The Annuity Puzzle

Elm Wealth

I recently read the book Missing Billionaires by Victor Haghani and James White.

- It’s very good, and deals mostly with how much risk to take on under various circumstances.

This is a topic that each of the authors has experience with.

- Victor lost $100M when LTCM collapsed 25 years ago, and James also lost a lot of money when the hedge fund he was working at ran into difficulties (it later recovered).

They both work today at Elm Wealth.

The book revolves around Expected Utility, which in turn requires you to understand your own utility preferences, and in particular, your degree of risk aversion.

One of the many interesting chapters in the book deals with annuities.

- Before we find out what the authors think, let’s review what I’ve previously said about this promising but ultimately disappointing product.

Don’t buy an annuity

Way back in 2016, I warned people not to buy an annuity. My reasoning was:

- they offer very poor value and

- they are completely inflexible

- You can’t sell them once you have bought them

- They consume all your retirement capital, leaving nothing for your dependants

A couple of years earlier, Chancellor George Osborne had announced the Pension Freedoms that would remove the obligation for retirees to buy an annuity (by age 75).

- By the time I wrote the article, this had become law.

Osborne’s announcement makes my top three list of changes introduced by Chancellors:

- Gordon Brown’s A-Day pension changes (mostly the increases in annual and lifetime contribution limits, but also deferring the need to buy an annuity from age 50 to age 75)

- Osborne killing annuities as part of the Pension Freedoms

- Hunt abolishing the LTA

Interestingly, they are all about pensions.

What is an annuity?

An annuity is like an insurance policy in reverse.

- With insurance, you pay a little bit each year – the premium.

- If something bad happens (eg. your house burns down) you get a lot of money back as compensation.

- With an annuity, you hand over a load of money upfront, and you get a little bit of it back each year.

- When the bad thing happens (your certain death) you stop getting back any more money at all.

What’s wrong with that?

Like insurance, the arrangement requires a middleman who will skim off a fee.

- But the real problem is that the protection offered (unlike that of rebuilding your house after a fire) is something that you could arrange for yourself.

Safely investing your initial pot (in a similar manner to the insurance company) would provide the same income with more flexibility.

- If you live a very long time or are very poor at investing, an annuity might have something to offer.

But in a nutshell, annuities take all your money away from you when you are relatively young and active, and they can only work out to have been a good idea if you live until you are extremely old and decrepit.

A second situation where an annuity might be useful is when you don’t have any guaranteed income to cover your basic expenses.

- My partner and I have two state pensions and two DB pensions to fall back on, as well as large DC pension pots and a growing allocation to VCTs (which provide tax-free dividends very useful in retirement).

So I am not in the market for an annuity, which could make me biased.

- The only thing that might change my mind would be a change in the UK tax system that favours annuities.

A third time for me to consider an annuity would be when I thought I was at risk of not being able to manage my own finances (through mental frailty).

- And even then, I would probably only want enough income to cover my basic living needs, at least to begin with.

You can always buy an annuity – or a second annuity – next year, but you can never un-buy the one you bought last year.

What are the current rates?

When I wrote the original article,

Looking at the rates available this morning, a 55-year-old man with the then maximum pension pot of £1M could take an income of £27.5K.

- That was less than 3% indexed with a 5-year guaranteed payout (a total of £138K, or less than 14% of the original money invested).

That yield looked easy to beat with a diversified portfolio (which you would still have control of).

- To get back the original £1M, our 55-year-old would have to live for 39.8 years, or until he was 95 years old.

The trouble was, life expectancy for a 55-year-old man was 83.3 years – 12 years short of break-even.

I’m a bit older now, and interest rates are much higher.

- The relevant rates are 3.81% at age 60 and 4.88% at age 65.

I’m 63, so the blended rate is 4.46%.

- This gives a payback period of 22.4 years, taking the break-even point to age 88.5

This is very close to my life expectancy, so things have improved significantly over the past seven years.

- But keeping the money in drawdown would leave me with the growth in the pot to spend, or to pass on to dependents.

As always, annuities only work out if you live to be very old, at which point massive spending is unlikely to be uppermost in your mind.

When to buy an annuity?

In 2021, I wrote about a paper from LCP on whether there is a right time to buy an annuity.

- Does the attractiveness of an annuity change as you go through retirement?

They try to answer this question using a utility approach, which makes it relevant to the Elm Wealth work.

- So I will reproduce a condensed version of that article here.

The report was written by Steve Webb, who used to be the Pensions Minister and Philip Boyle.

- They are both partners at LCP.

