Capital Gains Tax Review

Today’s post is about the recent Capital Gains Tax Review from the Office of Tax Simplification.

Contents

Capital Gains Tax Review

We noted back in July that Chancellor Rishi Sunak had commissioned a review of Capital Gains Tax from the Office of Tax Simplification, and last week they delivered their initial report, which runs to 135 pages.

- The report is non-binding and may never be implemented – Sunka has previous in ignoring OTS recommendations on IHT and income tax.

We’ll go through the report in detail below, but first, let’s take a look at how the financial media covered the story, and at the reaction from industry figures.

There were two key recommendations that the journalists focused on:

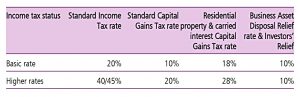

- Align the CGT rates with income tax, to remove the incentive to pretend that income is capital gains.

- This would largely mean doubling rates from 10%/20% to 20%/40% (see below for more detail on CGT rates).

- Reduce the annual allowance (exemption) – perhaps to £5K pa, or even to £1K pa – to ensure that more people pay CGT.

- Which of course assumes that people won’t change their behaviour in order to avoid paying CGT.

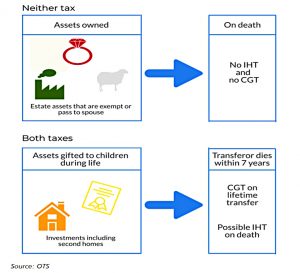

The third area of potential reform is the interaction between CGT and inheritance tax, particularly with respect to lifetime gifts.

- The issue here is that the absence of CGT on death dissuades people from transferring assets to others during their lifetime (when CGT would be payable).

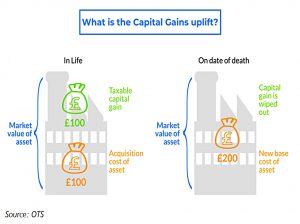

The OTS solution to this is to remove the capital gains uplift on death.

- This means that beneficiaries would inherit items at the historic cost price originally paid for them, rather than the current price – which means that the lost CGT would be reclaimed when they sold the assets.

The OTS also proposes that asset prices be rebased to the year 2000, which might prove tricky – re-basing works best when it’s done contemporaneously.

The fourth issue is the Business Asset Disposal Relief.

- This used to be called Entrepreneur’s relief and had a lifetime limit of £10M, but has recently been restricted to £1M.

The OTS would like to link the relief to the retirement of an entrepreneur and remove it entirely for investors.

- CGT exemptions for employee share schemes would also be removed.

Covid debt

The typical spin on the story was that an increase in the CGT take was needed to help pay for the Covid spend, but of course, that’s nonsense.

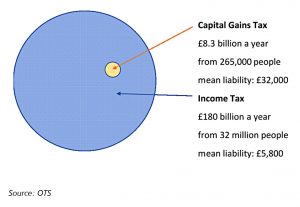

- CGT doesn’t raise much more than 1% of annual government spending, so even if the take doubled, most people (who don’t pay CGT) wouldn’t notice.

CGT raises £8bn today and the OTS reckons their changes will raise £14 bn – clearly not enough.

- If we want to make a hold in the Covid debt, everyone will have to pay more, not just the 1%.

It has also proven historically difficult to keep UK tax revenues above 38% of GDP, and we’re at that level already.

- So there’s a fair risk that any further tax rises will backfire.

Reaction

Miles Dean, Head of International Tax at Andersen, was not impressed:

The case for lower rates of tax on capital gains is that the asset that produces the gain is more often than not acquired using taxed income. To then tax the gain at income tax

rates is pernicious given that the capital has been tied up, [it] isn’t at the disposal of the

individual.There is no sensible case to tax gains at the same rates as income. The UK has myriad anti-avoidance rules to prevent income being repackaged as gains – and these provisions work.

Indeed, most countries don’t tax gains in the same way as income, and Dean warned that the changes could drive away foreign investment:

Aligning gains with income will result in wealthy foreigners shunning the UK, wealthy

Brits leaving.

