Lang Cat Retail Pricing Forecast

Today’s post looks at a report from The Lang Cat on disruption and innovation in retail investment pricing over the next five years.

Retail pricing

We’re a bit off our usual track here – regular readers will know that I advocate DIY rather than advised investing, both for reasons of cost and because advisers are not investment experts.

- Their weeks of training are directed towards how to most safely obey the unnecessarily heavy UK regulation and with keeping their clients – you, their source of income – on board during the testing times.

I would pay for superior performance, or even for time-diversified yet comparable performance, but what you are asked to pay for is inferior performance, plus compliance and client management.

- You can do better on your own.

Let’s see how bad things are:

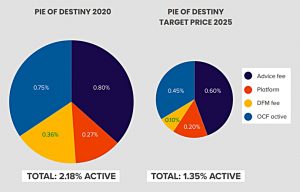

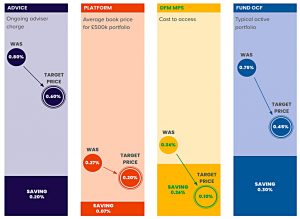

The pies show current average charges for a fully advised active service and the lower charges that Lang Cat (LC) hopes to see in five years.

- Current charges are 2.18% pa, and future charges are 1.35% pa.

For comparison, my current charges across my whole net worth are 0.42% pa.

- Which suggests that the industry is eleven years from catching up with me – by which time an advised investor would have paid an extra 10% of their portfolio in charges.

Of course, I’m not comparing apples with apples – only around 10% of my net worth is the legacy active funds (mostly OIECs) that the report focuses on.

- Without that 10%, my annual costs would be even lower, at around 0.3% pa.

So before we get into the report, take away this message:

- Following the DIY (mostly) passive route rather than the advised active one will save you more than half of your portfolio’s value over the course of a typical investing career.

It’s great that The Lang Cat expect this gap to close, but it will never close enough to be worth making the leap.

The status quo

Here’s how LC describes it:

Clients meet an adviser, get some advice which normally carries an ongoing percentage charge, and invest in a range of funds charging a flat percentage inside a product which charges them a tiered percentage of their assets.

That’s three of the four pieces of the pie covered.

- The fourth is discretionary fund management, where you pay more to let someone make active decisions on your behalf.

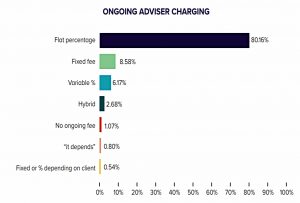

More than 80% of advisers use a percentage fee for ongoing advice, which means that investors with £1m pay twenty times as much as those with £50K to often be directed towards the same basket of OIECs – though in practice this also means that most advisers aren’t interested in investors with £50K.

- Less than 9% charge a fixed fed (though another 1% have no ongoing advice charge).

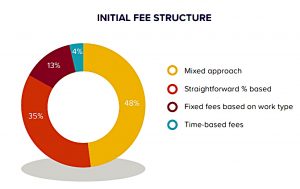

The situation is more complicated for up-front advice, but even here 35% use a percentage and 48% have a “mixed” approach.

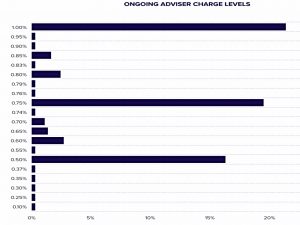

Fee levels cluster at round numbers – 1%, 0.75% and 0.5%.

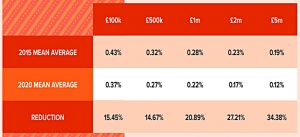

Platform fees have been falling.

- For a typical private investor with a £500K portfolio, they are now 0.27% pa – down by 0.01% over each of the last five years.

