Pension Drawdown Charges

Today’s post is a look at Pension Drawdown Charges.

Contents

Drawdown

Judging from press coverage, pensions are the unglamorous cousin to sexy ISAs.

- And decumulation (or drawdown) is the unsexy cousin to glamourous accumulation.

So today we’re looking at the unsexy quarter of the unsexy half of investment.

Before we get started, I should make clear that I am using Pension Drawdown as an umbrella term to cover all three ways of accessing a DC Pension (usually a SIPP):

- Taking all or part of the tax-free lump sum (usually 25% of the total value of the pension)

- Drawing a taxable income from the remaining 75% of the pension (now usually known as Flexi-drawdown, to distinguish it from a now largely obsolete older version of drawdown)

- Taking a lump sum from the whole pot which is 25% tax-free and 75% taxable (this has the delightful name of Uncrystallised Funds Pension Lump Sum or UFPLS).

I’ve written about the mechanics of these options before and as the rules haven’t changed since 2015, that won’t be my focus today.

State of Play

Ignoring a few small legacy workplace pensions, my partner and I have pensions with four providers (in order of assets):

- AJ Bell YouInvest

- Fidelity

- Hargreaves Lansdown

- PensionBee

Each of these was selected at a time when they were competitive for pension accumulation.

- But accumulation is not drawdown, and competitive is a moving target.

One of the HL Pensions is used for an annual UFPLS withdrawal, and the other HL pension and the PensionBee account have each been used to access tax-free cash.

We also have non-pension assets on other platforms, but SIPP are more specialist – and more expensive – than ISAs and GIAs, and many of the new entrants don’t offer them.

So the focus today is on the drawdown charges from these four platforms, and whether there are any obvious alternatives that are significantly cheaper.

Why now?

Three things have prompted me to write this post today:

- My partner is likely to become more active in drawdown in the next year or two, and I would like to consolidate her pensions on to the best platform.

- Moving pensions is tedious and time-consuming, and I want to get it right.

- I was disappointed by the performance of the PensionBee account last year, and I want to move it back under DIY control.

- I came across a Which review of drawdown costs (admittedly from 2020).

There have also been a few changes recently, with providers like AJ Bell and interactive investor (ii) cutting their drawdown fees in order to be more competitive.

- On the other hand, there have also been a couple of long-awaited SIPP launches (Vanguard, Freetrade) which proved to be disappointing.

What does good look like?

Pensions are a long-term product – I expect my drawdown period to last thirty years.

- So annual running costs are key.

Smaller investors may be able to tolerate percentage charges, but in the £100K to £500K account size range, we will be looking for the lowest annual charges (often known as custody charges).

- Although I am most likely to make only two withdrawals per year (one per person) I would like withdrawal charges to be as low as possible (and ideally zero).

I would also like decumulation charges to be the same as accumulation charges so that I don’t feel that I am being penalised for moving into drawdown.

Transaction charges (trading commissions) are less important since most of my pension holdings are long-term.

- But there are some instruments that can’t be held in ISAs, so one pension platform with charges of less than £10 a pop would be welcome.

And of course, a wide range of investments within the platform would be great.

Which report

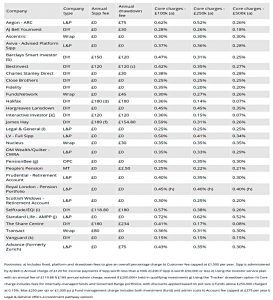

Here’s the summary table from the Which article.

- I won’t run through it in detail, but let’s look at my existing platforms.

One immediate problem with the article is that it looks at charges for OIECs rather than the exchange-listed products (ETFs and ITs) that I prefer.

- I obviously know the charges for my existing platforms, but this might mean that I miss some alternatives.

Existing platforms

- AJ Bell YouInvest

- £120 maximum annual custody charge on portfolios over £48K

- Transaction costs are £9.95

- Decumulation is the same as accumulation

- Choice of investments is wide

- Fidelity

- £45 maximum annual custody charge on portfolios over £23K

- Transaction costs are £10

- Decumulation is the same as accumulation

- Choice of investments is limited (I use just 9 ETFs)

- Hargreaves Lansdown

- £200 maximum annual custody charge on portfolios over £45K

- Transaction costs are £11.95 (!)

- Decumulation is the same as accumulation

- Choice of investments is wide

- PensionBee

- 0.5% on the first £100K and then 0.25% above that

- This includes underlying ETF fees, so is much cheaper than it sounds

- Decumulation is the same as accumulation

- Choice of investments is very narrow – one default allocation on the cheapest plan

I’m not unhappy with any of these, though a combination of AJ Bell and Fidelity look best, and my medium-term plan is to move towards that.

Alternatives

I’ll only be looking at DIY options here.

- Vanguard

- iWeb

- £220 maximum annual custody charge on portfolios over £50K

- Transaction costs are £5

- Decumulation adds another £180 annual fee and £90 per UFPLS

- Choice of investments is wide

- X-O (Jarvis)

- £120 maximum annual custody charge

- Transaction costs are £5.95

- Decumulation adds another £180 annual fee and £120 per UFPLS

- Choice of investments is wide

- Interactive Investor

- £240 maximum annual custody charge

- Transaction costs are £7.99, but you get one free trade per month

- Decumulation is the same as accumulation

- Choice of investments is wide

- Freetrade

- £120 maximum annual custody charge

- Transaction costs are zero

- Decumulation is the same as accumulation

- Choice of investments is moderate (a wider range costs another £84 pa)

That’s the usual suspects out of the way – nothing to beat AJ Bell and Fidelity there.

- Freetrade is the best of the bunch, but not large enough to trust with a big pension pot.

- ii is also decent, and probably not worth actively moving away from.

I didn’t spot anything good on the rest of the Which list. Amongst those I ruled out were:

- Alliance Trust

- Barclays Smart Investor

- Bestinvest

- Charles Stanley

- Close Brothers

- James Hay

- Halifax

- Selftrade

- Share Centre

Conclusions

I’m sticking with AJ Bell and Fidelity and moving away from HL and PensionBee.

- Until next time.

Mike,

One thing worth mentioning is that company provided DC schemes are often “run” by the providers mentioned in the Which report – but often at a worthwhile discount to the costs given in that report. So before transferring to a DIY option I would urge folks to see what (if anything) is on offer for deaccumulation from their workplace DC scheme – if they have/had one.

Yes, I’ve certainly come across company schemes run at a discount, though I’ve never been eligible for one myself. I would say that company schemes are more likely to be both pedestrian in scope and expensive, though.

But the focus of the article isn’t transfers – I just wanted to see if the open market offered anything better than what I have at the moment.