopa has been around for ten years now. How much of a track record are they looking for?

VCT & EIS

Regular readers will know that I am a fan of VCTs, and when Osborne announced changes to VCT & EIS rules to bring them into line with EU rules on state aid, I began to worry. Luckily the changes don’t involve the tax rebates:

- “companies must be less than 12 years old when receiving their first EIS or VCT investment, except where the investment will lead to a substantial change in the company’s activity”

- “a cap on total investment received under the tax-advantaged venture capital schemes of £15 million, increasing to £20 million for knowledge-intensive companies”

- “increase the employee limit for knowledge-intensive companies to 499 employees,

from the current limit of 249 employees”

The 12 year limit could be an issue, since many of the firms invested in at present are older than that, but perhaps the industry can find a way around this.

Income tax

The personal allowance rises to £10,800 from £10,600, saving £40 a year in 2016-17. The 40% threshold is going up by £315 at the same time, so that’s an additional £23 saved.

Osborne also introduced a savings allowance of £1K of tax-free interest, saving a theoretical £200 per year. The limit is £500 for high rate tax-payers, who can also save £200. Since this will take 95% of cash savers out of the tax system, the automatic deduction of tax by banks and building societies will end.

This seems fairly pointless to me as you can stick cash in an ISA anyway, and you shouldn’t be holding that much cash. In retirement, withdrawals from ISAs and dividends from VCTs are already tax free, so it doesn’t help much then, either.

At current interest rates this implies you can shelter another £35-50K, but when / if rates come back to normal it might serve as a handy £20K emergency fund. Overall this looks like a simple vote winner for the financially unsophisticated who love to hold cash.

I suppose it lets you have £20K in another account for emergencies (more at the moment with low interest rates). I guess when we are retired it means our income can be £1K higher for each of us, but the same can be achieved with ISAs (and even with VCTs).

More interesting was the announcement that the annual tax return is to be replaced by a digital tax account linking employers and bank accounts. I’m not sure how this will work for investors – it would be a nightmare to connect every broker and fund platform.

Housing

Osborne announced a Help To Buy ISA for first-time buyers, another vote winner aimed at the youth. For every £200 they save, first-time buyers get an extra £50 from the government towards their deposit.

But it’s capped at £15K (including the bonus) and will take years to save. It won’t be much use anywhere near London, even though two people buying together are each eligible for a separate bonus. It also appears to replace the existing Cash ISA for those who take it up, although the new ISAs (NISAs) now combine cash and shares. Another confusing point, and I will update the post if this becomes clear.

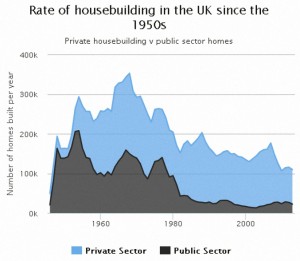

The big problem with this is that is adds more to housing demand (admittedly targeted to the right people) without doing anything about supply. As I wrote earlier this week, we need to build more houses around London and make sure there are good transport links to them.

Perhaps the best thing on the housing front from the budget was the continued emphasis on turning Manchester into a Northern Powerhouse. The more pressure that can be taken off London and the South East, the better.

Oil tax cuts

I won’t go into these changes in detail since I understand little about the sector, but it seems fair to expect them to support the many small listed oil and gas companies (explorers, producers and support services) which are the darlings of many private investors in the UK. It also seems fair to say that what they really need is a sustained pickup in the oil price, which is not in the gift of the Chancellor.

Conclusions

To sum up, from the perspective of a 7C Investor:

- Be careful how much you contribute to your pension, and try to also max out your ISA each year

- The annuity freedoms are irrelevant – we would only buy an annuity at age 75, and are unlikely to want to cash it in after that

- The ISA changes will have no impact unless you are a first-time buyer (see below)

- The VCT / EIS rule changes should have little impact, the 12 year limit notwithstanding

- The income tax changes save £73 a year in 2016-17, or up to £200 more if you have lots of cash outside a tax shelter (which you shouldn’t have).

- The digital tax account is another incentive to invest via non-reportable tax shelters (SIPPs, ISAs, VCTs).

- The Help to Buy ISA will be good for a minority of first-time buyers but does nothing to address the supply problems in the housing market

Until next time.

1 Response

[…] We begin today’s Weekly Roundup with a few loose ends from last week’s Budget. […]