Weekly Roundup, 19th April 2021

We begin today’s Weekly Roundup with John Redwood in the FT.

Redwood

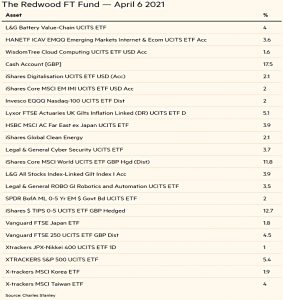

In the FT, John Redwood said that it was getting difficult to know what to do with the 40% cash and bonds allocation that he has to maintain in the ETF portfolio he runs for the newspaper.

I have therefore been running the fund with no conventional bonds from a developed country to avoid the losses that rising rates and inflation fears could bring. I have also kept cash levels high – at 17 per cent of the fund.

I have run a large holding in short-dated US inflation-linked government bonds, hedged back into sterling. These have remained fairly stable.

He also mentioned the US stimulus and money growth.

The fund is positioned with many others to receive some more benefit from the expectations of a good recovery and from the better profits and dividend figures to come later this year. A stronger US will stimulate the rest of the world.

John has taken profits on Nasdaq and moved the money into a world fund, anticipating a general recovery.

- He’s also reduced the clean energy position as valuations were becoming stretched.

PensionBee

Pensions aggregator PensionBee is going ahead with its IPO later this week, having published a 229-page prospectus.

- Unconditional trading (when retail investors can but and sell) begins on 26th April.

The price range for the float is 155p to 175p, which translates to a range of values between £356M to £384M – which is around one-third of a Unicorn.

- Still, it would mean a nice payday for executives like CEO Romi Savova, who still owns a sizeable chunk of the company.

Holders are selling 2.8M shares (around £4.5M) and are issuing 35.5M new shares.

- The listing will raise £49M after costs, the majority of which (£34M) is earmarked for marketing, with £10 for technology development.

PensionBee manages £1.65 bn (( Disclosure – I have 2.4% of my money invested with the firm )) – up 123% year on year to 31st March 2021.

- The firm has 81,000 customers, up 81% year on year, and 110 employees.

The firm is still loss-making, losing £13.2M last year on revenue of £6.2M.

- Revenue has grown more quickly than costs for three years in a row.

The offer is part institutional and part for customers – there is no public offer.

- Last I heard, twelve thousand customers had signed up for the offer. (( As a customer, I qualify for the offer but in the light of the Deliveroo flop, I haven’t decided whether to apply yet – I also need to research how the Primary Bid platform that is handling the public offer operates in detail ))

The offer has a 6-month lock-up for investors, and two years for execs.

Romi said:

An IPO has always been part of PensionBee’s corporate trajectory, and we are extremely proud to be reaching this milestone.

The flotation will further our vision to help millions of consumers look forward to a happy retirement through our technology platform and dedicated customer service offering that make pensions simple.

We’re delighted that so many of our customers wish to join us as shareholders and look forward to welcoming all of our new investors as important stakeholders in our business.

Nest

In the FT, Chris Flood reported that Nest, the UK’s largest workplace pension scheme (( Full disclosure – it’s the auto-enrolment provider that I use for my company )) is looking to add private equity to its illiquid investments, alongside green energy infrastructure and commercial property.

- Nest has £16 bn of assets and collects £5 bn pa in contributions from 10M scheme members – it expects to have £100 bn in assets by 2039.

Next wants to allocate 5% to PE, via open-ended “evergreen” funds which would continuously acquire (growth) companies.

- The stumbling block is the fee structure for PE.

Mark Fawcett, chief investment officer at Nest, said:

We think this is a new bargain that can deliver better results for both pension savers and private equity managers, [but] we won’t pay two and 20. Fees levied by most private market funds will remain too high for many DC pension schemes.

DC pension schemes currently have a 0.75% pa fee cap, but the Department for Work and Pension is thinking of averaging this over a rolling five year period (which wouldn’t solve the PE issue).

- Nest also plans to insist on high ESG standards.

The problem for Nest is that PE is very popular and has managed to resist downward pressure on fees.

- Just under $1.0 trn was raised last year, only slightly down from 2019’s record £1.1 trn

Hargreaves Lansdown

In the Times, Ali Hussain asked whether it was time to quit Hargreaves Lansdown.

- I’ve been saying something similar for the last seven years.

HL used to be my largest counterparty, but it’s down to less than 5% of my net worth these days.

Don’t get me wrong, HL was great back in the day – they introduced the idea of retail fund platforms.

- Before them, we had individual accounts with lots of asset managers.

Against that, their charges are insanely high (and haven’t been reduced in decades) and they promote the OEIC ecosphere with a constant bias to active trading.

Ali mentions the high cost but also HL’s reputation for “stellar” service.

