Funding Social Care – Life Gets Worse At 40

Today’s post is about a report from a Parliamentary Committee on how to pay the UK’s increasing bill for Social Care.

Contents

Funding Social Care

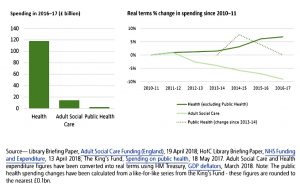

Healthcare in the UK is “free”, at least at the point of consumption.

- In fact the NHS is one of the biggest areas of government spending, responsible for more than 20% of taxation.

Like all forms of socialised provision / pooled insurance, there are winners and losers.

- Those on low incomes who need a lot of care do very well out of the system.

- Those on high incomes who need little care are subsidising the others.

Social care is different.

- For some reason it’s funded separately from the NHS – largely by local authorities.

Shortages in council funding mean that the NHS struggles to discharge (particularly) elderly patients who might otherwise receve no care.

Anyone with more than £23K in assets must pay for their own care.

- You cannot be forced to sell your home to pay for care if you or your spouse are living in it.

Most people don’t need much care, but one in ten has to pay more than £100K.

- Care can cost up to £50K pa.

And there is no insurance available.

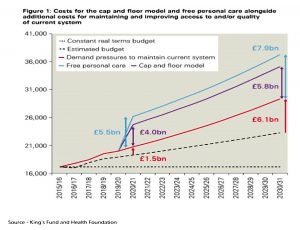

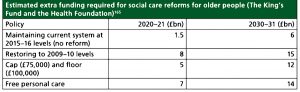

The previous Tory government had pledged to introduce a cap on individual contributions (originally set at £35K but later raised to £72K) by the 2020 election.

- In the snap 2017 manifesto, the Conservatives scrapped this pledge and instead opted for “further consultation”.

They had originally planned to include the family home in the calculation of assets, protecting only the first £100K of assets as an inheritance.

- This didn’t go down well, and was branded a “dementia tax” (in contrast to cancer, where treatment is at least free, even if it is mediocre).

The next stage in the promised consultation is the parliamentary report that we will look at today.

Committee aims

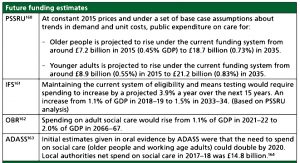

The Comittee is concerned that the present system cannot respond to surrent needs, let along increased demands from demographic trends (an aging population).

- A funding gap of up to £2.5 bn is predicted by 2020.

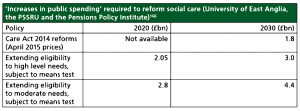

They also want to increase the quality of care for all (those with critical, substantial and moderate needs).

- And they emphasise that working age adults should be considered alongside the recent focus on older people.

Extending the existing inadequate care to more people is no good.

- A definition of what good care looks like should be the first step.

The long-term goal is universal access to personal care that is free at the point of delivery.

- That sounds like a merger with the NHS to me.

However, the fine print restricts free provision to the “personal care” element – help with washing, dressing and eating.

Accomodation costs (which are often higher) would be means tested.

- Which takes us back to square one – your inheritance can still be swallowed up by accomodation costs.

The current £23K “floor” of protected assets is likely to rise, but not to a level than would help home-owners in the south-east of England.

- There’s no mention of a cap on individual contributions.

The Committee also thinks that risk-pooling is a good idea.

- This is a form of insurance that protects heavy users from catastrophic costs.

- Of course, it means that light or non-users pay more that they would otherwise.

The committee also wants contributions to be earmarked (hypothecated) so that public support will be higher.

- It seems that people like paying more tax when it’s re-branded as health insurance.

They call this the Social Care Premium (SCP), though they admit that it could be combined with National Insurance (NI).

Their preference is for a seprately managed and audited fund, which is a break from the way that NI is managed.

- And in time they would like to see this approach extended to the NHS.

The committee would also like to see further integration between the NHS, public health and social care services.

- They have a preference for local provision, though this could presumably be delivered through NHS trusts eventually.

Paying for it

The proposal for local government funding is that local retention 75% of business rates should be used.

- Current plans involve using this retention to replace other grants from central governement.

They also want council tax to be increased, via a general reform of tax bands, and a revaluation exercise (not cheap).

The key point about national (ie. individual) contributions to SCP is that they are ageist.

- No one under 40 should pay, but those over 65 (I assume here they really mean those above the State Pension Age) should contribute.

- In both directions, this is a change from NI arrangements.

They also want a minimum threshold (which NI has), but they want to see the maximum threshold raised.

- This is confusing, since NI doesn’t have an upper threshold.

It does have lower rates of contributions in the higher rate income tax bands.

