Lowes Retail Structured Products Review

Todays’ post takes a look at a report from Lowes on a decade of retail structured products.

Contents

Structured Products

Structured products are pre-packaged investments designed to make the advantages of derivatives (specifically, changing the risk/return profile of an investment) available to retail investors.

- The most common form of structured product (henceforth, SP) is to guarantee a stock-market return under a certain set of conditions (most usually that an index does not fall below a certain level during a certain time period).

They got a bad reputation in the early days – when they were often issued by insurance companies and known as stock market bonds – as expensive and more in the interests of the IFAs pushing them than of the clients putting money into them.

Listed SPs

Since I haven’t used an IFA for decades, (( Strictly speaking, I was advised when I transferred a DB pension into a SIPP, but my former employer paid for that )) I haven’t had access to the traditional form of SP.

- I became interested again about ten years ago when Societe General (SG) launched their range of listed SPs in the UK.

- These were SPs traded on an exchange like ETFs (whereas regular SPs are a contract with a provider, like OEICs).

They hired David Stevenson (the Adventurous Investor from the FT) to promote them and he gave a very interesting series of monthly lectures at SG’s offices near Tower Hill. (( These lectures were the inspiration for me to start this website))

- David would explain some current feature of the market and the SG would explain how listed SPs could be used to exploit it or to protect against some future adverse event.

The story of listed SPs is one for another time, but while they are popular in Europe, they have struggled with UK retail investors because of the attractions of tax-free spread-betting profits.

- I also found it hard to trade them on the cheap execution-only platforms.

If they were easy to trade online I would find them an attractive product, and even more so if they could be used in ISAs and SIPPs.

Types of SP

Coming back to non-listed SPs The main two types of SP are:

- Principal guaranteed (you get your initial capital back whatever happens)

- Capital at risk

The returns can be fixed (like an annual interest payment) or can be linked to stock market returns.

- They can also be paid annually, or in one lump on the maturity of the product.

Under the Hood

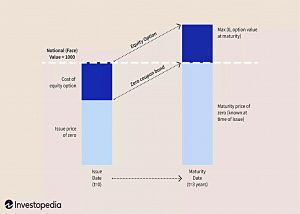

This image from Investopedia explains what is going on from the provider’s perspective:

- The zero-coupon bond will grow during the lifetime of the investment in order to guarantee the return of the original capital.

- The option on the equity index can provide additional returns depending on the performance of the index.

So the customer gets equity exposure with a capital guarantee.

- This product would suit a cautious investor who doesn’t want to miss out completely on the potential upside.

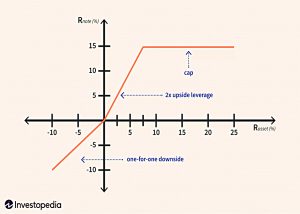

More complicated SPs offer geared returns:

- Here the customer participates in the equity downside risk in return for double the upside.

A cap on returns is applied to ensure the product remains profitable to the provider if stocks do well.

- So this product would suit a moderately bullish investor.

Lowes Review

A couple of weeks ago, a blog post from David alerted me to a review of the UK SP market over the past decade from Lowes Financial Management.

David sees SPs as alternatives to defensive or absolute return funds:

[They] have moved from being lightly questionable products in the earlier part of this century to mainstream alternatives to the absolute returns/defensive funds space.

The industry has well and truly cleaned up its act and started turning in some very respectable numbers.

Regulation

The report notes two main provisions:

- Structured-capital-at-risk-products’ (SCARPS) should ideally come with advice

so that investors understood the nuances around the potential for capital loss.- An investor should be limited in their overall exposure to structured investments (25%), limited to 10% in respect of any one counterparty.

These are not statutory requirements.

- The FCA refers to them as trigger points for advisors to reflect on.

Counterparties

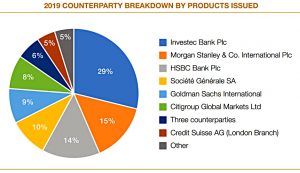

The chart shows the counterparties for products issued in 2019.

Statistics

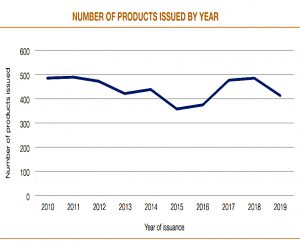

- 4,444 structured products were issued between January 2010 and December 2019.

- 1,628 were still open 31 December 2019.

- 3,895 structured products matured during the decade

- 2,467 maturities were capital-at-risk plans

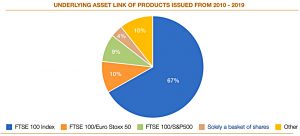

- 70% of maturing SPs were linked to the FTSE-100 Index

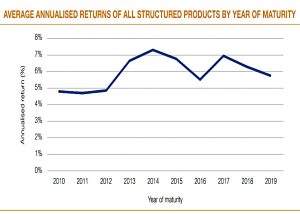

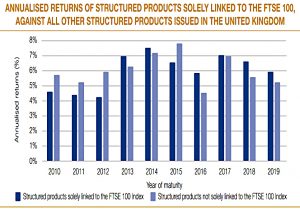

- The average annualised return for all SPs was 7.0%

- For capital-protected “structured deposits” this falls to 3.6% pa.

- Capital-at-risk products returned 7.8% pa

- “Income plans” returned 5.6% pa

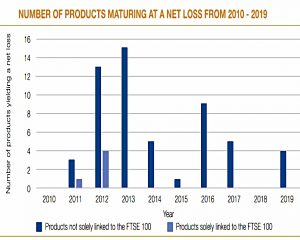

- Only 1.5% of products returned a loss.

- The average investment duration was 3 years, 9 months

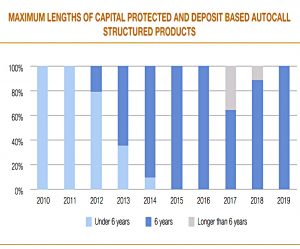

- Investors signed up for a typical duration of 6 years, but many SPs had early maturity features

Trends

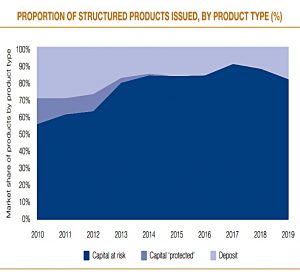

Capital-at-risk products dominated throughout the decade and became more dominant.

Returns from share-linked (non-index) products fell dramatically over the decade.

Autocalls (which end early if the index is above a barrier level) have grown to dominate the market.

They have also increased in (potential) duration.

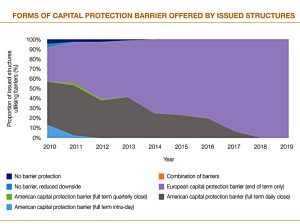

Capital protection barriers have moved towards a single test at the end of the product’s life.

I’m going to leave it there for today – there’s lots more in the report if you are interested.

- I’ll try to find out whether you can buy these products without going through an IFA, and whether there is an easy way to compare them all (like the justETF site for ETFs).

I’ll also do some digging into the state of play of the SG listed products, and maybe write an article about that.

- Until next time.