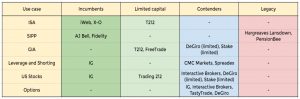

Broker Map

Today’s post explains which brokers I use and why.

Broker costs

I’ve been writing about broker costs ever since I started this blog way back in 2014.

- Back then I was using AJ Bell (YouInvest, formerly SippDeal), Hargreaves Lansdown (HL) and Fidelity.

- And I was interested in iWeb (part of Halifax/Lloyds) and also in Interactive Investor (ii).

Close to seven years later, I have accounts with ten brokers and platforms, and I’m eyeing up a couple more.

- That doesn’t sound like progress, so let’s dig into why I have so many, and how things might change in the future.

Here are the main factors involved in my choice of brokers:

- Products

- I mainly use ETFs, so the range of this type of fund is important.

- I prefer ETFs to OEICs for three reasons:

- live intra-day pricing

- easier to find capped annual charges (OEICS usually attract a percentage charge, which works against large portfolios)

- OIECS come with a retail investor marketing machine designed to induce trading – ETF providers don’t appear to market to retail

- lower costs used to be a fourth reason, but since RDR passive funds are broadly comparable, though active funds remain expensive

- I also buy individual stocks in the UK

- the available exchanges are a factor here – most brokers have access to the LSE main market and to AIM, but AJ Bell has just added the Acquis exchange (which used to be called NEX, I think)

- And I have a small US stock portfolio

- FX charges are a factor here (see below)

- My next project is options, for which there are few brokers in the UK.

- I’m also interested in crypto exposure, but haven’t found anywhere that is both safe and cheap.

- Costs

- Dealing costs, which range from free to £11.95 (HL)

- Lower dealing costs support more active strategies (eg. trend/momentum)

- Platform costs, which range from free (ISAs and GIAs) to £200 pa (HL SIPP)

- FX charges, which range from 0.15% (Trading 212) to 1.5% (ii)

- Stamp duty, payable on UK main market stocks

- Dealing costs, which range from free to £11.95 (HL)

- Tax status

- Gains in ISAs and SIPPs are tax-free

- Spread-bet gains are tax-free

- Gains in general investment accounts (GIAs) are taxable to CGT, with a £12.3K annual nil-rate allowance

- Gains on CFDs are taxable

- Leverage

- Selling short

- There are quite a few short ETFs available, but their long-term behaviour is not entirely predictable

- I use spread bets to sell short – CFDs are a taxable alternative

- Redundancy

- I like to have at least two brokers for each type of account (ISA, SIPP, GIA) in case there are problems with one of the platforms

- Counterparty risk

- Large, established brokers (Fidelity, HL, AJ Bell) are less risky than new entrants

- Government insurance scheme limits (£85K in the UK) are generally too low to have an impact, but I limit my exposure to the newest platforms to these levels

- Foreign brokers usually have lower insurance limits (eg. £17K for DeGiro)

Changes since 2014

The main change since 2014 has been the rise of the low cost-broker.

- In 2014, iWeb was the cheapest at £5 per transaction.

- Then DeGiro launched in the UK with a £2 charge.

- RobinHood introduced free trades in the US, but pulled their UK launch in 2020.

- So FreeTrade were the first free broker in the UK.

- And they were followed by Trading 212, which has origins in Eastern Europe but is regulated in the UK.

- Trading 212 also had no FX markup, which made them attractive for US stocks, but they recently introduced a charge (0.15% each way).

- Stake is also free for transactions but launched with a monthly account charge.

- In response to T212 adding charges, Stake appears to have dropped theirs.

- On FX they use a “foreign account” approach, where transfers in and out have FX charges, but trades don’t.

Use cases

- ISAs – these accounts are generally free and I use iWeb and X-O because they have the lowest transaction charges (of the established brokers).

- Not all ETFs can be held in ISAs and some have to be held in SIPPs instead.

- SIPPs – Fidelity and AJ Bell YouInvest are the cheapest here.

- I have legacy holdings with HL and PensionBee which I will exit in due course.

- GIAs – I use T212 and Freetrade because their zero transaction charges support active strategies like trend/momentum.

- I will only hold a certain amount of money with these brokers.

- When I hit these limits, Stake and DeGiro are next in line.

- Leverage and Shorting – I use IG for spread-betting.

- CMC and SpreadEx have been recommended to me at the next steps if I need multiple spread bet brokers.

- US Stocks – I currently use T212 and IG.

- I plan to investigate Stake in the near future, now that the monthly fee has gone.

- Alternatives include Interactive Brokers and DeGiro (I think).

- Options

- I don’t trade options at present, but I plan to.

- IG have bets on options, which is not quite the same thing.

- Interactive Brokers and TastyTrade appear to be the main brokers for US options.

- DeGiro offer options, but these might be European-only.

Broker Map

Here’s the broker map I promised at the start of the post:

That’s all for today.

- Until next time.

What initially caught my eye in your Broker Map was that you have relatively small GIA holdings. I then took a look at your 2020 annual review and noted from that post that since 2006 you went hard on your SIPP. My question – which admittedly is slightly off topic – is, with the benefit of hindsight, would you still say that this was a good approach and are you content with your current distribution across SIPP, ISA and GIA?

Well, there are several factors here. When the SIPP rules were relaxed in 2006 I had been earning well for two decades without being able to build up a decent pension pot. So my priority was to fill my pension and then my partner’s pension, while we were still earning and qualifying for tax relief.

Returns since then have been better than I anticipated, and Covid has put paid to my dream of the LTA being scrapped. So I will pay a bit more tax at some point and in retrospect, I might have put 5% or 10% less in there. But it’s a first-world problem.

ISA allowances have been used up mostly, but I can’t seem to develop the knack of getting the ISAs to grow faster than the SIPPs. I think UK stocks are a big issue here – they haven’t had the best 20 years. I would like to have more in ISAs but the annual limits were very small for a long time.

I don’t like GIAs at all – lots of record-keeping and tax on crystallised gains. So mine are sized to use up the annual CGT allowance. If that gets cut as many expect then my GIA’s will shrink, too.

Thanks.

I concluded that once “retired” on balance the ISA is probably the better vehicle. However, this did not occur to me whilst accumulating as I was focussed on securing tax relief at that time.

Trying to take a holistic, life cycle view is obviously the correct approach – but that is rather complex as the rules keep changing/being tweaked.

As I’m sure we have discussed previously, I have always thought it unlikely that HMRC would give up the tax revenue raised via the LTA!

I hear you re GIA’s.

And, as you say, these are definitely not the worst problems to have.

Hindsight is 20/20, but two years ago a low-tax Tory government looked likely.

I think the LTA problem will seem small potatoes in a few years as more and more ludicrous taxes appear. It seems increasingly likely that I will need to emigrate.