- But standards are slipping:

Complaints about the platform are rising — the Financial Ombudsman Service received 423 complaints about Hargreaves last year compared with 87 in 2019 and 117 in 2018 — and it has been embroiled in a damaging investment scandal that has left it facing the possibility of a class action lawsuit and a probe by the City regulator.

The platform – along with many others – struggled with vaccine day in November 2020 and with the Gamestop shenanigans in January 2021.

Other criticisms include:

- the amount of money HL makes from the £13.6 bn of cash it holds (12% of AUM)

- the poor performance of its own multi-manager funds

- allegations that funds make it onto the HL best buy list (currently called the Wealth Shortlist) by offering HL-specific discounts

- the lack of ITs (which don’t generate the same level of fees) on the Shortlist

- HL’s long-standing support for Neil Woodford’s funds

- the exclusion of Terry Smith’s fund (which won’t offer a discount) from the list

Acquis Exchange

AJ Bell YouInvest has added stocks from the Acquis Stock Exchange (AQSE – formerly NEX) to its platform.

- AQSE has 90 stocks, divided into the Access market – which focuses on earlier stage growth companies – and the Apex market for larger, more established businesses.

As with Aim, trading is exempt from stamp duty and shares are exempt from IHT if held for two years or more.

Andy Bell said:

Our goal is to make investing easy for our customers, whether they are managing their investments themselves or with the help of a financial adviser. Many of them have told us they want to be able to trade stocks listed on Aquis Stock Exchange and we are pleased to make this available to them.

Stocks on AQSE include Arbuthnot Banking, Chapel Down, Adnams, Rutherford Health, Baskerville Capital (wealth management), KR1 (blockchain), NFT Investments (crypto) and Samarkand (Chinese e-commerce).

- The average market cap on Apex is £80M, which is on the small side for me.

- Trading volumes in February were £37 bn.

Alasdair Haynes, CEO Aquis, said:

Today, some of the UK’s most exciting growth companies are choosing to get a quotation on AQSE. We fervently believe in retail investors having equal opportunities to trade as institutional players as part of our mission to get the public back into public markets for the benefit of all stakeholders.

AQSE (or possibly just KR1, up 4000% in a year) is obviously a draw for some punters, as a few days later, Interactive Investor announced that it too would support the exchange.

- And it turns out that Barclays and Jarvis (X-O) already offered AQSE stocks.

- HL offers “some of the more liquid stocks”, mostly over the phone.

But now we have a choice of four online platforms.

Crypto news

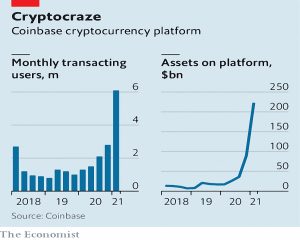

The Economist expected Coinbase’s float (not an IPO) to be a hit.

- No new shares would be issued, so liquidity would come from insiders selling (there is no six-month lockup as with most IPOs).

Coinbase made between $730M and $800M on revenues of $1.8 bn in 1Q21, up from $179M and $585M in the previous quarter.

- AUM is $223 bn – 10% of all crypto – and $335 bn of value was traded in 1Q21.

With a potential valuation of $100 bn, the PE might be in the 30s.

The big problem is that 96% of revenue comes from transaction fees.

- These are not cheap (0.5% each way) and so Coinbase could be undercut by competitors.

A second article looked at bitcoin’s environmental costs. A new paper concludes:

In the absence of legal curbs, bitcoin could by 2024 become a “non-negligible” barrier to China’s efforts to decarbonise its economy.

The problem for bitcoin is that the more valuable the currency becomes, the more computing power (and electricity) will be thrown at solving the mathematical puzzles that lead to the award of newly-minted coins.

Seventy per cent of mining takes place in China.

- Energy consumption but 2024 will be the same as for the whole of Italy, and the carbon emissions will match those of Nigeria.

Currently, global bitcoin matches Kazakhstan for electricity and Hong Kong for carbon.

Revolut, one of Coinbase’s competitors in the UK (albeit a more expensive one – Revolut charges 2.5% per each way transaction) has added 11 new currencies to its platform, taking the number of available coins up to twenty.

Here’s the list of new ones:

- Cardano, Uniswap, Synthetix, Yearn Finance, Uma, Bancor, Filecoin, Numeraire, Loopring, Orchid, and The Graph.

I can honestly say that I’ve heard of three of those.

Quick Links

I have eight for you this week, the first four from The Economist:

- The newspaper noted that profits at America’s banks are sky-high

- And that new ways of getting from A to B are disrupting carmaking

- And that there is a method in Microsoft’s merger madness.

- The Economist also wondered whether – if you can have microwave ovens – you might not also be able to have microwave boilers.

- Alpha Architect looks at inflation and the value premium

- And also at how portfolio construction affects the reliability of outcomes.

- UK Value Investor looked at the pros and cons of discounted dividend models

- And Mauldin Economics had a Tsunami Warning.

Until next time.