Irregular Roundup, 6th February 2024

We begin today’s Weekly Roundup with lifestyling.

Contents

Lifestyling

For the FT, Claer Barrett looked at lifestyling, which she called a hidden danger lurking in your pension pot.

The original idea (before drawdown was introduced in 2015) was that retirees would be forced to buy an annuity with their pension pot (see below for details on why this is a bad idea).

- To protect the value of that annuity, the pension pot would gradually transfer money from volatile stocks to less volatile bonds as the purchase date approached.

Once drawdown existed, most people were too sensible to want an annuity, but the impact from lifestyling (also known as target date funds) was relatively small – you might lose out on a few years of equity gains and have to make do with bond returns.

- The trade-off was that as long as stocks and bonds were negatively correlated (and interest rates were falling) the extra bonds would protect (stabilise) your pot.

But when inflation arrived after the Covid stimulus, stocks and bonds fell together.

59-year-old Martin unfortunately found out the hard way. Forced into early retirement after developing a disability, Martin considered what to do with his biggest pension pot. A statement from June 2021 said it was worth nearly £200,000. So he got quite a shock last October when he found its value had plunged to £134,000.

The problem is that Martin didn’t ask for this.

For decades, regulators have favoured lifestyling as the default option. Unless you opt out of this strategy, most pension providers will start to de-risk savers’ investment portfolios six to 10 years before their intended retirement date.

Lifestyling deserves the flack it is taking, but it’s just a spin on the industry standard 60-40 portfolio (and the 40-60 and 82-20 variations on that) pushed by most IFAs.

- Bonds are in most portfolios to protect when stocks fall, but in 2022 they did the opposite, with many bond funds falling by 20% or more.

People approaching retirement have always been vulnerable to a year of returns like 2022, and even outside of lifestyling, the usual advice is to build a “bond tent” around their retirement year.

- Usually, this works, but every now and then it doesn’t.

The real issue is that people don’t understand the risks of the assets that their money is invested in, and platforms and advisers are not incentivised to enlighten them.

A lousy inflation hedge

For the FT, Toby Nangle “TIPSplained” why index-linked bonds make a lousy inflation hedge.

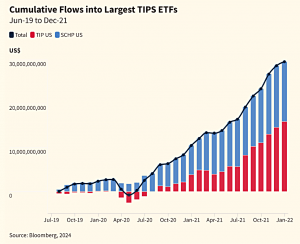

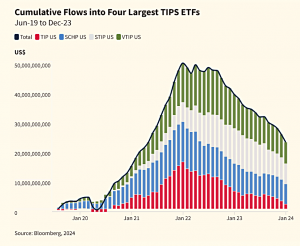

Back in 2020, as higher inflation seemed more likely in the future, investors bought ETFs containing TIPS (the US equivalent of index-linked gilts), expecting them to help protect against inflation.

That’s what the US retail bond portal says will happen:

As the name implies, TIPS are set up to protect you against inflation.

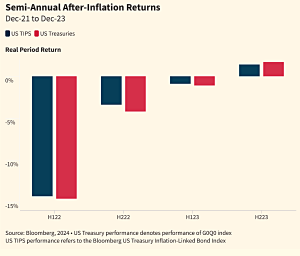

But they didn’t.

- Instead, they fell slightly less than regular Treasuries, losing close to 20%.

The yield on TIPS is known as the real yield, and it implies that your returns will be equal to that yield plus inflation each year.

By mid-2021 (when investors were buying), the real yield on 10-year TIPs was minus 1.2%, so people were locking in average inflation from 2021 to 2031, minus 1.2% each year.

- Even worse, in 2022, this real yield went up to plus 2%, causing TIPS prices to crash.

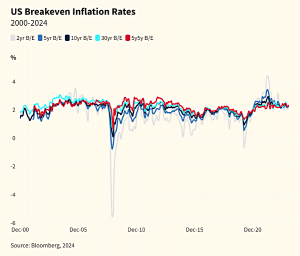

The gap between the TIPS yield and the regular Treasury yield is known as the breakeven inflation rate (as it’s the rate that would equalise returns on the two bonds).

- You might disagree with this prediction of the future and want to bet (invest) on that basis.

Here’s the “quite interesting” bit:

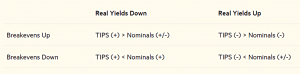

Your inflation view does not give you an outright investment view as to the likely absolute performance of TIPS. It only gives you an investment view as to the long-term prospects for relative performance between conventional US Treasuries and TIPS.

The best guide to the absolute return on TIPS is their real yield.

Toby provides a matrix from the Central Bank of Malta:

The (+) and (-) denote positive and negative absolute price changes, and the (+/-) denotes a positive or negative absolute price change depending on whether real yields move more than break-evens. (Eg, if real yields rise by 100 bps but break-evens fall by 80 bps, nominal yields will rise by 20 bps meaning that nominal bond prices will fall, but nominals will outperform TIPS.)

I’m not sure it’s that helpful to most of us.

If you had a view back in mid-2021 that inflation would turn out higher than break-evens, and that real yields would also stay negative, TIPS made a lot of sense.

This would imply that the Fed would be slow to raise rates, but they weren’t.

- So breakevens stayed flat (the Fed was fighting inflation) and real yields went up with nominals, pushing down the price of TIPS, and making returns negative even after indexation.

Short-dated TIPS should have done much better as they have a lower sensitivity to movements in yield.

