Die With Zero

Today’s post looks at the ideas in Bill Perkins’ book Die with Zero.

Die with Zero

Bill Perkins is a former hedge fund energy trader who has since dabbled in film producing and playing poker.

- He also does some venture capital investing, particularly in the energy sector.

I haven’t read Bill’s book, but it keeps coming up on other people’s blogs (and indeed, in conversations with my coaching clients).

- There’s a lot of material available online, so unless I’m really solid on the concepts, I might well skip it.

You can get a flavour from the book’s website.

- There’s also a Mental Models PDF that you can download (more on that below).

Here’s what Bill has to say:

You should be focusing on maximizing your life enjoyment rather than on maximizing your wealth. Those are two very different goals. Money is just a means to an end: Having money helps you to achieve the more important goal of enjoying your life. But trying to maximize money actually gets in the way of achieving the more important goal.

In some ways, the central idea of the book is an obvious extension of the FIRE approach to life:

- FIRE says to stop work when you have enough money to live off it

- Die With Zero (DWZ) says to spend all of that money before you die.

But there are a few obvious problems:

- You don’t know when you are going to die

- Products that swap capital for guaranteed income (annuities and their ilk) are very poor value

- In expensive locations like London and the south of England, a lot of your wealth will be tied up in property, which is quite difficult to dispose of effectively during your lifetime.

- My current end-state plan (not fully implemented yet) has me at 65% property, and that proportion will likely increase as I spend down my pensions.

- Quality elder care here in London is phenomenally expensive.

So I’m interested to see how this idea works in practice.

- Let’s dig in.

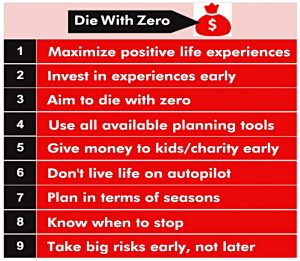

Nine rules

The DWZ philosophy is built on nine rules:

- Maximize positive life experiences

- Don’t wait until you retire to start doing stuff you like.

- Start today and have lots of memories.

- Invest in experiences early

- Your life is the sum of your experiences.

- Plan the ones you want to have and start now.

- Aim to die with zero

- Spend all your money on experiences, your family and legacies.

- Use all the planning tools

- You can use life expectancy tables to estimate when you will die (though there are long tails to the lifespan bell curve).

- Give money away early

- People die when their kids are too old to enjoy their inheritance.

- The tax system (at least in the UK) also encourages this – inheritance tax is a voluntary levy on those who trust the taxman more than their children.

- Don’t live life on autopilot

- Balancing competing demands is personal, so be prepared to make constant changes to your plan.

- Plan in terms of seasons

- Plan your experiences in terms of the life stages we all pass through.

- And look after yourself (eat right, get some sleep and exercise) so that these seasons last longer.

- Know when to stop

- There is an optimal point at which you should stop working (nobody wishes they had spent more time in the office).

- Figure this out before you get there.

- Take big risks early

- The younger you are, the more risks you should be taking.

- When you are older (with more responsibilities and less human capital) risk-taking becomes more difficult.

There’s not too much to disagree with here.

- But I think these rules offer a much more rounded philosophy of life than the “Die with Zero” headline.

“Die with as little as you think you can be comfortable with” might be a better title.

- There is a real issue here, that I’ve talked about before.

The switch from accumulating assets into decumulation (retirement) is difficult

- It’s hard to stop work when you have enough in the pot (and avoid “One More Year” syndrome)

- It’s hard to transition from being frugal to being spendy.

But aiming for zero only makes it harder.

Mental models

The mental models download from the website is 23 pages long (and worth a read).

- I’m just going to pick out a few concepts here to illustrate Bill’s thinking.

The first model is the Life-Cycle Hypothesis from famous economist Franco Modigliani.

- The key takeaway is that you should spread your wealth across the years up the the oldest age at which you think you might die.

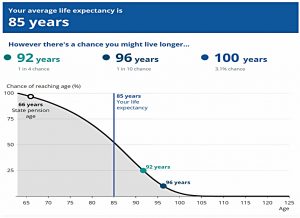

My life expectancy is 85, but there’s a 10% chance I’ll make 96, and the curve doesn’t hit the x-axis until around 103.

- I deal with these potential 40 more years by drawing less than the failsafe rate of 3.3% pa from my pot.

That’s my version of consumption smoothing (the second model).

- But I wouldn’t be thinking of giving money away until those 40 years become ten.