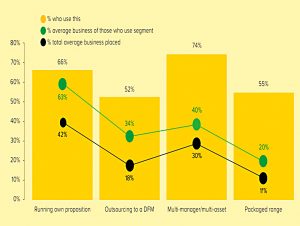

DFM is a minority sport:

About half of firms outsource at least some of their client assets to third-party discretionary MPS. Where firms are using a DFM, about a third of assets go that way; across the market just under 20% of flows are going to MPS.

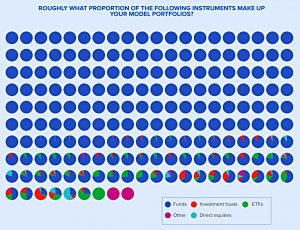

More than 90% of assets invested by advisers go to OIECs.

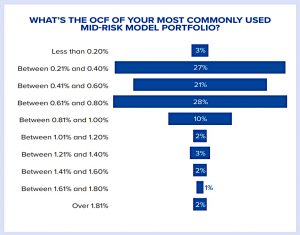

The OCFs of the mid-range OIECs used by advisers are mostly in the 0.2% to 0.8% pa range.

We’d suggest a passive portfolio is priced on average at around 0.2%, a core/satellite portfolio at around 0.5% and a straight active portfolio at around 0.75%.

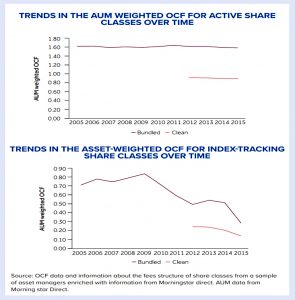

There’s an interesting contrast here between active and passive funds.

- Asset weighted OCFs for passive funds (which compete partially on price) have been falling for a decade, as funds charges shrink and advisers move to cheaper funds.

Active fund OCFs have flatlined for fifteen years.

Things that won’t change

Part four of the report is called “the serenity to accept the things we can’t change”. Here are a few of them:

- Advice – particularly initial advice – doesn’t have economies of scale

- Regulation means that advice must be charged for directly, and can’t be cross-funded

- Platforms want large investors to cross-subsidise smaller ones so that they can afford to take on the smaller ones

- Platforms see larger portfolios as risker (in terms of the penalties they might face for screwing up) and therefore see percentage pricing as an insurance policy)

What might change

Part five is about things that might change:

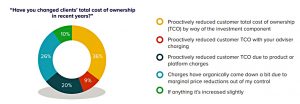

- Advisers might cut their charges (but few have recently – see chart)

- This might take the form of a fixed fee for ongoing advice

- Or it could be a subscription model (a monthly fee, like Netflix)

- Another approach would be fixed fees for (unregulated) planning and percentage fees for (regulated) advice

- Or more advisers might use tiered fees, perhaps with caps and/or collars

- Platforms could adopt capped fees or modular pricing for each of their products

- Or platform fees could be absorbed by the advisers (and partially recharged, or even recharge with a markup)

- DFM might also go fixed fee, or use tiers and caps.

- Or DFM fees might be routed via the adviser, as per platform fees

- Finally, the big one – fund fees might become tiered or stepped

- Or fund managers might take only a performance fee (Orbis operates in this way)

- Or retail investors might be allowed access to (much cheaper) institutional share classes within funds, or to a hybrid share class – this might be funded via deal aggregation to help with scale economies

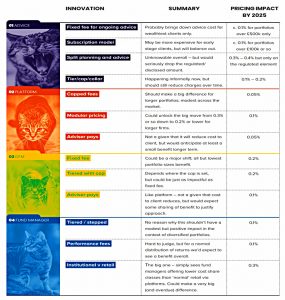

Here’s a summary table of the possible changes and impacts:

And here’s how those changes add together to give the new target charge of 1.35% pa:

Conclusions

That’s it for today – it’s been an interesting excursion across to the adviser side of the fence.

- But it seems that advised active investing will still be far too rich for my blood, even in five years’ time.

We’ve only scratched the surface of the report, which runs to 36 pages, so of you want more, please download a copy from The Lang Cat’s website.

- Until next time.