Weekly Roundup, 15th June 2020

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about the gap between value and growth.

Contents

Value and growth

Madison Derbyshire reported that the gap between value and growth stock has now reached a25-year high.

- Value is up 624% since 1995, but growth is up 1,072% – and the coronavirus pandemic has only made the gap bigger (since large US tech stocks have outperformed).

So is now the time to buy value?

- Possibly not, since value is more sensitive to economic slowdowns, and we are probably heading into a severe recession.

That said, the stock market is a forward discounting mechanism, and at some point closer towards an eventual recovery, value might present an opportunity.

- Unless, of course, you believe that low interest rates and the rise of intangibles mean that traditional measures of value will never work again.

Perhaps innovation, network effects and competitive advantage (bordering on what some people would call monopoly) will continue to dominate.

Keep the faith

John Lee’s regular column on small company investing advised us to keep faith with good companies during rough times.

- Lots of firms – large and small – have been cutting their dividends.

The looming recession makes that look like a smart move to me – but then I’m not a dividend investor.

- John thinks that not all of the firms needed to cut and that some – for example Shell, with a two-thirds cut – have just taken advantage of a “good day to issue bad news”.

John accepts that dividends had gone too far (as shown by reductions in dividend cover (net profits to dividends) but he worries that when dividends resume after the pandemic, they will be rebased at lower levels.

- He also asks for better guidance from boards of directors, comparing Aviva (which has said little beyond announcing a review in the company’s fourth-quarter) to M&G and L&G (where previously-declared dividends are still being paid).

Looking at his stocks, John felt confident about Christie (where he has a large holding) and Vitec (where he topped up) plus Air Partner.

- He also mentioned Anpario, Cerillion, Concurrent Technologies, FW Thorpe, Lokn’Store, and Treatt.

And he opened a new position in Jarvis Securities (who own X-O, amongst other businesses).

John also mentioned Primary Bid, which helps retail investors take part in company fundraisings.

- This is a welcome development but I’ve noticed complaints on the bulletin boards that stocks can’t be easily moved into ISAs or SIPPs, and that even getting shares into regular taxable brokerage accounts can cost £100 per transaction.

Which would rule out the service for almost everyone.

Efficient markets

Joachim Klement wrote about whether markets are becoming more efficient.

The idea is that increased access to data should make a difference:

In the days of Ben Graham data about stocks had to be copied by hand from newspapers and company financial statements. Today, a plethora of websites provide millions of data points for free to everyone. And professional investors can access even more data through Bloomberg.

Joachim thinks instead that there is too much data (and financial media coverage) and that this forces us to focus our attention on the most familiar names.

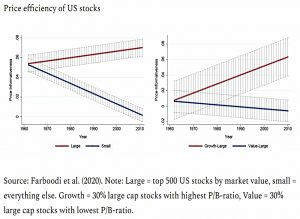

A new paper shows that large stocks are becoming more price efficient, but small caps are becoming less price-efficient.

- And within large caps, prices of growth stocks have become more efficient whilst those of value stocks have become less efficient.

Large glamour stocks get all the attention while unloved value stocks and small- and mid-cap stocks are ignored more and more.

Which should make it easier for managers of small-cap and value funds to outperform.

Social insurance

The Economist looked at the likely impact of Covid-19 on social insurance in the UK.

- Has the furlough (Job Retention) scheme moved the Overton window on state support?

If so, it would represent the reversal of a long trend since the 1980s whereby risk was shifted from the state – and more noticeably, from large, cradle-to-grave employers – to the individual.

- The end of DB pensions as interest rates fell is the best example and the rise of freelance and ultimately zero-hours contracts is another.

Social care is likely to be the next battleground.

- Theresa May came to grief with her proposed “dementia tax”, and it’s clear that the middle classes are still looking to the state to underwrite the worst consequences of the care lottery.

The traditional Tory fix of providing individual resilience by converting more people into home-owners and share investors looks a stretch over the next few years.

Metals rally

Buttonwood looked at the rally in metals prices.

- Iron and copper are each up 25% over the last month.

Perhaps the metals rally is a template for the post-virus economy, in which supply bottlenecks push prices up as activity gets going again. Perhaps it shows how mindlessly the ocean of liquidity created by the Federal Reserve and the European Central Bank has washed into financial markets of all kinds.

Or for iron, it could just be China, where steel mills are back to working flat out.

- Copper is more of a speculative metal, with the market dominated by trading algorithms.

And a weaker dollar will have helped both metals (and emerging-market economies).

Price rises are usually self-reinforcing, as production country currencies appreciate and higher prices are needed to restore margins.

- But perhaps this time the price rises are “too soon” – a sign (like US tech stocks) that optimism is running ahead of reality.

Who deserves to be rich?

Over on Capx, Rainer Zitelmann looked at who people think deserves to be rich.

- “The Rich in Public Opinion” is a new survey from Ipsos MORI.

Here are the results:

Entrepreneurs 47%

Self-employed people 43%

Creative people and artists 36%

Lottery Winners 27%

Top Athletes 24%

Financial investors 19%

Senior Level Managers 17%

Property Investors 17%

Heirs 13%

Senior Bankers 11%

Not much love for brains and hard work there – luck (with the exception of inheritance), risk-taking and exceptional talent seem to be much more popular justifications.

- Interestingly, the young are much less biased against investors, managers and even bankers.

The study classed people into three groups:

- social enviers

- non-enviers, and

- ambivalents.

Enviers think lottery winners deserve their riches more than do non-enviers.

- Which seems strange, given that lottery winners have the largest gap between effort and reward.

The explanation from sociologist Helmut Schoeck is that enviers prefer the results of luck to those of achievement because the former group don’t beg the question of why the envier isn’t similarly advantaged.

- Lottery winners don’t impact the self-esteem of social enviers, whereas hard work and brains are more of a problem.

Wealth tax

The FT found space for an article by a History Ph.D candidate at Harvard.

- Ian Kumekawa has written a paper on AC Pigou, a British Economist who called for a 25% wealth tax after World War 1.

Needless to say, the tax was never implemented, but Ian seems to think that the pandemic warrants its resurrection.

- I think we can safely ignore such talk until a credible UK political party wants to risk re-election by floating similar ideas.

The drift leftwards by the FT over the last five or ten years has been astonishing to watch.

- I can’t imagine who their target audience is for their weekly Personal FInance supplement.

Quick Links

I have seven for you this week:

- Alpha Architect listed five surprising things they learned from a factors expert

- Disciplined Systematic Global Macro Views looked at momentum and turning points

- UK Value Investor wrote about how to measure dividend growth and the factors that support it

- Jesse Felder looked at the Robinhood retail investing phenomenon

- Flirting with Models wrote about tail hedging

- And the Economist had two more articles about the impact of the pandemic on great cities,

- The second of which focused on the future of New York.

Until next time.