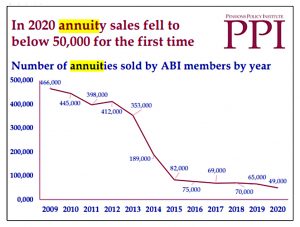

The report included a chart to show how Osborne’s reforms killed the UK annuity market.

Mortality risk

The thesis of the paper is that attitudes to annuities might change as people age since mortality risk (the risk of living longer than you expect – or as the paper defines it, the risk of living longer than the average person) increases as you get older.

Managing a drawdown pot to make sure that you don’t run out of money (on the one hand) or end up living excessively frugally to avoid the risk of running out (on the other hand) becomes steadily more difficult as you get older.

I think that’s an oversimplification.

The difficulty of managing your pension pot in drawdown will depend to a great extent on two factors:

- The size of your pot (or equivalently, the withdrawal rate that you need to live on)

- Your investment allocation and performance (which are related over the long term)

Many people will end up with final pots that are several times the size of the pot they started with, despite drawing an income each year.

- Which means that the problem gets easier for some.

Mortality by age

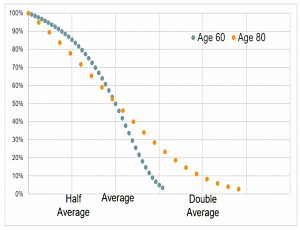

I take the general point that the chances of living longer increase with age but, your remaining expected lifespan does not increase with age – it shrinks.

- What LCP mean is that at age 60, the expected lifespan is 26, and living to 112 (52 years, or double the average remaining lifespan) is very unlikely.

At 80, the average lifespan is 9 years, and living to 98 (double the average) is a real possibility (a 6% chance, actually).

- But those 18 years are still less than the average of 26 years at age 60.

If the pension pot has been managed properly in the interim, the risk of exhaustion is probably lower than at age 60.

- This would make an annuity less attractive at 80 than at 60 (though annuity rates would be much higher, which needs to be factored in).

The LCP model

LCP has built a utility (happiness) model based on three assumptions:

- ‘Upside’ – people will be happier if their annual income in retirement goes up rather than down;

- ‘Avoiding downside’ – people will be very unhappy if their annual income falls in retirement;

- ‘Bequests’ – people may attach some value to having an unspent balance when they die

The problem is that the weighting of each will be different for each individual and is hard to calculate.

- Annuities score well on downside protection, but badly on the other two scores.

One general finding is that downside protection is valued more highly than upside.

- Another is that money today (income) is valued more than money in the future (bequests).

The LCP model assumes a baseline annuity income where £1 of income provides £1 of utility, but the extra income from flexible drawdown is worth only 50p of utility per £1 of income.

- Where drawdown provides a lower income, each £1 of lost income is assumed to translate into £2 of pain (negative utility).

Note that using my preferred strategy of a flat failsafe withdrawal rate (of 3.33%), there is no loss from drawdown – you can withdraw that level of income indefinitely.

LCP also assume that bequests are worth only 10% of money spent during life – each £1 of a bequest provides just 10p of utility.

Let’s put some real-world numbers on this:

- At the time of writing, a £100K pension pot provided an indexed annuity income at age 60 of £2,070.

- In drawdown, a failsafe withdrawal rate of 3.33% would provide an income of £3,333.

- That’s 161% of the annuity income, but LCP will value this at only 130%, by halving the upside.

There’s some truth to this law of diminishing returns, but another way to look at the extra drawdown income is that it allows you to retire with a smaller pot.

- If you need £25K to live on, then you need a £1.2M pension pot to fund the required annuity.

With drawdown, your pot “only” needs to be £750K.

Examples

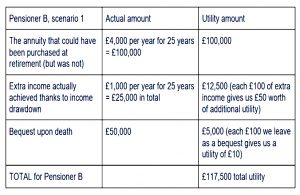

The LCP example assumes a 60-year-old who takes out a 4% flat annuity and lives neatly for 25 years so that he gets his £100K back in the end.

- That annuity is certainly available, but the calculation ignores inflation and assumes that the £4K of income (or whatever multiple of that is actually purchased) will still be enough to live on after 25 years.

The comparison is with £5K of drawdown income and a terminal value (bequest) of £50K.

- This leads to £115.5K of utility (100 + 12.5 + 5).

I would argue that the drawdown investor would actually take only £3.3K pa and would end up (on average) with a much larger pot to bequest.

- So we are not comparing apples with apples and the LCP utility calculations don’t make sense.

Their analysis seems to be aimed at retirees with pots that are too small, and who therefore need to withdraw more each year to live on than is prudent for optimal pension management.

