Managing Lifetime Wealth

Today’s post looks at a recent report from Aegon on retirement planning in the UK.

Contents

Managing Lifetime Wealth

The report we’re looking at today is the fourth in a roughly annual series (previous reports came out in 2018, 2020 and 2021), though I don’t think I’ve come across it before.

- It looks at the UK retirement landscape from the perspective of financial advisers, which is always something that I’m interested in.

Aegon pays for the report, but the work is carried out by NextWealth. There are two parts to the research:

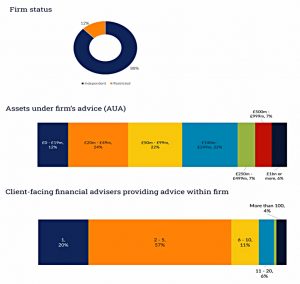

- An online quantitative survey of 212 financial planners in November and December 2021, and

- “In-depth” qualitative interviews with 10 financial planners in December 2021 and January 2022.

Demand

Assessing demand for retirement advice is complicated:

- The population is ageing, so more people are spending more time in retirement

- The pension freedoms of 2015 have made the management of retirement income superficially more complicated (though in practice a DIY approach is pretty simple)

- Covid-19 may have prompted some people to retire early, but

- Affordable advice for those will small pension pots is lacking

Against this, we have an ageing adviser population and some consolidation within the sector.

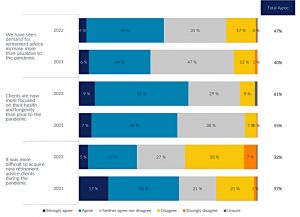

- Half of financial advisers (47%) say that demand for retirement advice

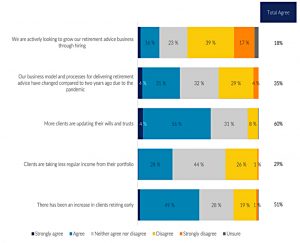

has increased more than usual due to the pandemic.- 51% of financial advisers have seen an increase in the number of clients

looking to retire early.- Client interest in tidying up their finances, through wills and trusts, grew according to 60% of financial advisers.

The return of face-to-face meetings has made the acquisition of new clients easier.

Services

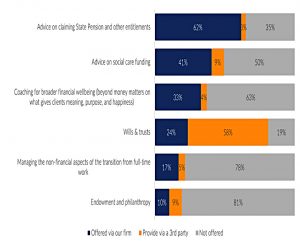

As well as private pensions, topics on which advice is offered by IFAs include state pensions and social care funding, wills and charity.

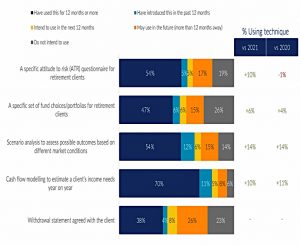

The most popular techniques used by IFAs are cash flow modelling, scenario analysis, default portfolios and risk questionnaires.

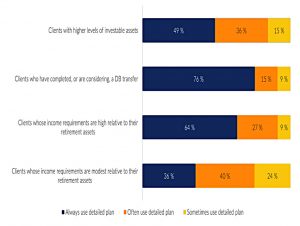

Cash flow planning is becoming more popular, particularly with richer clients and those considering a DB pension transfer.

Clients

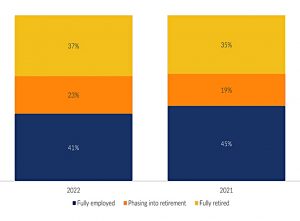

IFA clients are fairly evenly split between the already retired and the still employed, with a minority phasing between the two states.

Most clients (53%) had between £100K and £250K in investable assets.

- 28% had between £250K and £500K and 9% had between £500K and £1M.

Only 1% had more than £1M.

- Just as surprisingly, 8% of clients had less than £100K (I’m not sure how advice could be cost-effective for these people).

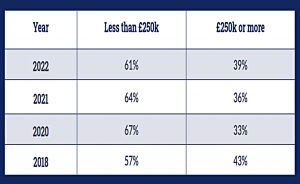

The proportion of richer clients has been falling slightly across the four surveys.

There are some variations in typical client size across firm types. Restricted advisers typically have more clients with less to invest.

Smaller firms also had more clients with fewer assets.

Guidance

The FCA is proposing to offer a new form of advice called “personalised guidance”, which would have lower regulatory requirements.

- The idea is that this guidance would be cheaper and therefore more suitable for those with smaller pots.

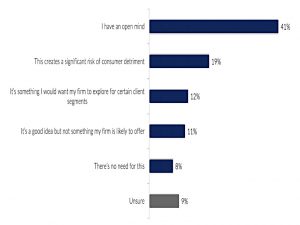

The majority of IFAs claim to have an open mind about this, though 19% think there is a risk of consumer detriment and 8% think that is not needed.

- Presumably, the devil will be in the detail of the proposals.

Objectives

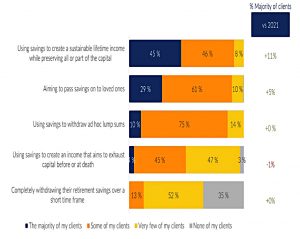

The most common client objective was to create a sustainable income without totally depleting capital.

- Other popular goals were inheritance and ad hoc lump sums.

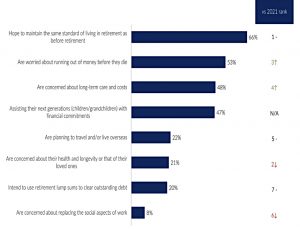

Clients’ biggest concerns were maintaining their standard of living and not running out of money before they die.