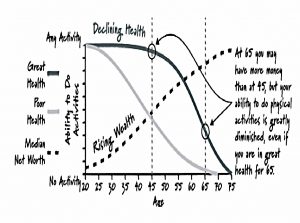

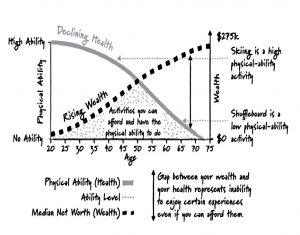

Bill is of the opinion that your health declines from 95% at 45 to 30% at age 65.

- I just don’t buy that – at age 63, my health has no impact on my life whatsoever.

- I’m also a lot happier than I was at age 45.

I guess Bill is keen on some intensive activities that hold no interest to me.

- I don’t want to go on a cycling holiday in the Dolomites with a load of middle-aged men in lycra (MaMiLs).

The next model is humans as energy-processing units, but I didn’t get anything from that one.

- The fourth model describes money as life energy, and comes from the FIRE classic “Your Money or Your Life”.

You might shorten it to Time is Money (and vice versa).

Bill equates utility with experiences and asserts that the ability to enjoy experiences declines with age.

- So for Bill, the utility of money (its exchange rate with experiences) declines with age.

On the chart, he explicitly contrasts skiing with shuffleboard.

- I don’t buy any of this, and you couldn’t pay me to go skiing again.

Model number five is Quanifying Life Experiences – Bill wants us to score our days.

Think about the enjoyment you get from each experience in terms of points, like the points you’d earn in a game. Peak experiences will bring you many experience points. Small pleasures will get only a few points.

Scoring my day sounds like the opposite of retirement to me, but if I did, I’m pretty sure I would have higher scores in my sixties than in my thirties and forties.

- The greatest freedoms in life are not having to do what anybody else wants and not caring what anybody else thinks, and they don’t cost anything.

Model number six is time buckets, which are like a series of mini bucket lists for each five-year period in your life, separated by what Bill calls “mini-deaths”.

- I buy into a watered-down version of this, in that I do have five- ten- and twenty-year plans, but I don’t get too stressed about my progress against them.

For me, it’s all about knowing the general direction that I want to head in.

Model number six is the Peak Net Worth Epoch.

- This replaces your FIRE number with a biological age.

Bill says that no number will ever feel like enough, but I had no problem retiring as soon as I hit my number.

- Bill says that they have run simulations for dozens of scenarios, but he doesn’t reveal the optimal age range in the download.

Model number seven is Decumulation – once you hit your peak net worth you have to start spending.

- This is no different to regular FIRE, other than you are targeting zero terminal wealth.

Model number eight is LifeCycle Timing Optimisation, and relates to inheritance.

- The peak age for receiving an inheritance is 60, which Bill thinks is too old to enjoy the money.

He wants us to give our money away to people (presumably our relatives) who are much younger than that.

Model number nine is the Deliberate Mindset – don’t live on AutoPilot.

I want you to plan for your future — but never in such a way that you forget to enjoy the present. We all get one ride on this roller coaster of life. Let’s start thinking about how to make it the most exciting, exhilarating, and satisfying ride it can be.

I think mindfulness is a good thing, so I’ve no argument with this one.

Model number ten is the Survival Threshold.

(Cost to live one year) × (Years left to live) = Survival Threshold

This is pretty similar to the FIRE number, though you also need a place t live.

Model number eleven is Minimising Longevity Risk.

- Bill doesn’t reveal in the download what his solution is (he has a book to sell), but he’s clearly talking about annuities.

Annuities are a good idea that has been badly implemented and as things stand, almost nobody should buy one.

Model number twelve is Asymmetric Risk (big upside, little downside) but Bill doesn’t explain how this is relevant to the DWZ approach (has still has a book to sell).

Model number thirteen is Minimising Regret.

- This is the expansion of “nobody wishes they had spent more time in the office” and I’m a big fan.

[The] number one regret [of dying people] was wishing they would have had the courage to live a life true to themselves- as opposed to living a life others expected of them. It’s regret about not pursuing your dreams.

Number two was “I wish I hadn’t worked so hard”.

Model number fourteen is Irrational Fear.

99% of you will not make any lasting changes in your life. You’ve been conditioned with false stories about money. You’ve been conditioned to have certain beliefs about money from your family, society, the news, friends, and even yourself!

That’s it for the models.

- As with the rules, there’s plenty to like.

But as with so many personal finance books, there’s a shortage of actionable content (at least in what’s available for free online).

- I remain unconvinced that navigating from peak net worth to zero over what could be forty years is anything like as straightforward as Bill makes it sound.

There’s plenty of food for thought, but no real changes that I need to make to my life tomorrow.

We’ll leave it there for today.

- In the next article, we’ll look at Big ERN’s critique of the book, and try to draw some conclusions.

Until next time.