- So presumably the point is that SCP would have a flat rate through all the tax bands.

Even more dramatically, the Committee proposes that “unearned” income (from pensions and investments) should be liable for SCP.

- Pensions and investments are outside NI at present – only income from work is included.

The third leg of the stool is an extra levy on Inheritance Tax (IHT) – let’s call this SCP-IHT.

- This would apply to estates above a certain threshold and would involve a percentage cap of the total estate.

- Those two statements imply that the rate of SCP-IHT would be higher than the percentage cap (eg. 20% above £500K up to 10% of the total).

The German model

The report is light on numbers:

- We don’t know what the rates of SCP or SCP-IHT will be.

But the Committee looks favourably on the German social care system, so let’s look at that:

- The SCP is 2.55% on income.

- Childless people pay more – 2.8% (an extra 10%).

- During employment, the payment is split with the employer.

- In retirement, the individual makes the entire payment.

There’s no mention of SCP-IHT, or of a minimum age to start contributions.

But this system pays out a maximum of £1,763 per month – £21K pa.

- That’s totally inadequate for residential dementia care.

The Germans claim that it covers 58% of average costs (residential and at-home care).

The average “co-payments” by individuals are:

- £512 per month for care

- £594 for hotel costs

- £360 for maintenance / infrastructure

So that’s an average of £17.6K pa top-up.

- I can’t see the point of this system myself.

And I find the repeated references to averages a bit weaselly – it’s worst case scenarios that matter here.

The Japanese system

Here, payments begin at age 40 (there’s no mention of the percentage contribution).

- Those over 65 have their contributions docked from their pension payments.

- Those between 40 and 64 share contributions with their employers.

Co-payments are 30% up to a ceiling, with hotel costs on top.

- Its estimated that people only take up half of the services they are eligible for, because of concerns over co-payments.

Conclusions

Let’s ignore for today the unspoken assumption that services provided by the state must constantly rise, and therefore taxes must rise to fund them. (( This approach won’t even succeed, since higher taxes eventually raise less revenue ))

- Instead, we’ll assume that the issue is the best / fairest way to fund the existing level of social care.

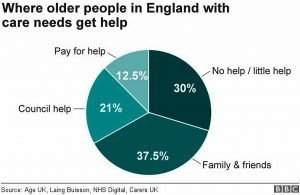

At present, this is unevenly distributed and unevenly (unfairly) funded.

We seem doomed in the UK to have an ever more complicated tax system.

- Adding a second NI (SCP) that is only paid by the over-40s, plus a new layer of inheritance tax (SCP-IHT) is a step in the wrong direction for me.

And if accomodation costs are excluded from universal provision, then the “dementia tax” is alive and well.

- We need a solution that caps an individual’s contributions, as successive governments have promised.

Former pensions minister Steve Webb has proposed a one-off social-care insurance contribuion (of say £30K) from pension pots (SIPPs).

- He suggests that this should be branded “inheritance insurance”.

It sounds like a return to the Dilnot report, but it suits me.

I think that we need a system with just three taxes:

- Income tax, which could be progressive or flat above a tax-free allowance.

- CGT and a “gift tax” could be part of this.

- VAT – a consumption tax.

- Sin taxes on things we don’t like (booze, fags, sugar, CO2)

We don’t need corporation tax since corportions pay people, who in turn pay the above taxes.

- We don’t need IHT because it is a tax on assets that have already been taxed.

- It would be better to tax recipients through the income tax system as the draw on their inheritances (this is already the case for pensions bequeathed by those over 75).

I could be persuaded that a “pooled risk tax” should be separated out from income tax, so that it is more popular with the public.

- If that happened, it could fund both the NHS and social care.

- You might say that NI is the closest we have to this at present.

I also think that we need exemptions from tax that reward good behaviour.

- ISAs (using the TEE system) and SIPPs (using EET) cover most bases.

- Your primary residence also needs to be CGT exempt.

- VCTs / EIS (high risk investment) is the only extra required.

I think that some of the limits are currently too low:

- The LTA of £1M doesn’t provide sufficient retirement income.

- VCT / EIS investments should allow you to reclaim more tax than you paid in that tax-year, and would ideally attract relief at your marginal rate (otherwise they become cashflow negative at higher tax rates).

But most importantly, funds within the ISA and SIPP shelters should be protected.

- The government should not retrospectively target people’s savings, in order to subsidise those who have not saved.

Tax needs to be collected as people earn and as they spend, or we risk incentising bad behaviour.

Until next time.

Great article as always.

I think that we are sleepwalking into a crisis and it will take a brave government to make the changes that are necessary to fix things. But don’t expect it while Brexit consumes all attention.