- Care costs and inheritances were also of interest.

Tax

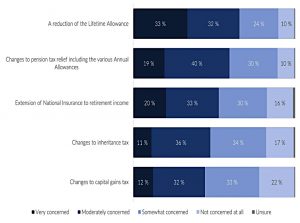

Clients are worried about potential tax changes, in particular further reductions in the LTA (which is frozen for the next few years).

Annual allowances, NI on pensions, IHT and CGT were other worries.

Social care

Social care barely registers as a funding priority for end clients – only 7% of UK consumers view putting money away to fund possible future social care needs as a priority.

This somewhat contradicts the finding that paying for social care was third on the list of client concerns.

The government recently announced a lifetime cap on social fees of £86K, but daily living costs like room and board are not included, so this will make little difference to many people (including me).

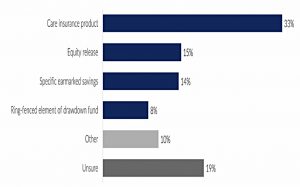

Interestingly, most IFAs think that insurance is the best way to fund care costs.

- I don’t know anything about care insurance (in fact I wasn’t even sure it existed in the UK) but I expect it will offer the same terrible value for money as other products targeted at the elderly (such as annuities and equity release). (( If anyone knows otherwise, please let me know in the comments ))

Other options included equity release and ring-fenced savings (either inside or outside a pension pot).

- Commentary in the report suggests that direct payments from drawdown pots to the care provider can bypass income tax, which is interesting.

Another comment mentioned a “care pension”, which also has no tax if used for care.

- This might be a different perspective on the same tax break.

Minimum income

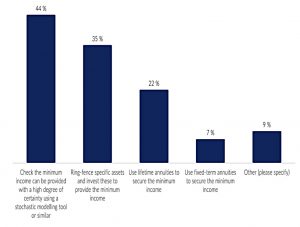

One of the most common problems that IFAs have to solve is securing a minimum income for their clients.

There are three (overlapping) approaches to this:

- Stochastic modelling tools

- Ring-fencing of assets

- Annuities

State and DB pensions are also useful in this regard, for those who have access.

SWRs

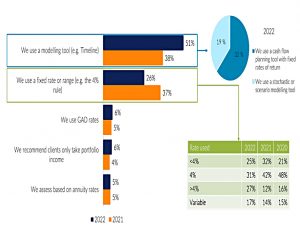

Another common problem is working out what a safe withdrawal rate will be.

The use of modelling tools is replacing fixed rates here.

- I personally use a fixed rate, but a conservative one – clients with smaller pots won’t find this approach meets their needs.

Portfolios

There are three main approaches used by IFAs for structuring retirement portfolios:

- Total return – income payments funded by selling investments

- Buckets/time segmentation – dividing the pot into short, medium, and long-term components to match future income needs

- Income-driven (less popular than the other two) – income payments made from income arising from investments

Most IFAs vary their approach to best fit the client.

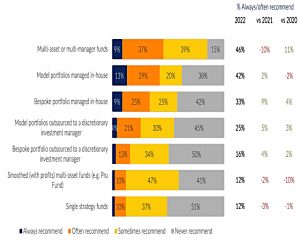

Multi-asset funds and model portfolios are the most commonly used portfolio solutions.

- Bespoke portfolios are less popular.

There’s no detail here on whether portfolios use active or passive funds, though elsewhere in the report it states that 32% of client funds are in passives.

- Larger IFAs have only 17% of client assets in passives.

Interestingly, IFAs have many reasons for using multi-asset funds:

- they simplify the advice process

- they reduce client costs

- they reduce adviser regulatory risk

- they improve investment performance

I invite you to assess the accuracy of these views.

DB transfers

Just before the previous report, the FCA has introduced a ban on contingent charging for DB transfers.

- This means that clients have to pay for advice even if the advice is not to transfer (as would usually be the case).

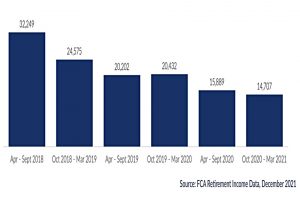

This was expected to reduce DB transfer volumes, and it has, though we only have six months of data.

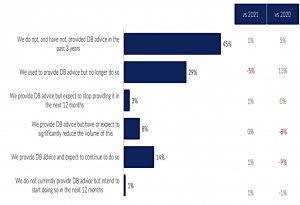

The number of firms offering DB transfer advice had fallen from 56% in 2018 to just 25%.

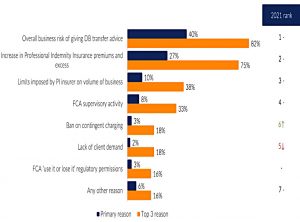

The main reasons for stopping giving this advice were the cost of indemnity insurance and general business risk.

There’s been a concerted effort to clamp down on DB transfers after some scandal surrounding mostly smaller pots (eg British Steel).

- Sadly that’s generally the way with UK financial regulation.

To use a couple of cliches, we wait until the horse has bolted, and then we throw the baby out with the bathwater.

That’s it for today – it’s been an interesting peek into the way that IFAs see the retirement income market.

- There were no great revelations, but equally, nothing to change my view that the vast majority of people should be ignoring IFAs and taking the DIY route.

Until next time.

Issue 5 came out in February 2023 as I discovered when I tried to find the source report.