Rachael Griffin, a tax expert at Quilter said:

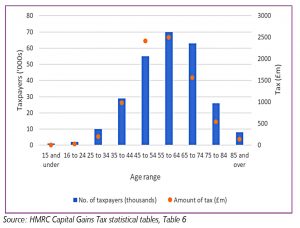

The tax can be reformed in order to squeeze asset owners, shareholders and landlords without impacting the majority of people. It is also a tax that is almost exclusively paid by older, wealthier households – 97% of CGT tax revenue is paid by over 35s, with most people caught by the tax in their 50s and 60s.

It means that raising additional revenues can be positioned as a tax on those with the broadest shoulders. In general, the message is clear from the government and the OTS. Use your allowances now or lose them.

Helen Jones, Private Client Tax Services partner at BDO, said:

Higher rates of CGT could distort behaviour as people choose to retain assets rather than trigger a tax charge. It is essential that capital gains tax rates remain lower than income tax rates so that we incentivise individuals and businesses to keep investing into the UK.

Graham Boar, partner at accountants UHY Hacker Young said:

Considering the amount of disruption, it’s hard to see how this would create a more user-friendly CGT system. The proposals seem designed to increase tax revenue and add complexity rather than simplify CGT. Making CGT much more punitive, on top of the already-unpopular IHT system, would be a very risky move for the Chancellor to make.

Laith Khalaf, formerly of HL and now a financial analyst at AJ Bell, said:

It seems like change is afoot, possibly in a spring Budget. If CGT rates are increased, there could be a fire sale of assets as investors sitting on big gains seek to take advantage of current rates before any deadline for transition.

In order to enable the economy to thrive, it is essential that capital gains tax rates

remain lower than income tax rates so that we incentivise individuals and businesses to

keep investing into the UK.

Capital gains tax

CGR is a tax on the difference between an asset’s value when acquired and its value on disposal.

- Sometimes transaction expenses are allowable, but tapering and indexation (to remove “gains” from inflation) were removed more than a decade ago (by Alistair Darling in 2008).

The taxation of on nominal as well as real gains makes CGT a stealth wealth tax.

The standard rates of CGT are half those of income tax, but there are punitive rates for residential property and “carried interest” (private equity profits) and a discounted rate for entrpreneurs.

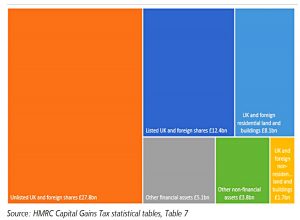

The report uses figures from the 2017-18 tax year, during which £8.3 bn of CGT was paid on £55.4 bn of net gains by 265K taxpayers.

- This compares with £180 bn of Income Tax paid by 31.2 M taxpayers.

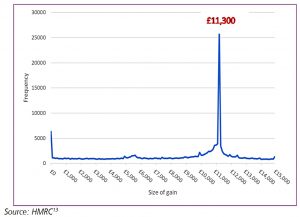

Since some gains (eg. share sales) are under the control of the investor, there is clear evidence that people try to use up their allowance each year.

- Reducing the size of the allowance would not end this behaviour, but rather would move it leftwards along the x-axis.

Unsurprisingly, since people tend to accumulate more assets over the course of their life, most CGT is paid by older people.

Shares are the main source of gains, with property (land and buildings) next.