Sadly, these 0-5 year US TIPS lost almost 9% in real terms in 2022. Which is to say they didn’t really work out for their holders either.

A lot of the money has gone out of the TIPS ETFs now.

But real yields are much higher today than they were, and break-evens are middling compared to their long-run history.

In other words, the prospects for TIPs are much better.

- Because the threat of future inflation has receded.

How many factors?

Joachim Klement looked at the Factor Zoo, and asked How many factors do you really need?

- Several recent papers have questioned whether many factors are really statistically significant, or if they can be replicated.

A new study suggests that only about 14 factors really count (other than market beta), but Joachim’s article focused on the top five.

- They include momentum, value, quality and investment (growth) but not size or low volatility, which I use as well.

There are a couple of Low-Risk / Low Vol measures lower down the top 14, and size (small and medium cap stocks) is worth having some exposure to for the diversification benefits, even if the excess returns which used to be available seem to have disappeared.

There is one value factor in there, the ratio of intrinsic value to market cap as defined in this paper. Essentially, that is the valuation of stocks as derived from a classic discounted cash flow model based on analyst expectations.

There is one quality factor in there, namely cash operating profits to book assets, a close relative of return on capital.

There are two investment-related factors in the top five, the quarterly sales growth of a company and the change in net operating assets. These are closely related to the measures growth investors look at – and when I mean growth investors I mean real-life practitioners, not the imaginary growth investors academics write about.

So we can stick to Joachim’s top four (or my top six) and not worry too much about the dozens of measures lower down the league tables).

Annuities

For the FT, Moira O’Neill looked at whether annuities are back on the table for pension planning.

- Spoiler alert, they aren’t – using this morning’s rates, the breakeven payback time for a man of my age on an index-linked annuity takes me to 18 months past my life expectancy.

That annuity yields 4.3% pa, which is a fraction above the 10-year treasury, and a rate I expect to beat comfortably from my investments.

- Flat annuities (which journalists tend to write about more) have a higher yield, but if you live long enough to make them sensible retirement planning tools, inflation will have eroded their value.

The annuity proposition is that I hand over my pension pot and have no flexibility over what I do with my money over the next decades (indeed, ever again), just in case I live much longer than expected.

- I’d rather manage my own money and take the risk of having a bit less money when I am ninety and have nothing to spend it on.

And with an annuity, there’s nothing to hand down to my descendants (not a major concern for me, but I know it matters to many).

Moira is writing about ultra-cautious types who prefer certainty to decent returns.

- Rates have risen in recent years alongside bond yields (and inflation), so the investment media is talking about annuities again, after a few quiet years.

Don’t listen. Moira says:

It’s a demanding question involving fine judgments about your appetite for risk and whether the stock market will deliver a better return than the annuity you can buy.

But the maths says otherwise.

- On average, an index-linked annuity will pay out roughly what a very cautious portfolio (one stuffed with 15-year bonds) will, minus a juicy profit margin for the insurer underwriting the deal.

Now if I could sell annuities, that would be a different matter.

- The public is crazy for them – Moira reports record sales in 2023.

State Pension Age

There’s been a fair bit in the media about research from the International Longevity Centre (ILC) which suggests that the UK state pension age (SPA) will need to rise to 71 by 2050 to maintain its affordability.

- Morally, this need not be a problem, if the increase was driven by rising life expectancy and the adjustment needed to maintain retirement at 32% of the adult lifespan (that might not be exactly the right number, but the government has a target).

But a different aspect of demographics is to blame – the projected dependency ratio of retirees to workers, which is expected to hit 50% (defined by the ILC as one worker for each retiree) in 2050.

- One in four people in the UK will be aged 65 or over.

Leaving morals aside, the current SPA of 67 means that a log of people will be unfit for work before they officially retire.

- Increasing the SPA to 71 will only make things worse – only 50% of adults are disability-free by age 70.

There’s also the issue of poorer people dying earlier, in some cases before reaching the SPA.

The alternative way of balancing the books would mean a real-terms cut to what is already one of the meanest state pensions in the developed world.

There’s no easy answer here, but without medical advances and lifestyle changes, we’re running out of road in expecting people to work ever longer.

ETF equivalence

The UK has granted equivalence to UCITs (EU) ETFs under the Overseas Fund Regime.

The bad news is that there’s no mention of removing the block on US ETFs.

- The requirement to have a KID document (which US firms are not motivated to create) is an EU invention, but we’re still using their rules some eight years after voting to leave.

There are some terrific ETFs in the US but we can’t buy them inside our tax shelters.

Quick Links

I have a bumper eleven for you this week, the first four from The Economist:

- The Economist asked Could AMD break Nvidia’s chokehold on chips?

- And said that EV sales in Britain are disappointing expectations

- And reported on The end of the social network

- And said that Many family firms lack heirs. Unrelated help is at hand.

- ERN said that Stocks are STILL a great long-run investment

- The CFA Institue looked at Popularity: A Bridge between Classical and Behavioral Finance

- Alpha Architect said that The Smart Money Can Buy Stocks, but They Can’t Sell Them

- Schroders wondered How do stocks, bonds and cash perform when the Fed starts cutting rates?

- All-Star Charts wrote about “Only Tech Driving This Market”

- Of Dollars And Data asked Should You Invest in Stocks at All-Time Highs?

- And AQR looked at Inflation and Tax Efficiency.

Until next time.