Core and Satellite

Today’s post is about the Core and Satellite approach to arranging your investment portfolio.

Core and Satellite

I first heard about the Core and Satellite (CS) approach on my MBA, almost 30 years ago now.

- So this is not a new idea.

It’s never really caught on in the UK, though it’s more popular in the States.

- It’s also used by some of the largest investment funds in the world (sovereign wealth funds, pensions funds and university endowments).

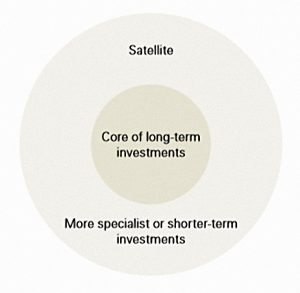

The basic idea is that the bulk of your money is invested in a diversified portfolio of safe (low-volatility) and cheap elements (the core) – and a minority is punted on racier short-term bets (the satellite).

The intention is that the combination of the two will enjoy higher returns than the core with lower volatility than the satellite – diversification at its best.

- The low turnover of the core section should also help to minimise costs.

Another way of looking at this strategy is that the core should be selected according to an investor’s long-term goals, whereas the satellite holdings should be more closely tied to market conditions and movements.

- Core holdings might be kept for 20 years, whilst satellite positions might be closed within twelve months.

You should also ensure that your core holdings at least – and ideally your overall portfolio – is / are consistent with your risk tolerance.

- But there are no rules, and one person’s core asset will be another’s satellite holding.

The Core

The fundamental requirement of the Core is that it provides broad exposure at a low cost.

- This makes a diversified portfolio of trackers (ETFs) ideal.

The core is low maintenance and low turnover, usually valued and updated only once a year.

- It is usually larger than the satellite, forming the majority of the overall portfolio.

- The typical allocation to the core is somewhere between 60% and 90%.

Well-understood, developed markets offer the best core holdings, since they offer lower risk of certain groups of investors gaining an information advantage.

- But illiquid investments that need to be held for the long-term also fit the bill.

Satellites

The satellite portfolio is basically a performance kicker bet.

Satellite components can be chosen in a number of ways.

- They can offer more aggressive exposure to the same assets in the core (eg. concentrated funds with high active share).

- They might include niche assets, geographies or themes that don’t form part of the core.

- They might offer active strategies (rather than just active management) in contrast to a passive core.

- As a half-way house, they might involve smart-beta or factor strategies designed to deliver outperformance.

- Or they might involve the use of individual share holdings, rather than funds.

Some investors use more than one satellite to cover multiple strategies.

The key attribute is that the satellite should be imperfectly correlated to the core, and able to offer divergent (and higher) performance under prevailing / anticipated market conditions.

- When market conditions change, remedial actions (hedging, or a move to cash) would focus on the satellite portfolio, with the core left untouched.

Examples

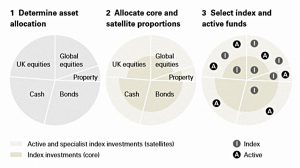

I couldn’t find too much about this strategy on the web, but here’s another schematic from Vanguard:

And here’s one from Goldman Sachs:

My approach

My personal interpretation of CS is to use a buy-and-hold portfolio as the core, and view my active investing strategies as the satellite.

The core will be mostly passive ETFS, diversified across asset class and geography.

There are also long-term holds like physical property, DB pensions (as a bond proxy), VCTs and cash.

- Thus the “greater core” includes both listed and unlisted assets.

There are currently six satellite portfolios across four groups:

- factors – smart-beta funds, across all available factor strategies

- themes – over allocations to areas I expect to outperform – currently there are three of these:

- ESG (in the broadest sense possible)

- tech

- biotech and healthcare

- A trend-following (momentum) portfolio designed to reduce the volatility in the core

- My UK share portfolio

- How this is invested depends on where we are in the market cycle

- During bull markets, it sits mostly in growth/momentum stocks, but in bear markets, I focus more on quality for defensive reasons, before adding value stocks for the recovery.

- Making these changes is not easy in practices, but that at least is the theory.

The satellite portfolios make up around 25% of my listed portfolio, which is in turn around 50% of my net worth.

- The satellites could go as low as 10%, or as high as 50% of the listed portfolio’s value, but in practice, this has never happened.

The benefits of this approach are:

- the ability to focus on active strategies without worrying too much about overall portfolio asset allocation (since the core does most of the heavy lifting)

- a cap on costs (for the majority of the portfolio)

- lower admin (the core only needs to be monitored and rebalanced once a year).

Until next time.

Interesting article, and thanks for pulling it together.

It seems like CS is good framework for your approach – did you set out to follow CS or does it just happen to be a good fit for your approach?

The only other place I recall seeing CS described is in the 2nd Edition of Jason Butlers Wealth Management book for the FT Guides series. For information, he too uses schematics from Vanguard!

I’ve always liked the idea since my MBA (early 90s) but I didn’t have enough money to put it into practice. Also platform, fund and transaction costs were high.

So I probably got into it seriously after the 2006 pension reforms, and I’ve been analysing things more closely since I started this blog (2014). It suits me, but it might be too complicated for a lot of people.