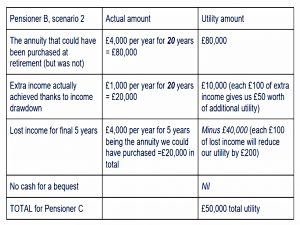

LCP’s second scenario assumes poor investment returns and the pot being depleted after 20 years (at £5K pa – this is actually zero returns over 20 years, which is pretty pessimistic.

- This adds up to a total utility of £50K (80 + 10 – 40).

Scenarios

The rest of the paper looks at variables that could potentially affect the annuity/drawdown decision.

- Note that this decision exists only in the LCP model – taking a failsafe withdrawal from a big enough pot can’t be beaten by using annuities.

The scenarios involve the following assumptions:

- a flat annuity at age 60 of 3.87% pa

- I understand that most people buy flat annuities, but I still think this is not the best comparator for drawdown

- drawdowns at 130% of the annuity, or 5.03% pa

- This is an unsustainable withdrawal rate – someone who needs to draw this much hasn’t saved enough in their pot

- A true comparison would be an indexed annuity of 2.07% against a failsafe drawdown of 3.33%

- a 55/45 stock-bond split

- 1.2% pa return on bonds

- inflation of 3.3%

- an expense ratio on the drawdown product of 0.9% (a tad high for me – my annual costs are 0.34% at the moment)

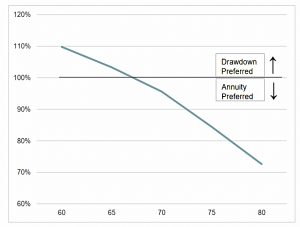

Here’s the baseline scenario – the crossover to annuities happens around age 67.

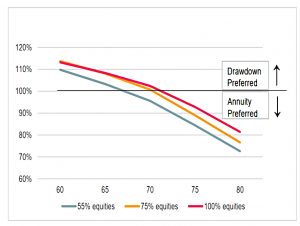

More risk

Upping the equity allocation increases the cross-over age to your early 70s.

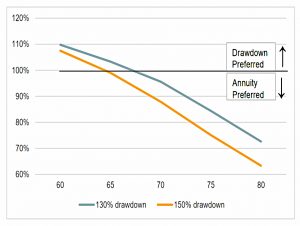

More aggressive drawdown

Not surprisingly, using a more aggressive drawdown rate (5.8% pa!) pulls the crossover age forwards.

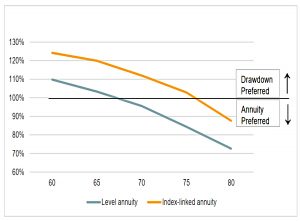

Index-linked annuity

Using an index-linked annuity pushes the cross-over age out to 77.

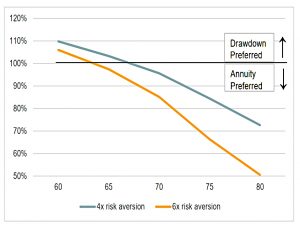

Greater risk aversion

Increasing risk aversion from 4x (up is 50p, down is £2) to 6x pulls the cross-over age forwards.

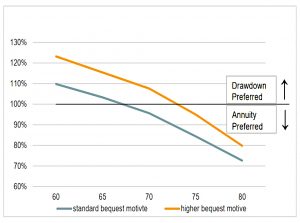

Bequests

Increasing the utility of a £100 bequest from £10 to £25 makes the drawdown option more attractive.

- This is not surprising, since buying an annuity leaves no money behind for a bequest.

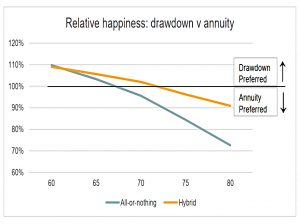

Hybrid approach

The baseline assumes a 45% allocation to bonds.

- In a hybrid approach, this 45% is used to buy an annuity, and the remaining 55% stays in stocks.

This pushes the crossover age out by a few years.

LCP Conclusions

The LCP model doesn’t connect with me at all.

- I don’t have an issue with a utility model, but comparing flat annuities to withdrawal rates above 5% pa just doesn’t match up to the real world of DIY investors working towards financial independence.

The Annuity Paradox

Now we come to the Elm Wealth book. The authors are refreshingly positive about annuities:

The looming savings crisis in the United States is usually attributed to people not saving enough and making poor investment decisions with their savings.

(I think that is a large part of the problem.)

We believe additional culprits are the failure of the annuity industry to provide attractive solutions for pooling and reducing longevity risk and a lack of recognition by consumers of the tremendous potential welfare benefits annuities can offer.