Full list of recommendations

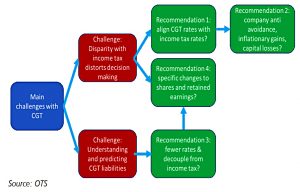

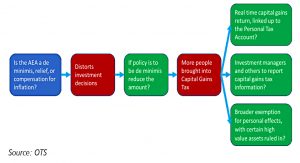

Recommendation 1 – If the government considers the simplification priority is to reduce distortions to behaviour, it should either:

- consider more closely aligning Capital Gains Tax rates with Income Tax rates, or

- consider addressing boundary issues as between Capital Gains Tax and Income Tax

Recommendation 2 – If the government considers more closely aligning Capital Gains Tax and Income Tax rates it should also:

- consider reintroducing a form of relief for inflationary gains,

- consider the interactions with the tax position of companies, and

- consider allowing a more flexible use of capital losses

Recommendation 3 – If there remains a disparity between Capital Gains Tax rates and Income Tax rates and the government wishes to make tax liabilities easier to understand and predict, it should consider reducing the number of Capital Gains Tax rates and the extent to which liabilities depend on the level of a taxpayer’s income.

Recommendation 4 – If the government considers addressing Capital Gains Tax and Income Tax boundary issues, it should:

- consider whether employees and owner-managers’ rewards from personal labour (as distinct from capital investment) are treated consistently and, in particular

- consider taxing more of the share-based rewards arising from employment, and of the accumulated retained earnings in smaller companies, at Income Tax rates

Recommendation 5 – If the government’s policy is that the Annual Exempt Amount is intended mainly to operate as an administrative de minimis, it should consider reducing its level.

Recommendation 6 – If the government does reduce the Annual Exempt Amount, it should do so in

conjunction with:

- considering reforming the current chattels exemption by introducing a broader exemption for personal effects, with only specific categories of assets being taxable,

- formalising the administrative arrangements for the real-time capital gains service, and linking up these returns to the Personal Tax Account, and

- exploring requiring investment managers and others to report Capital Gains Tax information to taxpayers and HMRC, to make tax compliance easier for individuals.

Recommendation 7 – Where a relief or exemption from Inheritance Tax applies, the government should consider removing the capital gains uplift on death, and instead provide that the recipient is treated as acquiring the assets at the historic base cost of the person who has died.

Recommendation 8 – In addition, the government should consider removing the capital gains uplift on death more widely, and instead provide that the person inheriting the asset is treated as acquiring the assets at the historic base cost of the person who has died.

Recommendation 9 – If the government does remove the capital gains uplift on death more widely, it should:

- consider a rebasing of all assets, perhaps to the year 2000

- consider extending Gift Holdover Relief to a broader range of assets

Recommendation 10 – The government should consider replacing Business Asset Disposal Relief with relief more focused on retirement.

Recommendation 11 – The government should abolish Investors’ Relief.

Impacts

There are several obvious implications of the recommendations:

- Transactions which would have happened will not happen because of the CGT they will now attract.

- If we are given notice of the changes, there could be a lot of extra transactions just before the deadline, which might depress prices temporarily.

- Some assets may be passed down the generations more quickly, if you believe that avoiding CGT on death – rather than retaining control – was the motivation behind hanging on to them.

- There will be less private investment into SMEs and less entrepreneurship in general – though you could argue that most of the damages here has been done already by the reduction in entrepreneur’s relief.

- People with a lot of uncrystallised capital gains – buy-to-let landlords spring to mind – will be clobbered.

- So there could be some impact on second home prices, and further entrenchment of the move towards BTL becoming a game for larger players rather than individuals.

- A lot more people will be dragged into record-keeping for CGT purposes.

CGT shelters

What all this would mean for investors – were the recommendations to be implemented – is a greater focus on CGT shelters.

I know of nine, but there are probably some smaller loopholes hiding somewhere:

- pensions (SIPPs)

- ISAs

- your primary residence

- VCTs

- EIS

- spread betting (and other betting profits)

- gold bullion that is legal tender (sovereigns and Brittanias)

- UK government bonds (gilts)

- chattels (“wasting” assets worth less than £6K per item – not antiques)

Conclusions

I’m not convinced that these changes will be implemented, at least not by the current Tory government:

- They largely hit core Tory voters

- They won’t raise enough money to make a difference to the Covid debt

- And the Chancellor has bigger fish to fry at the moment.

If they are enacted, we as investors will need to avoid BTL (and second homes generally) and move towards VCT, EIS and spread betting.

- Until next time.