Annuities were just 8% of the US retirement assets market in 2021. Perhaps we can blame insurance companies:

[They] make most of their annuity contracts unnecessarily complex, and load them with fees, creating a significant wedge between the value of a “model” annuity and that of the real investment product.

Optimistically, the authors think that more competitive offers would emerge if there was enough investor demand.

Why aren’t annuities popular?

People faced with uncertainty about how long they will live would want to keep some savings in reserve against long life. But if they convert part of their savings into an annuity with reasonable terms, they should be able to reserve less and spend substantially more, as their longevity risk can be pooled with other people.

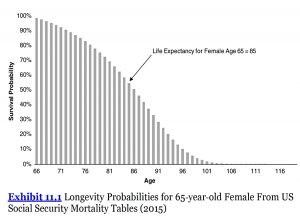

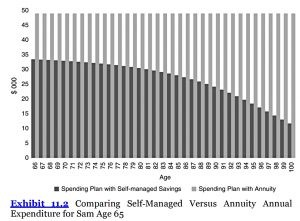

The example they use is Sam, a 65-year-old single woman who has $1M in savings and whose subsistence needs are met by the state pension.

- She has a normal risk-aversion level of 2 and has no interest in bequests.

To simplify the calculations, they start with a single asset – an index-linked bond returning 0% real.

Sam’s life expectancy is 20 years, with a fair amount of variability.

This chart shows the increased spending available from buying an optimal annuity (not a real one with insurance company profits removed).

- Note also that Sam is self-investing in a 0% real bond.

The annuity pays out $50K pa since she has a life expectancy of 20 and a $1M pot.

- If she lives to an unlikely 105, she will have seen $2M from the annuity.

Sam’s optimal spending per year if she chooses to manage her own longevity risk is substantially lower than the annuity payment because she needs to keep much of her savings as a precaution against living longer than expected.

The authors price the gap at a 3.25% annual charge from the annuity provider.

- Alternatively, Sam would need a $1.6M starting pot to generate the same Lifetime Utility as the annuity.

Bequests

The next section looks at Sam wanting to leave one-third of her pot as a bequest.

She would need $1,150,000 of starting wealth in order to generate, without annuitizing, the same Expected Lifetime Utility as from buying an annuity with two‐thirds of her wealth and leaving the other one‐third to her family.

Self-managing would on average leave a larger bequest than required ($440K vs $333K).

And the gap has closed considerably, from 60% to 15%.

Increasing the realism of the assessment by accounting for the fees charged by the insurance company selling the annuity, the tax treatment of the annuity and the benefit from owning equities directly outside of the annuity can easily result in the conclusion that buying the annuity does not make sense for Sam.

Equities

What if Sam could self-invest in equities?

In this case, we’ll find that higher expected equity returns would cause Sam to optimally invest more in equities and annuitize less.

So why aren’t there equity-linked annuities?

- Apparently in the US, there are – they are called variable annuities.

They tend to be complex, with convoluted embedded options and generally higher costs than plain vanilla fixed payment structures.

Mutualisation

Mutualized annuity pools could be run very cost‐efficiently, with a Vanguard‐like administrator competently managing the investment, payouts, and pool membership for a low fee.

In theory, this could provide longevity insurance with equity exposure.

The mutualized structure is a key feature of the solution because it allows investors to trust they are getting the longevity risk sharing and equity exposure they want, without worrying about the frictions and credit risk involved in being on the other side of a transaction with a profit‐seeking insurance company.

This sounds like a rare situation where government intervention could be a good thing.

The British government [once] funded itself through the sale of lifetime annuities, and various mutualized schemes and instruments have seen success in the past.

This office was opened in 1808 and only closed in 1962 (due to declining demand).

- There are still some life annuities in payment.

Perhaps it’s time to reopen it.

Conclusions

Annuities are a good idea that has limited practical application, for many reasons:

- Equities return more than bonds over the timescale that annuities operate in

- You can’t get your money back (inflexibility)

- They have an unfavourable tax treatment (in the UK, at least)

- They introduce provider fees and credit risk

- Most people want to leave bequests

Annuities particularly don’t work well in a world of long lives and low interest rates, but the finance industry doesn’t seem to have caught on.

- Index-linked annuities pay 3.8% pa at age 60, which is not compelling in comparison to a failsafe withdrawal rate of 3.3% pa from a drawdown pot.

The best plan is to retire when your pot reaches 33 times your target income and withdraw 3.3% pa.

- That way your pot should last indefinitely, and under extreme (never-seen-before) circumstances, you would simply run down the size of your eventual bequest.

Until next time.